‘Hundreds of simulations’ pin Bitcoin at 50% odds of $140K this month: Why This Prediction Makes the Digitap ($TAP) Best 2025 Presale

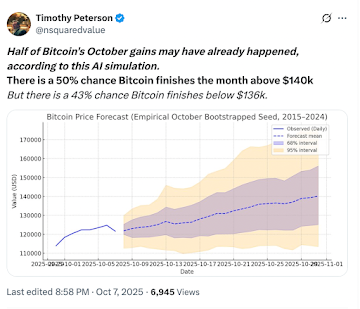

Economist Timothy Peterson believes there’s a real possibility that Bitcoin could climb past $140,000 this month. His latest research, based on hundreds of simulations covering more than a decade of market data, puts the odds at roughly 50–50.

After hitting a record high of $126,200, Bitcoin has now settled around $122,000, showing the kind of pause that often follows a breakout run. Seasoned investors know the pattern – when Bitcoin breaks new ATHs, small-cap altcoins like Digitap ($TAP) typically deliver the most explosive returns.

Bitcoin Price Prediction 2025 — What Data Shows Now

Peterson’s analysis runs hundreds of simulations based on Bitcoin’s daily returns since 2015, replicating real-world volatility patterns to estimate end-of-month outcomes. The results suggest a 50% probability of Bitcoin closing October above $140,000, and a 43% chance of finishing below $136,000.

This data-driven outlook arrives in a seasonally strong period for crypto: October has been Bitcoin’s second-best month on average since 2013, producing mean gains of 20.75%. From Bitcoin’s current price of roughly $122,000, only a 14.7% increase would be needed to hit that milestone.

The simulations strip away emotional bias, focusing solely on the price dynamics that have defined Bitcoin’s decade-long market behavior.

Bitcoin Leads, but History Says Altcoins Deliver Bigger Gains

Markets aren’t random in the short term, especially around institutional rebalancing cycles. October often is the pivot point for crypto — the end of Q3 reporting and the start of fiscal-year planning — when professional money typically re-enters risk assets.

The data supports this: combined spot and derivatives trading volume on centralized exchanges rose 7.58% in August to $9.72 trillion, the highest monthly total of 2025.

What makes this moment more compelling is how past bull markets have unfolded. In 2017, when Bitcoin passed $10,000, Ethereum jumped 9x, Cardano rose 14x, and XRP gained more than 35x in just six months.

The same thing happened in 2021 — once Bitcoin started climbing, smaller DeFi tokens like Aave, Solana, and Polygon went up between 400% and 1,200%.

History shows that when Bitcoin captures headlines, altcoins capture returns — and analysts say in 2025-2026, Digitap is going to repeat that pattern.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

Digitap Bridges Banking and Crypto as Bull Market Heats Up

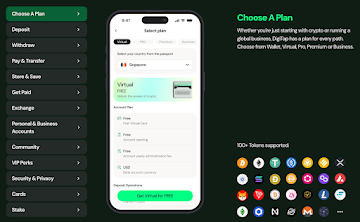

Digitap is a fintech startup trying to solve one of crypto’s oldest problems — how to actually use it. For years, digital assets have existed in a parallel economy: easy to trade, hard to spend. Digitap’s idea is simple but ambitious — make crypto behave like cash without forcing people to choose between the two.

Its app combines a full banking suite with on-chain access. Users can hold euros, dollars, or digital assets in the same dashboard and move between them instantly.

Payments are handled through a Visa network integration, so you can walk into any store, tap your Apple Pay or Google Pay wallet, and pay straight from your crypto balance. Conversion happens automatically at the point of sale, with Digitap’s backend searching for the cheapest route across banks, exchanges, and payment rails.

Beyond payments, the platform offers features you’d normally expect from a private bank: offshore accounts, multi-currency IBANs, and built-in smart routing for global transfers. What’s unusual is that it also supports a no-KYC entry tier — something aimed at users in regions with limited banking access, or those who prefer privacy for low-value transactions.

The hype around Digitap has surged over the past few weeks, and its presale performance speaks for itself. The first stage sold out within weeks, and the second stage is already 93% complete.

What makes this presale different is its tiered pricing structure — the token price increases at each new stage. That’s why experienced investors are moving quickly to secure positions early and maximize potential gains once $TAP lists on exchanges.

Why Digitap Could Be the Next Breakout in the 2025 Cycle

Peterson’s data model doesn’t just predict Bitcoin’s next move; it signals the start of a market phase where altcoins historically outperform. Every major bull cycle has followed the same rhythm: Bitcoin leads, sentiment turns, and smaller tokens multiply in value.

Digitap enters this window with a functioning product, Visa and Apple Pay integrations, and a deflationary supply model designed for growth, making it a perfect candidate to become the next breakout crypto this bull run.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post ‘Hundreds of simulations’ pin Bitcoin at 50% odds of $140K this month: Why This Prediction Makes the Digitap ($TAP) Best 2025 Presale appeared first on Live Bitcoin News.

You May Also Like

Privacy Coins Rally Driven by Technicals, Narrative

‘Survival Mode’ Activated: Bitcoin Miners Struggle As Hashprice Collapses