Is the global liquidity cycle peaking? Is the Bitcoin bull market over?

Author: Michael Nadeau

Compiled by: Plain Language Blockchain

The post-pandemic era has been defined by fiscal dominance—an economy driven by government deficits and short-term Treasury bond issuance, with liquidity remaining high even as the Federal Reserve maintains high interest rates.

Today, we are entering a phase dominated by the private sector, where the Treasury is withdrawing liquidity through tariffs and spending restrictions, unlike the previous administration.

That's why interest rates need to fall.

We analyze the current cycle from the perspective of global liquidity to emphasize why the current round of "devaluation trading" has reached its final stage.

Is fiscal dominance coming to an end?

We always hope to "buy the dip" when everyone else is "chasing the rise".

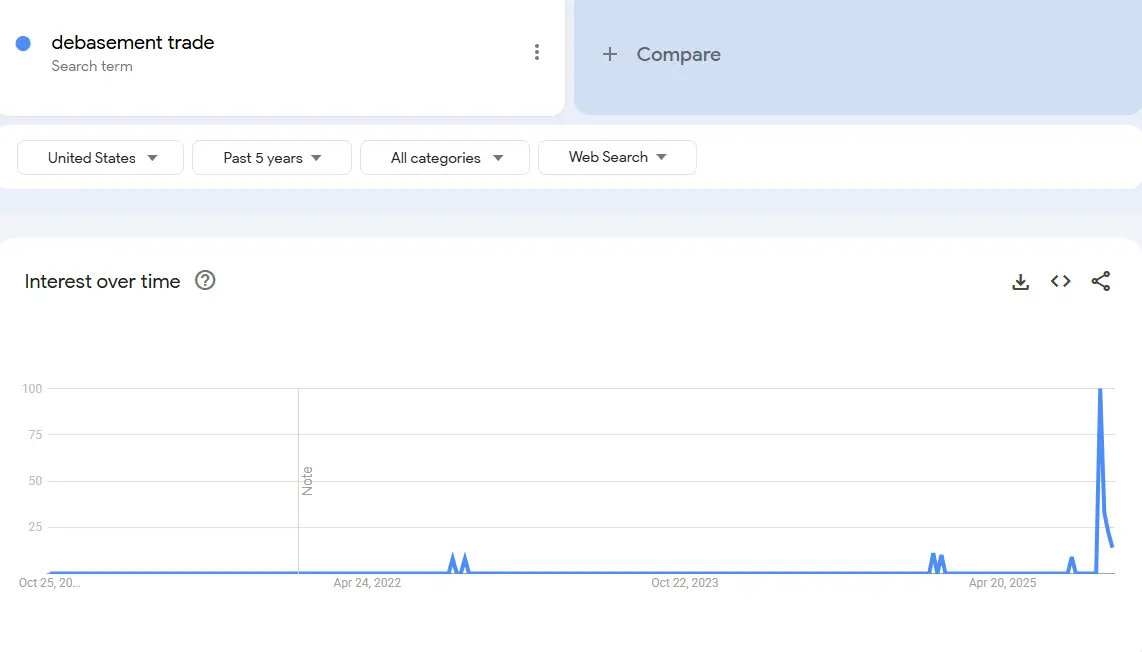

That's why all the recent discussions about "devaluation trading" have caught our attention.

Data: Google Trends

Data: Google Trends

We believe the interest in "devaluation trading" arose a few years ago. At that time, Bitcoin was priced at $25,000 and gold at $2,000. Back then, nobody talked about it except cryptocurrency and macro analysts.

In our view, this "deal" is essentially complete.

Therefore, our task is to understand the conditions that created it, and whether those conditions will continue to exist.

What drove this deal? In our view, there are mainly two factors.

