JPMorgan Says Bitcoin Is Now More Attractive Than Gold And Could Rise To $170,000

Key highlits

- PMorgan says Bitcoin now rivals gold as a top investment pick

- Analyst forecasts Bitcoin could rise toward $170,000 soon

- Volatility shift makes Bitcoin more stable and undervalued

In a striking reversal, JPMorgan has declared that Bitcoin now looks more attractive than gold, signaling a major change in sentiment from a bank once wary of cryptocurrencies. The Wall Street giant now sees “significant growth potential” for the world’s top digital asset.

Just last month, on October 5, Bitcoin surged to an all-time high of $126,000, only to drop more than 20% by the end of the month and briefly slip below $100,000. But according to JPMorgan, this downturn isn’t a red flag — it’s a reset.

Bitcoin Price. Source: CoinCodex

What drove the recent Bitcoin drop

Nikolaos Panigirtzoglou, a global markets analyst at JPMorgan, attributes the correction to two main triggers:

- The mass liquidation of perpetual futures, leveraged contracts that amplify price moves

- The $88 million theft from the decentralized finance platform Balancer

This event reignited debate around crypto security and showed how swiftly deleveraging can hit Bitcoin markets.

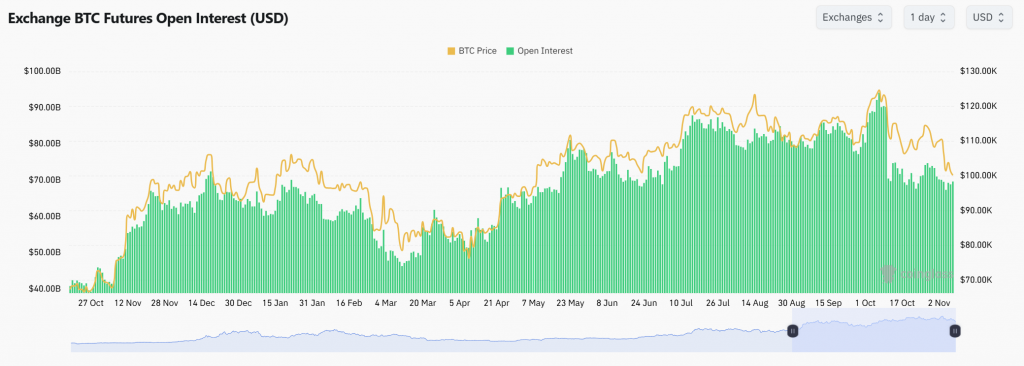

Panigirtzoglou notes that open interest in Bitcoin futures — a key leverage indicator has since fallen back to average levels seen since early 2024, suggesting the worst of the correction may be over.

Exchange BTC Futures Open Interest (USD). Source: CoinGlass

Bitcoin vs Gold a shift in volatility and value

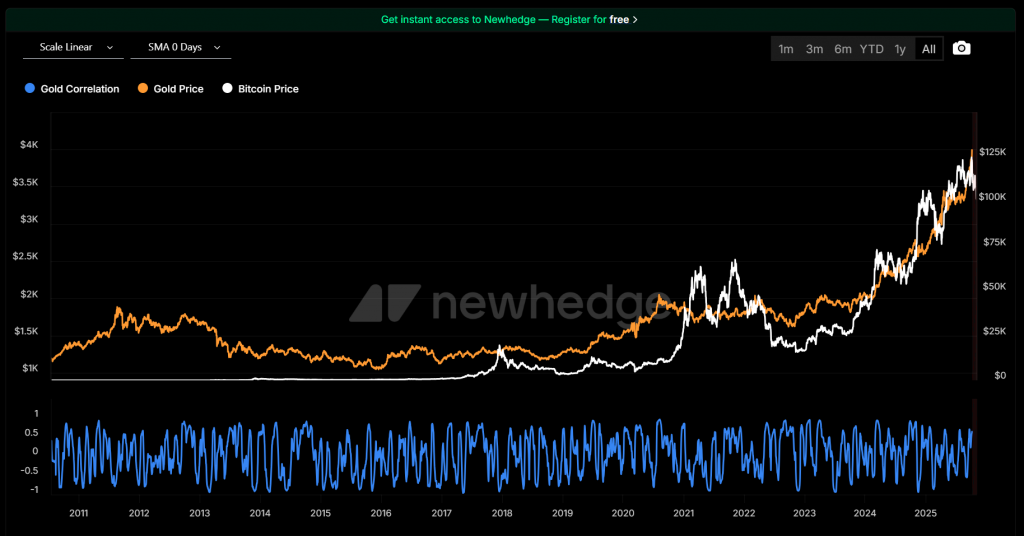

While Bitcoin’s price has been volatile, its risk profile has improved relative to gold.

