Inventory of crypto reserves of five major listed companies: After Trump’s election, they accelerated their entry into the market, and Strategy’s floating loss exceeded US$4 billion

Author: Nancy, PANews

Currently, more and more listed companies are actively promoting crypto asset reserve plans, especially after Trump won the US election and took power in the White House. This strategy has rapidly heated up around the world and become a new trend in corporate asset allocation. However, with the fluctuations in the global economic environment, panic caused by policy uncertainty, and concentrated exits of profit-taking, the crypto market has experienced drastic fluctuations, and many listed companies have fallen into the dilemma of paper losses.

In this article, PANews lists 5 listed companies that launched crypto reserve plans. These companies generally increased their investment after Trump won the election. However, with the obvious correction of the crypto market, high-level purchases have led to a general increase in floating losses. Among them, Strategy's floating losses on Bitcoin holdings during this period have exceeded US$4 billion, while Metaplanet, Semler Scientific, SOL Strategies and other companies have also suffered book losses of more than 10 million US dollars, and their stock price performance has also experienced roller coaster-like fluctuations.

Strategy: Bitcoin holdings have a floating loss of more than $4 billion, and the stock price has retreated more than 40% from its high

Since Trump won the US election on November 6, 2024, Strategy has purchased nearly 276,000 BTC at an average price of $94,506 per BTC, with a total investment cost of $25.679 billion. Based on the current (April 8) Bitcoin price of $79,581, Strategy's Bitcoin holdings currently have a floating loss of approximately $4.12 billion.

From the purchase strategy of Strategy during this period, we can clearly observe its strategic shift from aggressive expansion to cautious wait-and-see. Specifically, in November 2024, when the price of Bitcoin was at a high stage, Strategy increased its holdings by more than 134,000 Bitcoins, accounting for about 48.7% of the total increase during the period, showing its aggressive market expansion attitude and strong confidence in the long-term bullishness of the market. After entering 2025, as the price of Bitcoin fell back, Strategy adopted a more cautious strategy, significantly reduced its purchases, and entered a wait-and-see period. However, recently Strategy has shown signs of re-increasing, investing nearly $1.92 billion in its latest investment on March 31. But it is worth noting that Strategy did not further increase its holdings of Bitcoin last week, and it still maintained a certain wait-and-see attitude when the market situation is not yet clear.

In addition, since November 6, Strategy's stock price soared to $473.8 in the short term, an increase of 83.77%, but then continued to fall. As of April 8, its stock price fell by about 43.4% from its high point during this period.

Metaplanet: Accelerating Bitcoin reserves but still in a loss, stock price hits multi-year high

Since November 6, 2024, Metaplanet has purchased 3,188 bitcoins through 11 purchases, with an average purchase price of $82,001, and a cumulative expenditure of more than $260 million. Calculated at the current (April 8) bitcoin price of $79,581, Metaplanet's bitcoin holdings during this period currently have a floating loss of approximately $23.63 million. Since it began to reserve bitcoins in April 2024, Metaplanet has spent a total of more than $360 million to purchase 4,206 BTC, indicating that it has significantly increased its bitcoin reserves after Trump's election. However, based on the overall average purchase price of $86,500 for bitcoin, Metaplanet currently still has a floating loss of approximately $29.09 million.

From a time point of view, since Bitcoin began to decline from its historical high in January, Metaplanet has significantly accelerated the pace of increasing its holdings, increasing its holdings 9 times in less than 2 months, buying a total of approximately 2,444 BTC, accounting for 58.1% of the total holdings, demonstrating its investment strategy of buying on dips.

It is worth mentioning that the Japanese hotel development and operation company plans to increase its Bitcoin holdings to more than 10,000 by 2025, aiming to be among the top ten Bitcoin holding companies in the world. At the same time, during the Bitcoin price volatility, in order to consolidate its financial situation, Metaplanet has recently repaid 2 billion yen (13.5 million U.S. dollars) worth of bonds in full ahead of schedule.

In terms of stock price performance, Metaplanet's stock price rose to 665 yen after Trump's election, an increase of 216.7%, setting a new high since October 2013. However, as the price of Bitcoin fell, its stock price also fell nearly 49.2% from its high point.