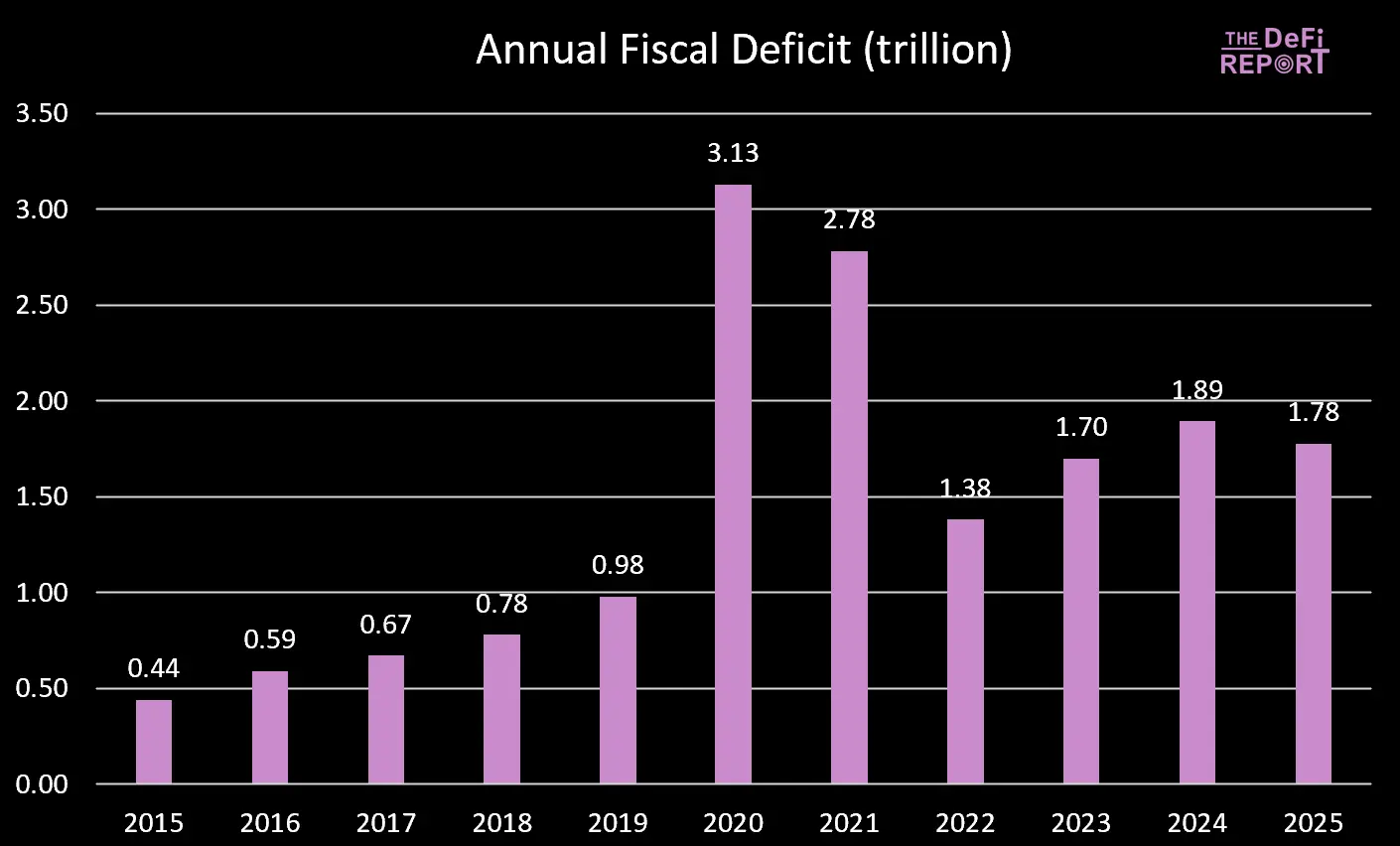

1. Treasury spending. During the Biden administration, we implemented a large-scale fiscal deficit.

Data: US Treasury

Data: US Treasury

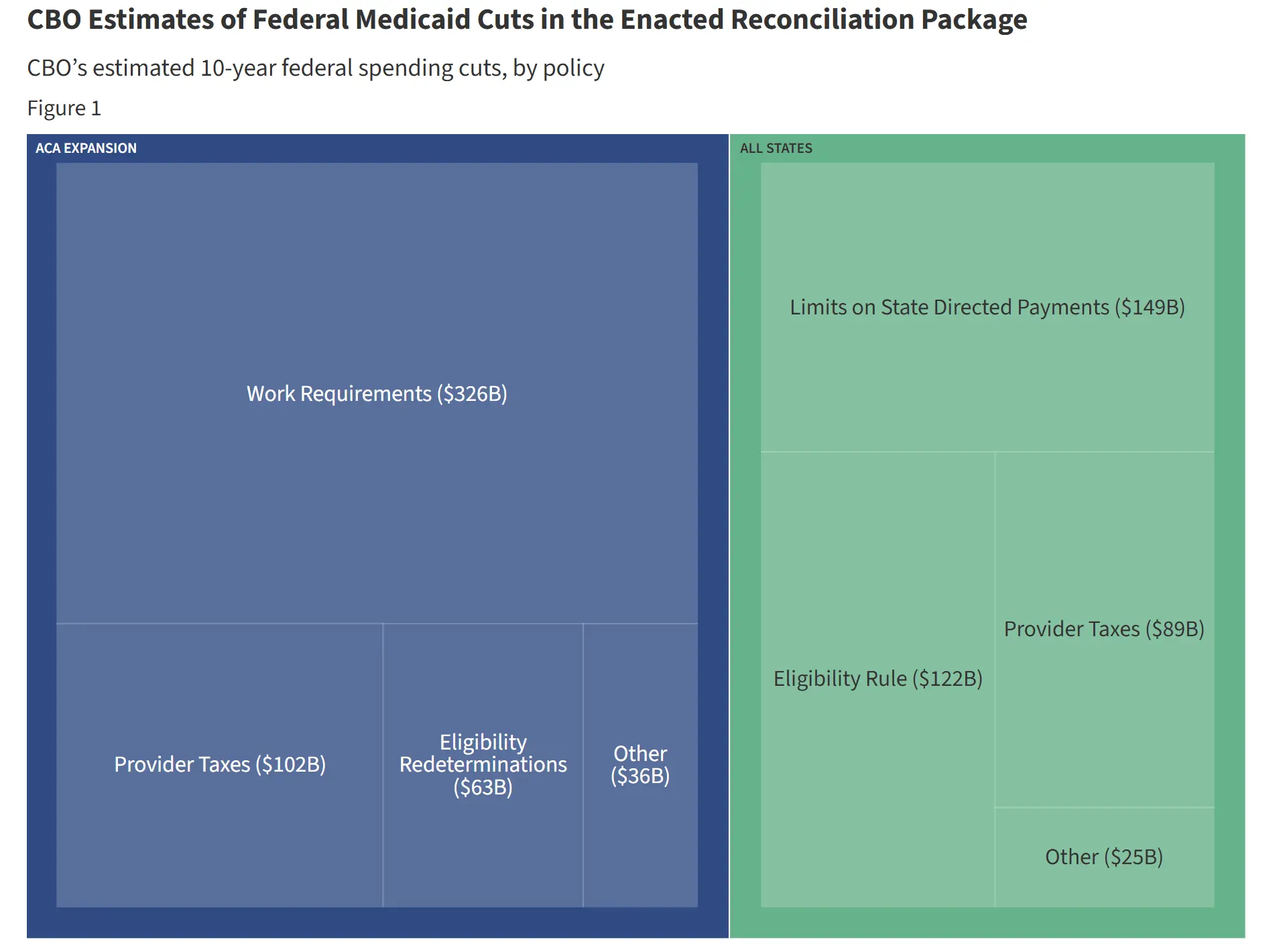

The fiscal year 2025 has just ended, and the deficit has narrowed slightly—primarily due to increased taxes (tariffs) rather than reduced spending. However, the Big Beautiful Bill is expected to achieve spending cuts by reducing benefits from Medicaid and the Supplemental Nutrition Assistance Program (SNAP).

Data: Comparison of KFF (Kaiser Family Foundation) cuts with current spending trajectory

Data: Comparison of KFF (Kaiser Family Foundation) cuts with current spending trajectory

