Kanye West Unveils Official “YZY Money” Ecosystem on Solana

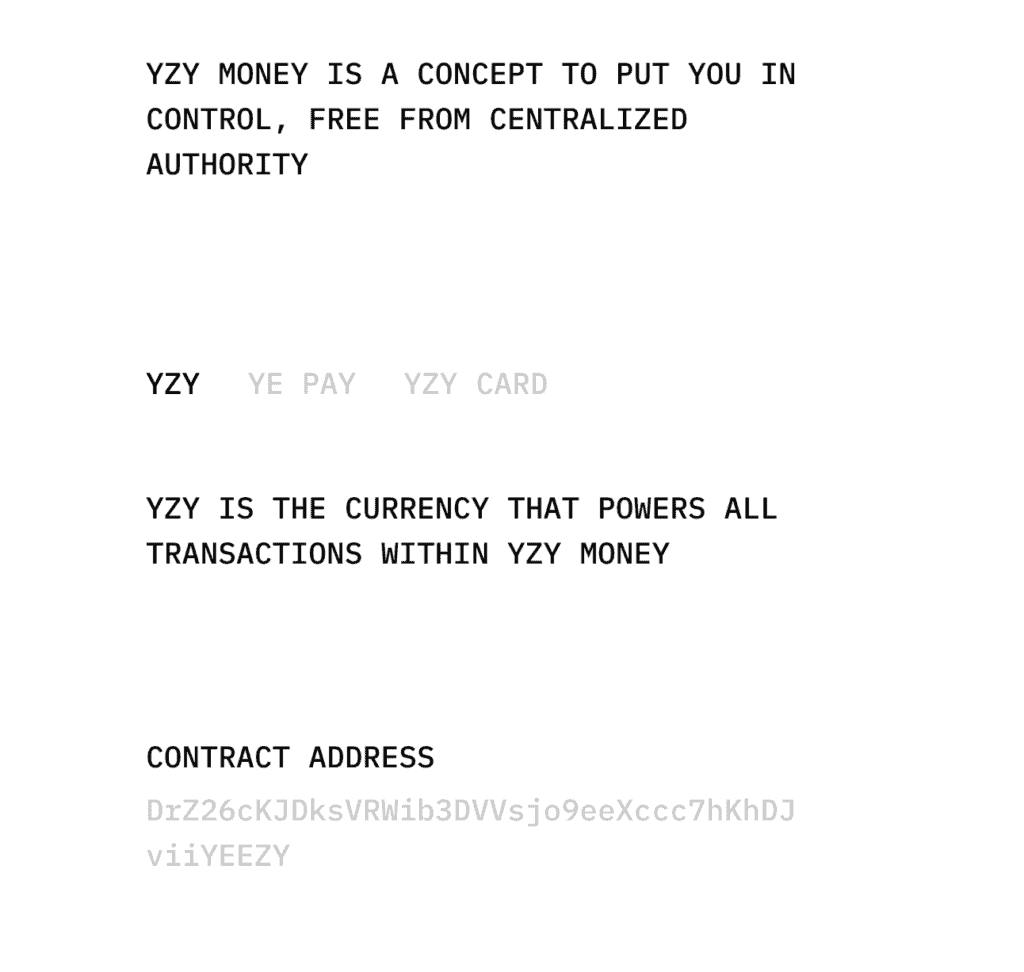

YZY Money is presented as a bold push into decentralized finance, part of what Ye dubs a “new economy, built on chain.” The ecosystem consists of:

- YZY token: A Solana-based memecoin meant to power transactions within the YZY ecosystem.

- Ye Pay: Designed to offer merchants lower processing fees than traditional credit card platforms.

- YZY Card: A non-custodial debit card allowing users to spend YZY, USDC, and USDT directly at merchants—without converting into fiat currency.

The YZY Website, YZY

Initial Performance:

Within 40 minutes of launch, the YZY token’s market capitalization soared to approximately $3 billion, riding a massive surge of speculative interest.

However, the spike was short-lived. The token’s value plummeted significantly—dropping by roughly two-thirds within hours. Reports estimate the market cap fell to about $1 billion or below.

Insider Concerns & Tokenomics:

On-chain data raised red flags:

- Roughly 70% of the total token supply was allocated to Ye’s team, with 10% reserved for liquidity and only 20% available to the public.

- Major token holdings were concentrated among insiders, prompting widespread skepticism and claims of unequal opportunity.

- Critics argue the launch bore hallmarks of a “pump-and-dump” model—with insiders cashing out early while latecomers took heavy losses.

Security Features:

In a bid to curb automated speculation (sniping), the project deployed 25 contract addresses, randomly selecting only one as the valid token contract. This meant users had just a 1-in-25 chance of picking the right one—an attempt to level the playing field for real traders.

What About Earlier Kanye-Inspired Tokens?

Prior to YZY Money, two unofficial meme coins—Yeezy Coin (4NBT) and Swasticoin—gained traction within fringe crypto communities. Some holders viewed them as part of a cryptic performance art piece or alternate reality game, reading Ye’s social media updates like prophetic clues.

But once the official YZY token dropped, everything unraveled:

- Yeezy Coin (4NBT) plummeted 88% from its recent high.

- Swasticoin followed close behind with a decline of 78%.

The symbolic collapse exposed the danger of conflating excitement with endorsement—and the perils of speculative hype in the absence of any official backing.

Back in 2014, Coinye, a Kanye inspired crypto coin was launched. We covered its long strange history here.

Ye’s launch of YZY Money signals a high-profile convergence of music, fashion branding, and crypto—leveraging celebrity influence to push a nascent financial ecosystem. But the dramatic launch and steep correction underscore flashing caution signs. With insider-heavy tokenomics and explosive volatility, YZY exemplifies both the allure and the risks of celebrity-driven meme coins.

You May Also Like

XRP Price Prediction: Investors book $300M profit as hawkish expectation rises ahead of Powell's speech

BNB hits $883 ATH – Can it break $1K despite THIS hurdle?