Panigirtzoglou highlights that gold’s recent volatility surge — after prices topped $4,000 has narrowed the gap. The Bitcoin-to-gold volatility ratio now sits below 2.0, meaning Bitcoin consumes only 1.8 times more risk capital than gold.

Bitcoin vs Gold Correlation. Source: Newhedge

In simple terms, Bitcoin no longer looks like the wild gamble it once was. With lower volatility, investors need less “safety capital” to hold it, making it more competitive with traditional assets like gold.

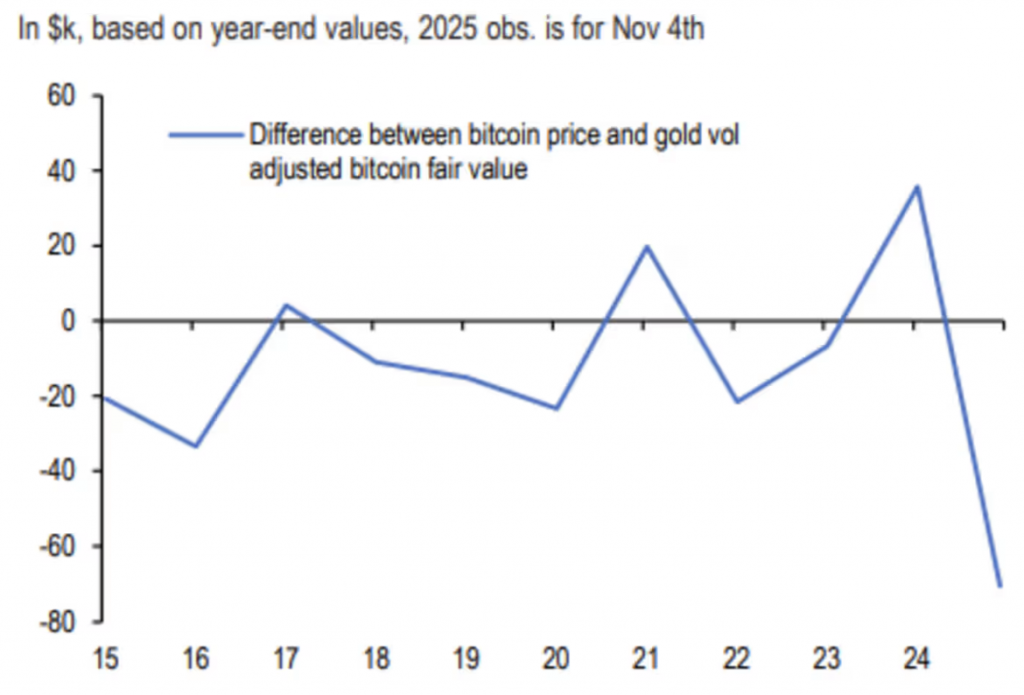

The difference between Bitcoin’s price and its fair value relative to gold, taking volatility into account. Source: MarketWatch, JPMorgan

According to JPMorgan’s models, with a market capitalization of $2.1 trillion, Bitcoin’s price would need to climb roughly two-thirds (to about $170,000) to match the $6.2 trillion in private gold investment — once adjusted for volatility.

“If at the end of last year Bitcoin was overvalued by $36,000 compared to gold, now it’s undervalued by about $68,000,” Panigirtzoglou explained.

Despite recent ETF outflows, JPMorgan analysts believe most leveraged positions have been unwound, stabilizing the market.

With volatility easing and institutional interest rising, the bank argues that Bitcoin could soon challenge gold’s dominance as a store of value.

For investors who doubted Bitcoin’s long-term resilience, JPMorgan’s new stance delivers a powerful message — the digital gold era may be closer than ever.

You May Also Like

Bitcoin Price Weakness: The Shocking Truth About Who’s Really Selling

CME Group to Launch Solana and XRP Futures Options