During Biden's presidency, government spending and transfer payments continuously injected liquidity into the economy. However, under the Great America Act, spending growth slowed.

This means that the government is injecting less money into the economy.

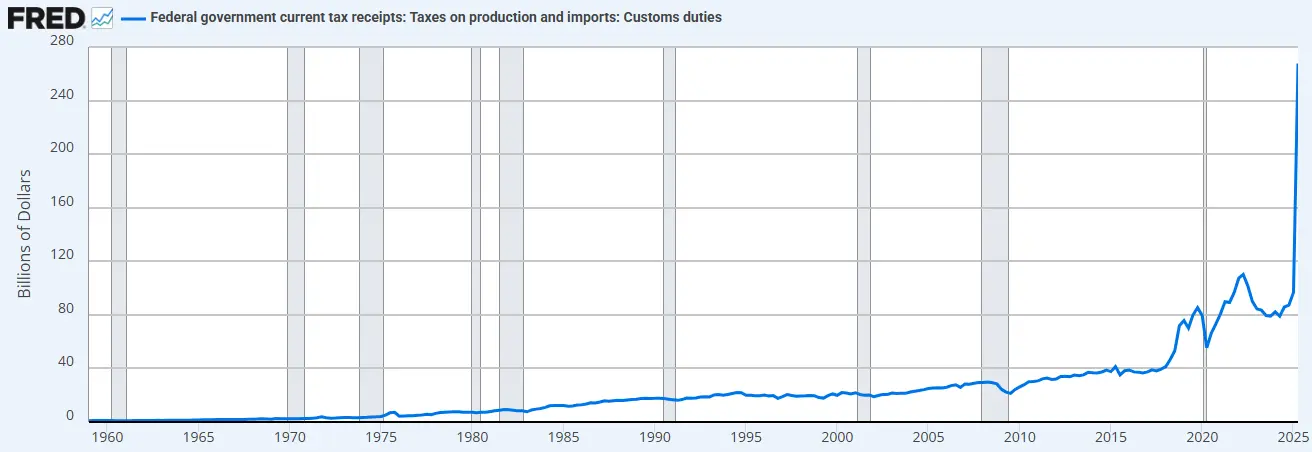

In addition, the government is withdrawing funds from the economy through tariffs.

Data: FRED (St. Louis Federal Reserve Economic Data)

Data: FRED (St. Louis Federal Reserve Economic Data)

The combination of spending restrictions (relative to the previous administration) and increased tariffs means that the Treasury is now absorbing liquidity rather than supplying it.

This is why we need to cut interest rates.

"We will privatize the economy, revitalize the private sector, and shrink the government." - Scott Bessent