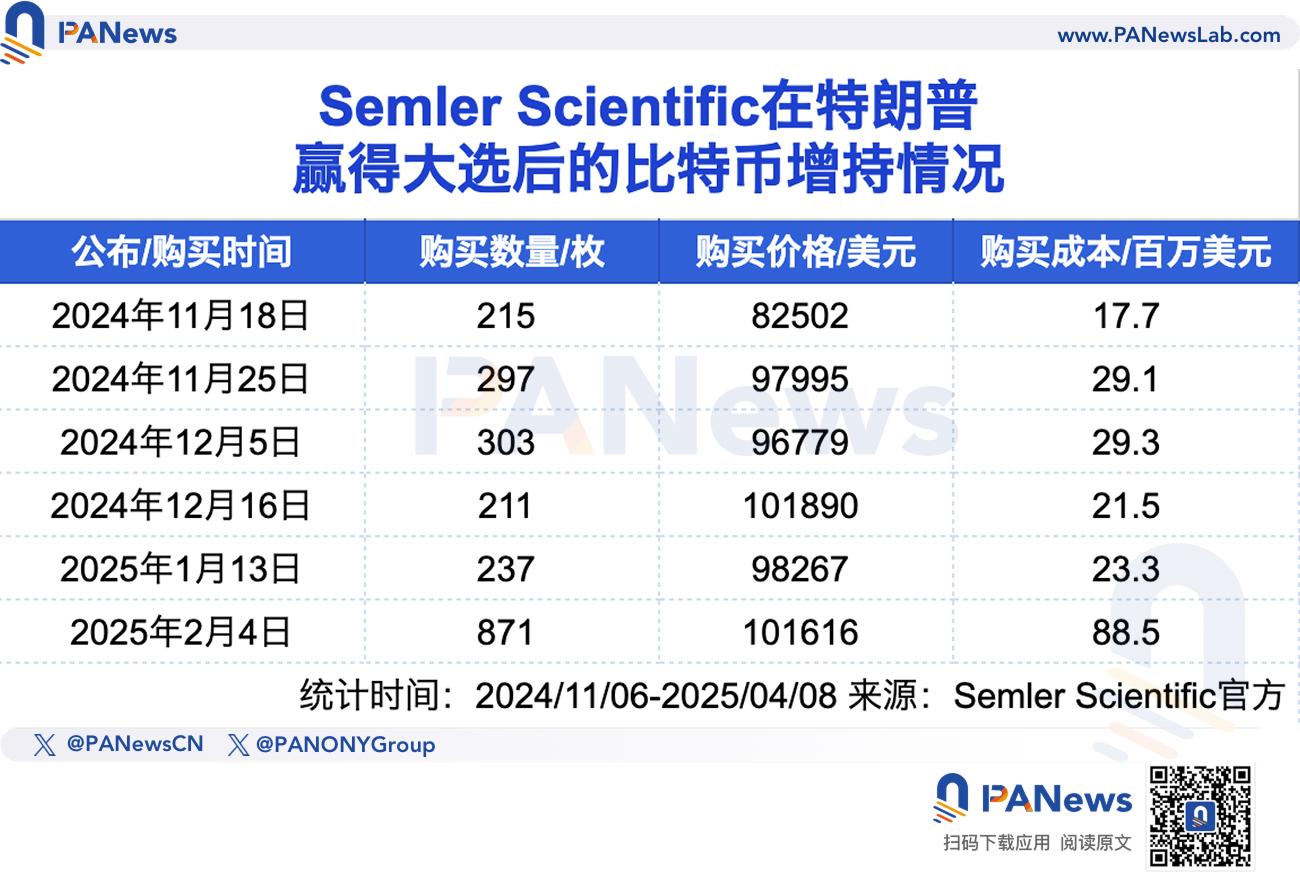

Semler Scientific: Bitcoin holdings increased significantly at high levels, and stock price gains were reversed

Since Trump's election, Semler Scientific has significantly increased its holdings of Bitcoin, with a total of 2,134 BTC, accounting for 66.8% of its current public holdings (3,192 BTC), and a total investment cost of nearly $210 million. However, its Bitcoin acquisition strategy shows obvious "high-level takeover" characteristics: compared with the previous average price of $69,682, the average purchase price during this period was as high as $96,508. Calculated at the current Bitcoin price of $79,581, the company's book loss has exceeded $36.12 million.

In terms of stock price performance, Semler Scientific's stock price experienced a short-term surge during this period, reaching a maximum of US$74.7, with an increase of 86.3% at one point. However, the stock price subsequently fell back, and all gains were wiped out, failing to maintain its previous strong performance.

SOL Strategies: Heavy positions at high levels caused a floating loss of tens of millions of dollars, and the stock price fell by more than 60% after reaching a new high

SOL Strategies has invested a total of $29.4 million since Trump was elected, purchasing more than 128,000 SOLs, accounting for 47.9% of its total holdings (267,000 SOLs). However, its purchases were mostly made at high prices. For example, on February 3, 2025, SOL Strategies announced the purchase of 40,300 bitcoins at a cost of $246, while on January 27, 2025, it purchased 19,100 bitcoins at a cost of $365. This high-price buying strategy resulted in SOL Strategies' average purchase price of about $235. At the current market price of $108, its paper loss has exceeded $16.28 million. Despite this, SOL Strategies used the more than 265,000 SOLs it held for staking, effectively mitigating some of the losses through staking rewards.

Meanwhile, SOL Strategies' stock price fluctuated dramatically during this period, soaring 258.8% to $6.1, setting a new record high. However, the stock price subsequently fell sharply, down 65.74% from its peak.

Remixpoint: High-frequency small-amount purchases of Bitcoin, with an average price of up to $96,000

Remixpoint, a Japanese listed company, will include crypto assets in its strategic reserves starting in 2024, including BTC, ETH, SOL and XRP, among which BTC is its main purchase asset. Since November 6 last year, Remixpoint has significantly accelerated the pace of BTC holdings, with a cumulative investment of more than US$46 million to purchase 483 BTC, accounting for 78.4% of its total holdings (616 BTC). From the perspective of investment strategy, Remixpoint adopts a high-frequency, small-amount purchase method, with the purchase quantity controlled at dozens of BTC each time, and the maximum single purchase not exceeding 56.3 BTC.

However, Remixpoint's average BTC purchase price was relatively high, reaching $96,807. Based on the current Bitcoin price of $79,581, the floating loss of the 483 BTC it purchased has exceeded $8.32 million. If the overall average holding price is estimated at about $86,000, Remixpoint's floating loss is narrowed to about $3.95 million.

Despite this, Remixpoint's stock price performance during this period was quite impressive, soaring by about 444% to $806, a record high since October 2018. However, as of April 8, 2025, the stock price has fallen back by about 55.5% from its peak.

You May Also Like

Altcoin Season Index Surges to 46: What This Means for Your Portfolio

Mira Network establishes a foundation and may launch TGE soon