GME Stock Tumbles Amid GameStop Offering Debt FUD: Should You Buy The Dip?

From mall staple with neckbeard cashiers to Reddit rally cry, the latest GameStop offering has moved into convertible debt, looking to raise $1.75 billion in private funding.

What it plans to do with the money is anyone’s guess, but the crypto crowd is already bracing for a BTC headline. It’s a long way from selling Xbox controllers but in 2025, so is everything else.

GameStop Offering: A Familiar Playbook for Bitcoin Investment

In April, GameStop locked in $1.5 billion through a bond sale. It didn’t take long to see where that cash might be going. Over the next few weeks, the company scooped up 4,710 Bitcoin, staking a serious claim in crypto and rewriting its treasury policy to include BTC.

It’s a page ripped straight from MicroStrategy’s handbook.

GameStop’s statement regarding the latest debt offering underscores its intention to stick to its updated investment policy. The funds could also be allocated toward “general corporate purposes” or potential acquisitions.

Notably, GameStop ended its first quarter with $6.4 billion in cash, cash equivalents, and marketable securities, a stark rise from $1 billion in the same period a year ago.

Market Reaction and Investor Concerns

GameStop’s latest earnings report landed with a thud, missing forecasts and dragging its stock down 15% between the bell and after-hours.

At the same time, rumors of another Bitcoin buy have reignited speculation about the company’s broader play. BTC sat near $109,000 late Wednesday, and another buy-in would nudge GameStop deeper into the playbook of long-horizon institutional investors

Bitcoin’s Role in GME’s Strategy

GameStop’s embrace of Bitcoin as a treasury asset marks a clear attempt to shed its old skin. 99Bitcoins analysts are already comparing the move to Strategy’s now-famous pivot into crypto, but the comparison has limits.

Unlike a software firm, GameStop is still tethered to a retail model that’s yet to prove it can support, or even coexist with, a high-stakes digital asset strategy.

If Bitcoin climbs, GameStop could ride that wave to relevance. If it stumbles, critics will point to the $1.75 billion debt raise as reckless.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

The post GME Stock Tumbles Amid GameStop Offering Debt FUD: Should You Buy The Dip? appeared first on 99Bitcoins.

You May Also Like

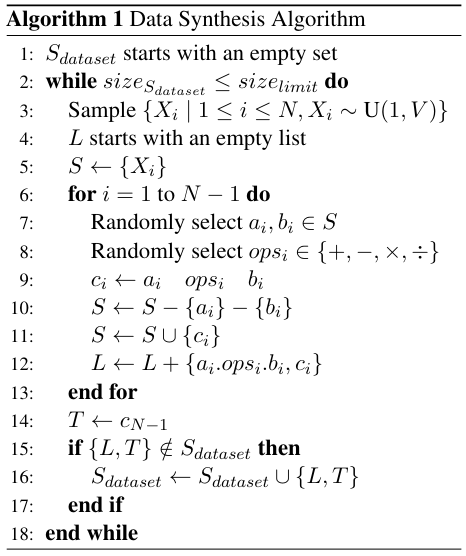

A Framework for Synthesizing Arithmetical Puzzle Datasets for Large Language Models

Crypto Weekly Round-up: BTC and ETH Break Key Levels — What’s Next?