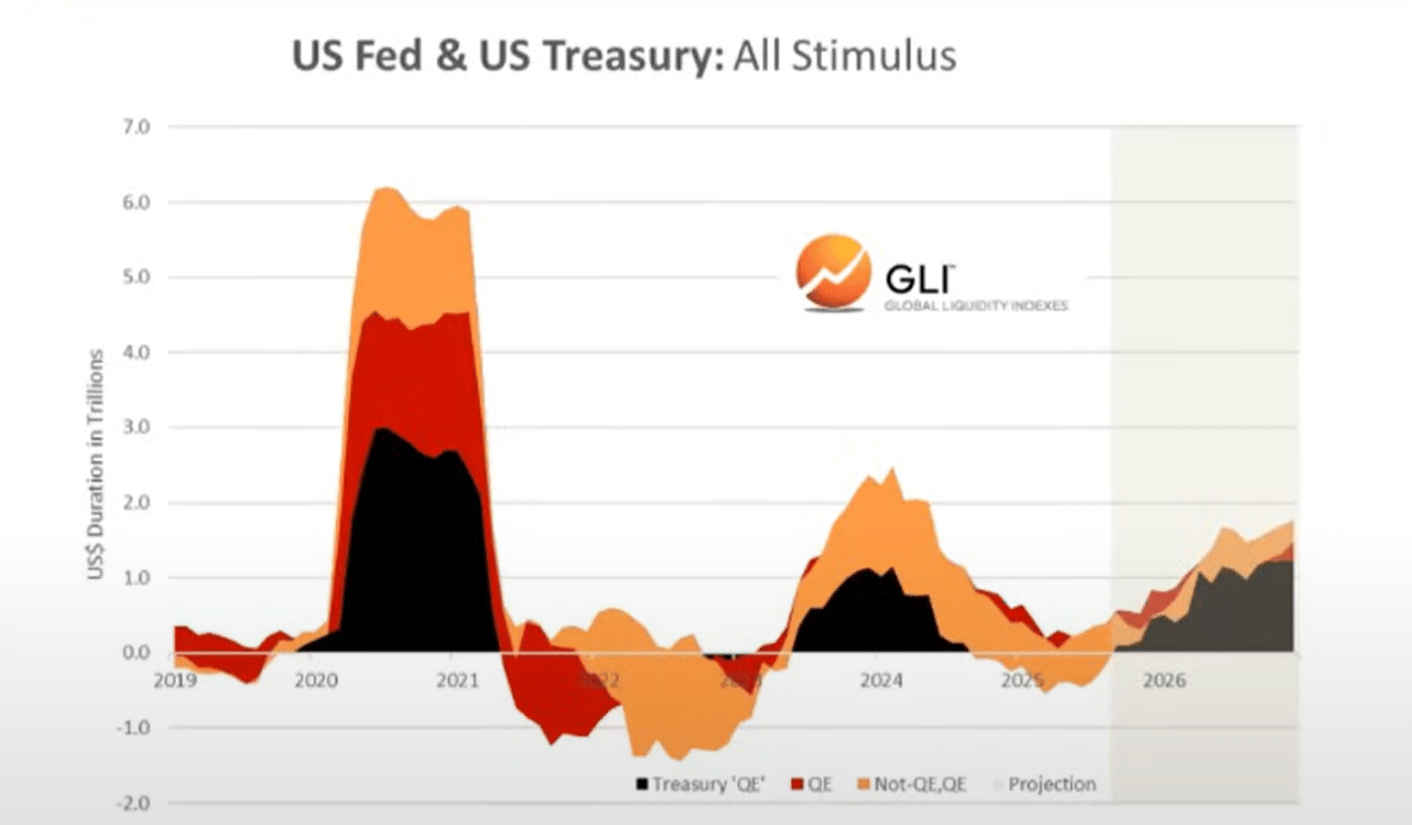

2. "Treasury QE". To fund the excessive spending by the Treasury during the Biden administration, we also saw a new form of "quantitative easing" (QE). We can observe this below (black line). "Treasury QE" supported the market by funding government spending through short-term notes rather than long-term bonds.

Data: Global Liquidity Index

Data: Global Liquidity Index

We believe that fiscal spending and quantitative easing by the Treasury have fueled the “devaluation trade” and “everything bubble” that we have seen in the past few years.

But now we are transitioning to a "Trump economy," with the private sector taking over the reins from the Treasury.

Similarly, this is why they need to lower interest rates. They need to use bank loans to stimulate the private sector.

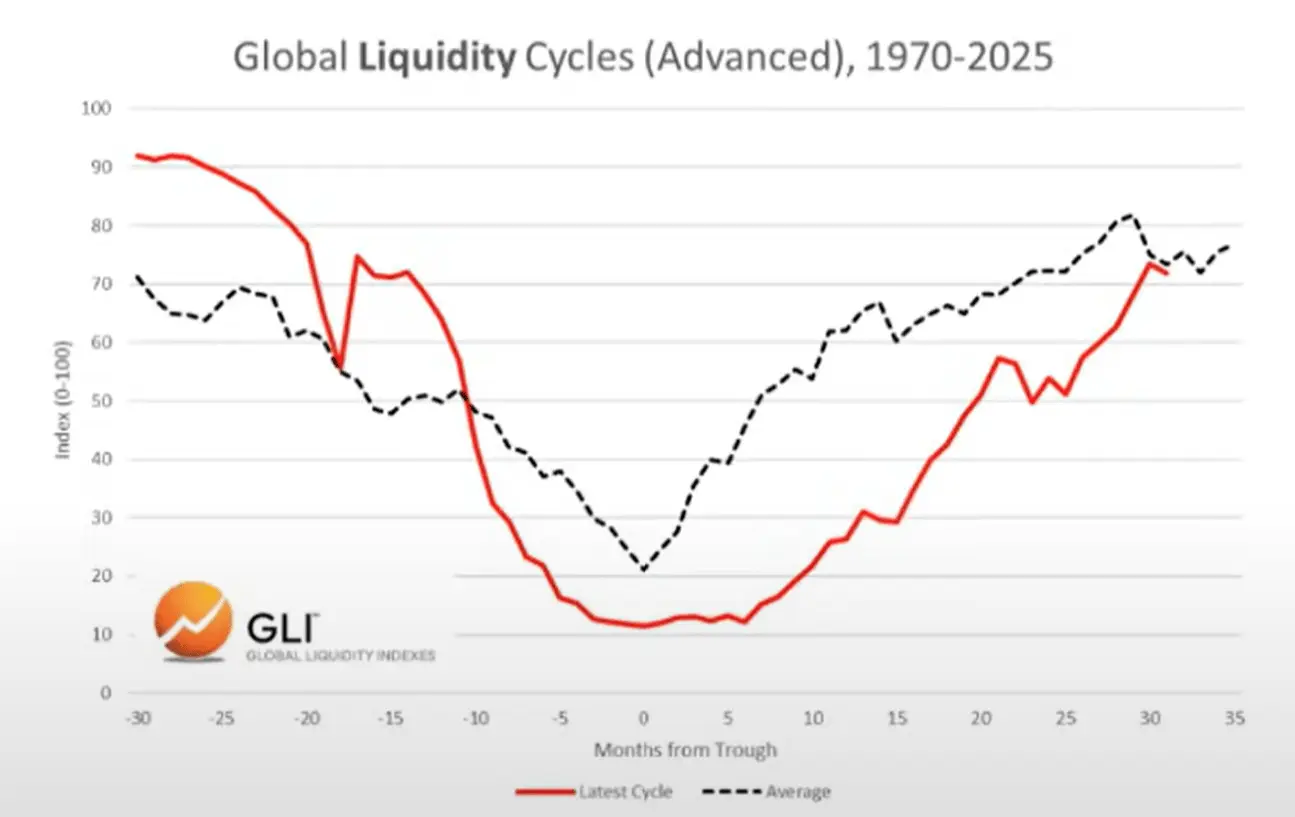

As we enter this transition period, the global liquidity cycle appears to be peaking...

The global liquidity cycle is peaking and declining.

Current cycle and average cycle

Below, we can observe a comparison between the current cycle (red line) and the historical average cycle (gray line) since 1970.

Data: Global Liquidity Index

Data: Global Liquidity Index

Asset allocation

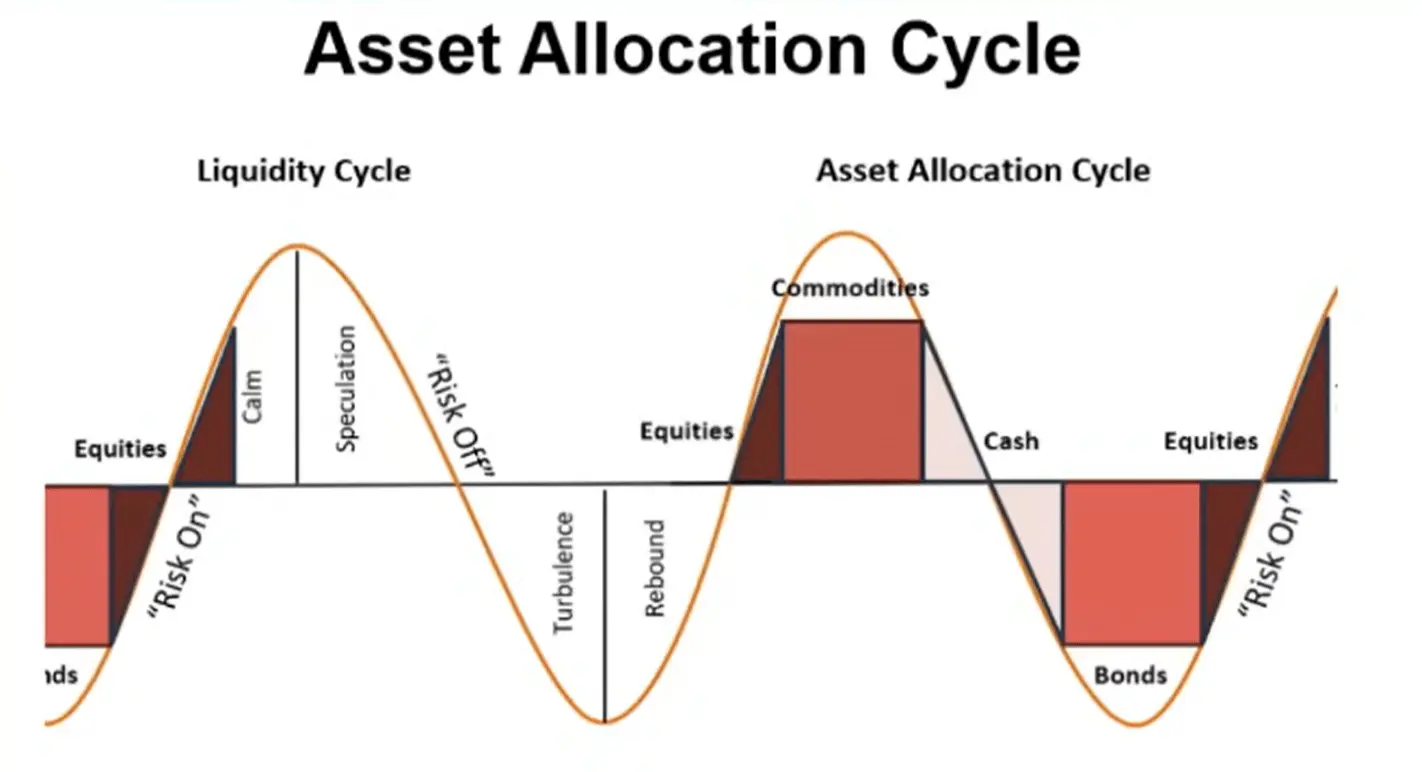

Based on Mr. Howell's work on global liquidity indices, we can observe typical liquidity cycles and their alignment with asset allocation.

Commodities are often the last assets to fall, which is exactly what we are seeing today (gold, silver, copper, palladium).

From this perspective, the current cycle looks very typical.

Data: Global Liquidity Index

Data: Global Liquidity Index

So, if liquidity is indeed peaking, we expect investors to rotate into cash and bonds as the environment changes. To be clear, this process hasn't even begun yet (the market remains "risk-averse").

Debt and Liquidity

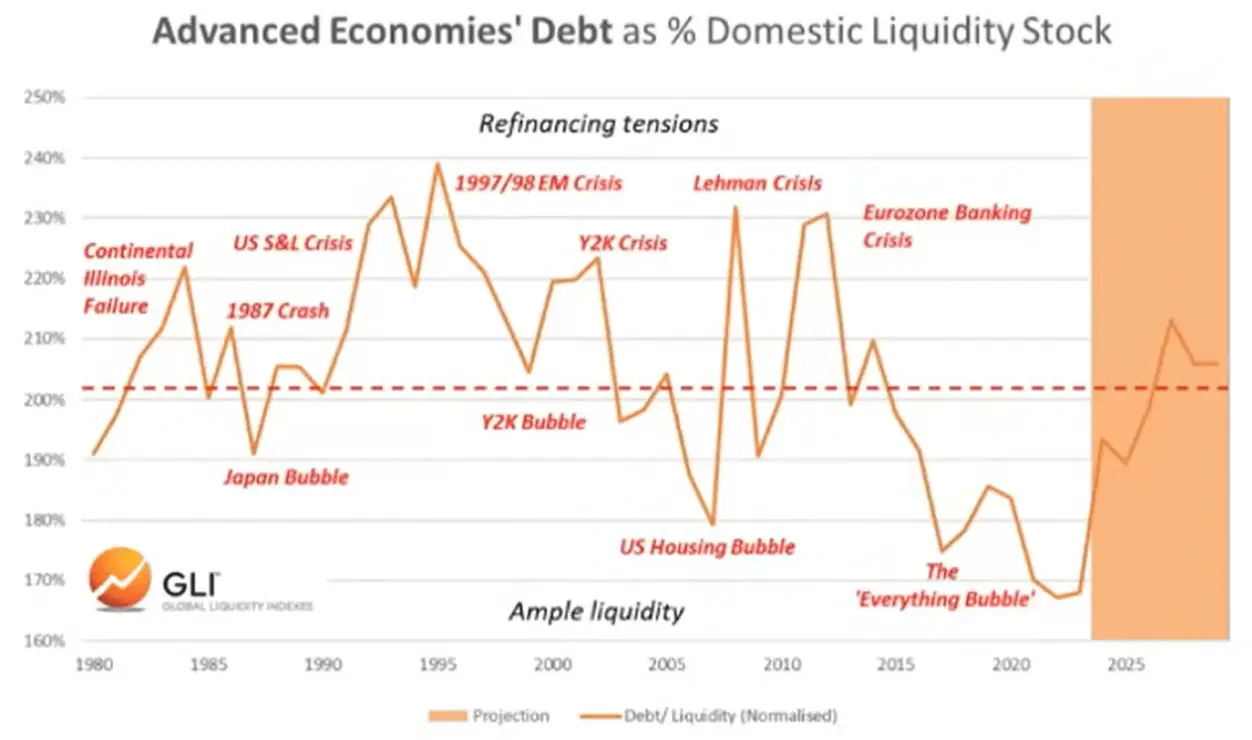

According to the Global Liquidity Index, the debt-to-liquidity ratio of major economies reached its lowest level since 1980 at the end of last year. It is now rising and is expected to continue rising until 2026.

Data: Global Liquidity Index

Data: Global Liquidity Index

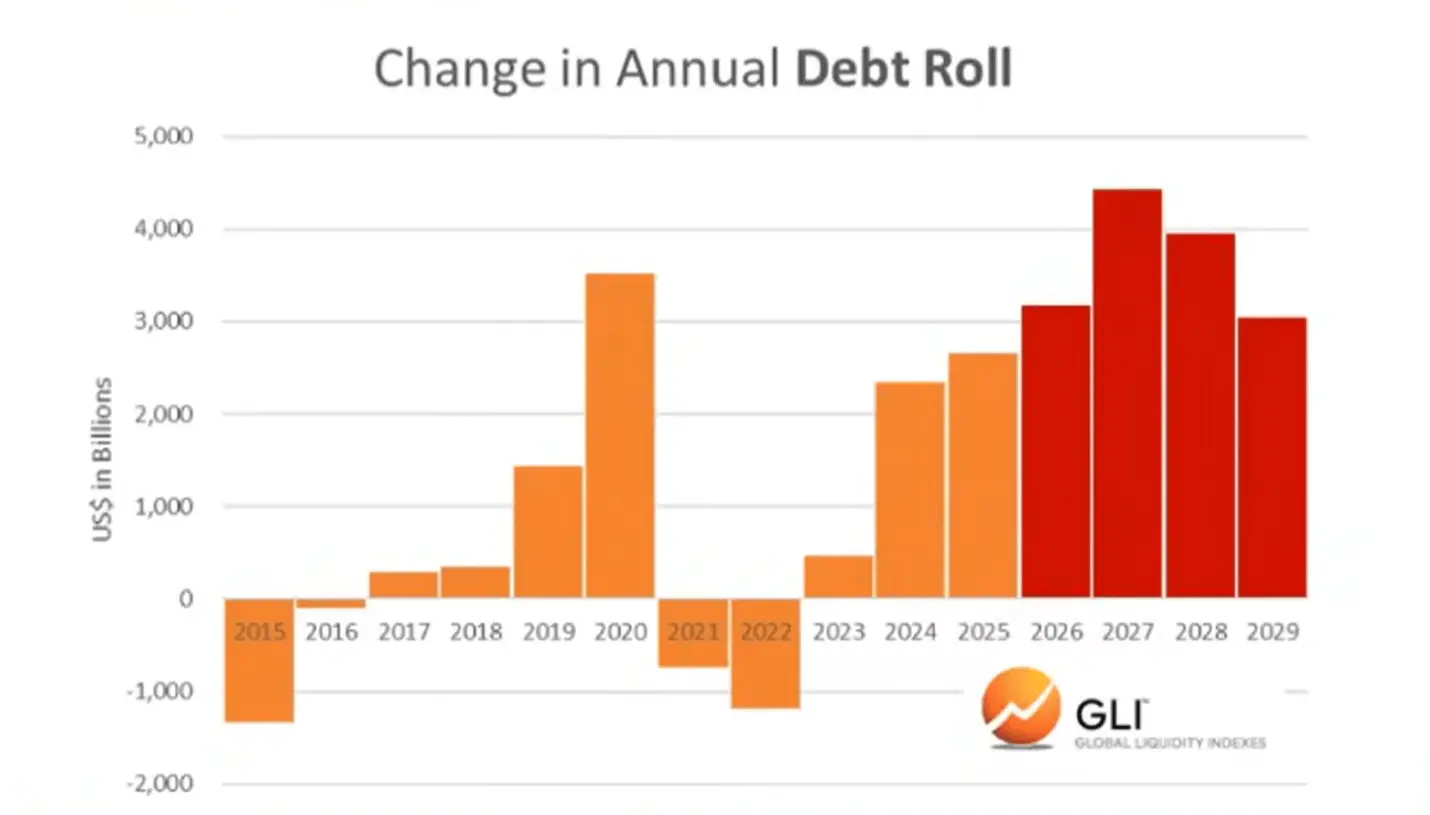

The rising debt-to-liquidity ratio makes it more difficult to service trillions of dollars of outstanding debt that need to be refinanced.

Data: Global Liquidity Index

Data: Global Liquidity Index

Bitcoin and Global Liquidity

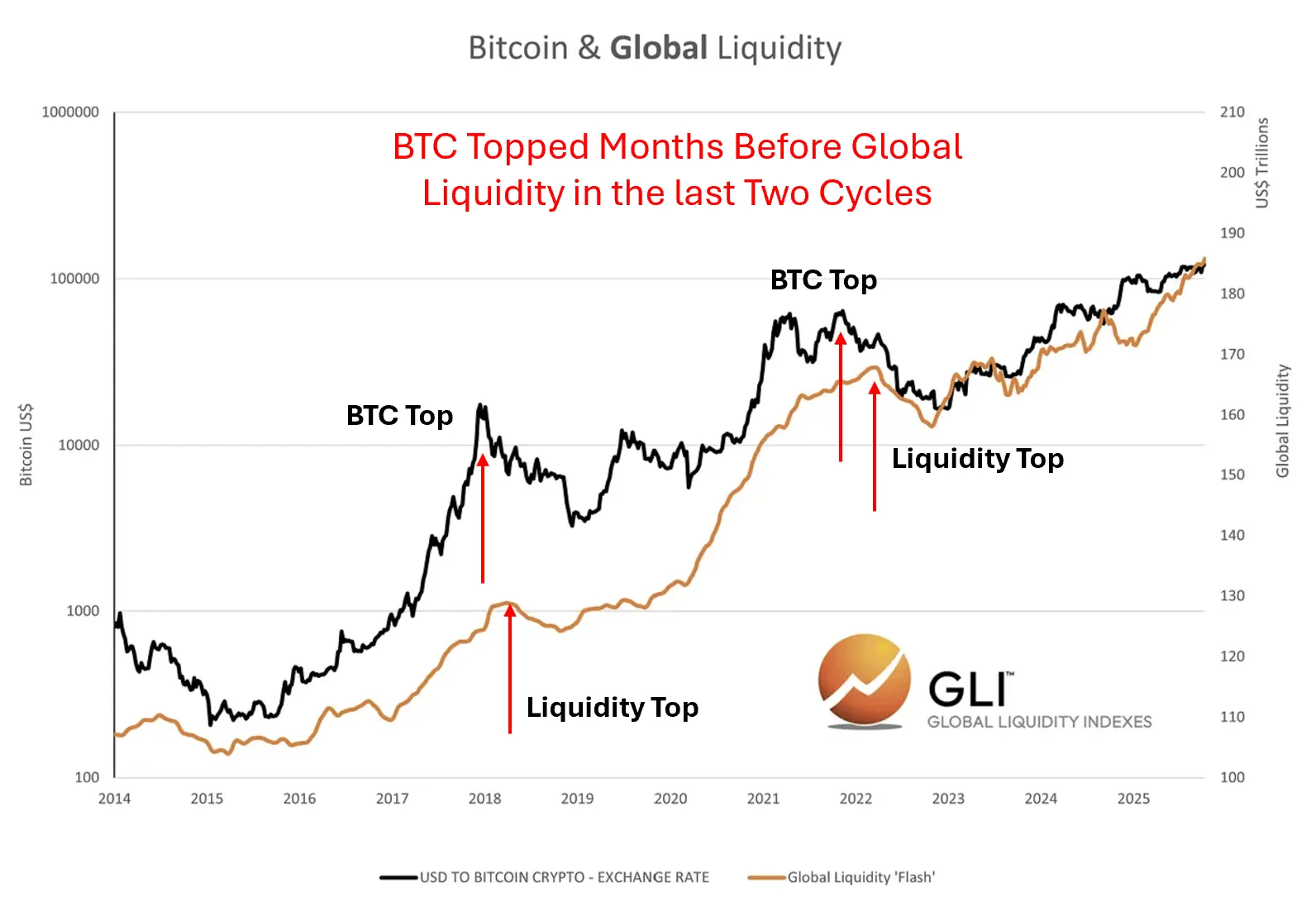

Of course, Bitcoin has "foreshadowed" peak global liquidity in the past two cycles. In other words, Bitcoin peaked months before liquidity peaked and began to decline, seemingly anticipating the subsequent drop.

Data: Global Liquidity Index

Data: Global Liquidity Index

We don't know if this is happening right now. But we do know that cryptocurrency cycles always closely follow liquidity cycles.

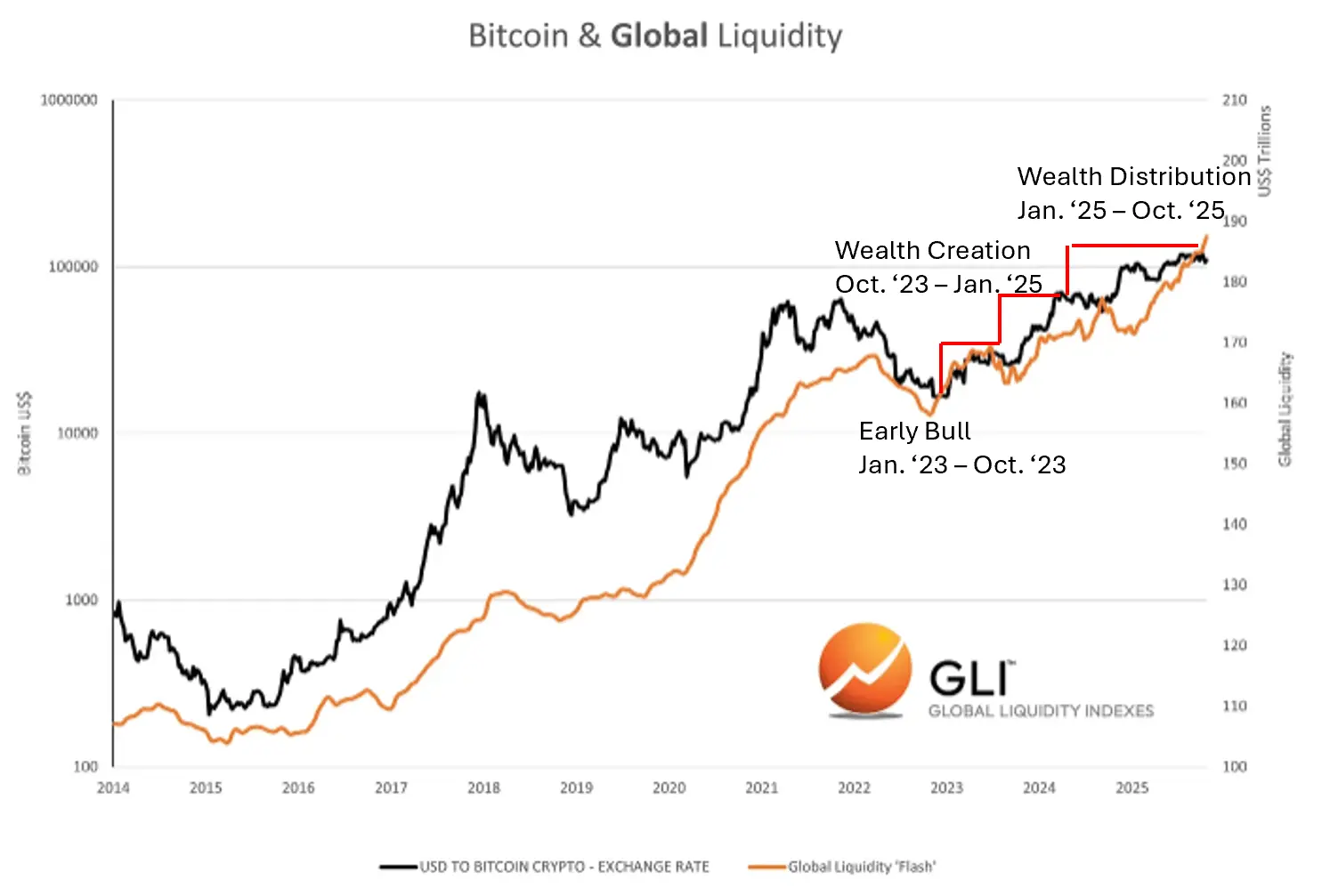

Alignment with the cryptocurrency cycle

Data: Global Liquidity Index

Data: Global Liquidity Index

You May Also Like

Best Bitcoin Casinos: 2025’s Top 7 Crypto Casino Platforms

Thailand's Finance Minister: Regulatory oversight of cryptocurrencies, gold, foreign exchange, and cash transactions will be strengthened.