Machi Big Brother’s $44M Profit Turns to $9M Loss After Hyperliquid Ripoff

- Jeffrey Huang faces nearly $9 million in floating losses on his Hyperliquid account, after a sharp decline from previous substantial profits.

- The celebrity’s large leveraged positions include a $1.2 million Ether trade and a $10 million Plasma token bet, both impacted by recent market volatility.

- Despite the current losses, Huang’s account remains profitable overall, with a combined profit and loss exceeding $11.6 million.

- Whale investors are actively accumulating Plasma tokens, signaling confidence in a potential price recovery, even as upcoming token unlocks threaten further selling pressure.

- Market analysts continue to monitor the Plasma token’s price trajectory amid significant scheduled vesting and unlock events.

High-Profile Trader Suffers Massive Floating Losses on Crypto Leverage

Taiwanese music star and prominent digital asset investor Jeffrey Huang — also known as “Machi Big Brother” — has recently found himself on the wrong side of the volatile cryptocurrency markets. His Hyperliquid account, linked to the Ethereum and Plasma tokens, has seen a drastic shift from a profit of approximately $44 million just 13 days ago to a floating loss nearing $9 million. The account, associated with the address 0x020c, holds highly leveraged positions that are vulnerable to market swings.

Huang’s position on the Plasma (XPL) token, with 5x leverage, involved a long bet on price appreciation. With an initial profit of $44 million, the position has now unrealized losses of $8.7 million, with a liquidation threshold at $0.5366. Meanwhile, his Ether position, leveraged at 15x on a $1.2 million position, remains profitable at about $534,000 unrealized gains, with a liquidation point near $3,836.

Such sharp reversals underscore the perils of high-leverage trading, as it costs Huang over $115,000 in funding fees. Nevertheless, his overall account remains in profit, with the combined PnL exceeding $11.6 million.

This recent decline follows Huang’s exit from a $25 million Hyperliquid HYPE position at a $4.45 million loss on Sept. 29. The move was prompted by warnings from notable figures like Arthur Hayes’ Maelstrom fund about impending token unlocks, which could introduce additional volatility and selling pressure.

Whales Are Accumulating Plasma Tokens, Signaling Optimism

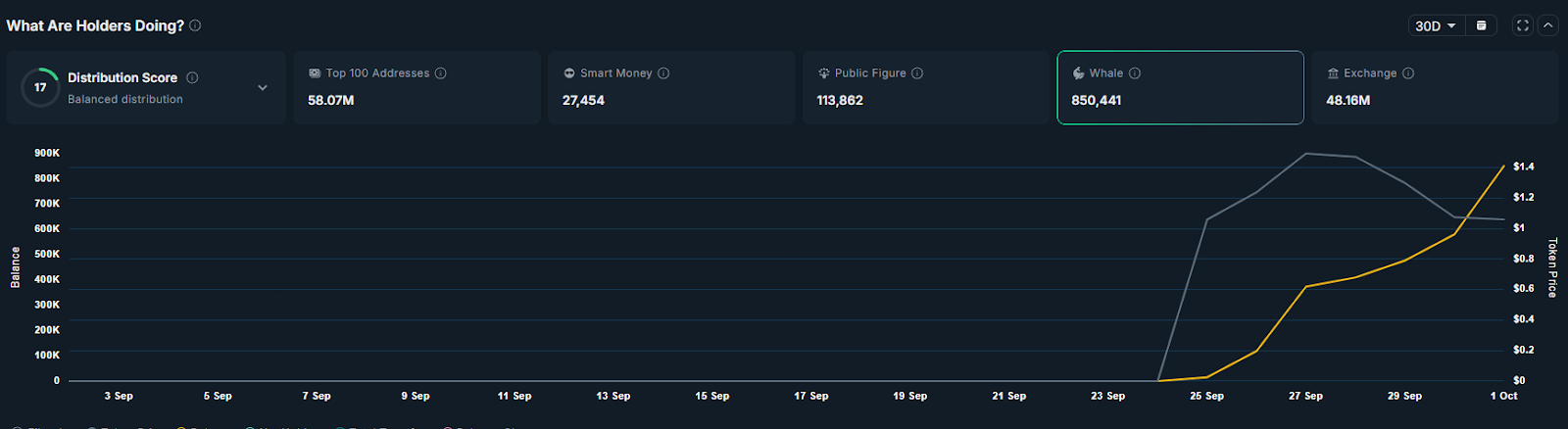

Meanwhile, large-scale crypto investors, or whales, are actively building their positions in the Plasma token. Data shows that over the past week, whale wallets have added more than $1.16 million worth of XPL tokens, while $3.83 million worth of tokens have been withdrawn from exchanges, indicating an optimistic outlook among major holders.

Whale wallets holding XPL, 30-day chart. Source: Nansen

Whale wallets holding XPL, 30-day chart. Source: Nansen

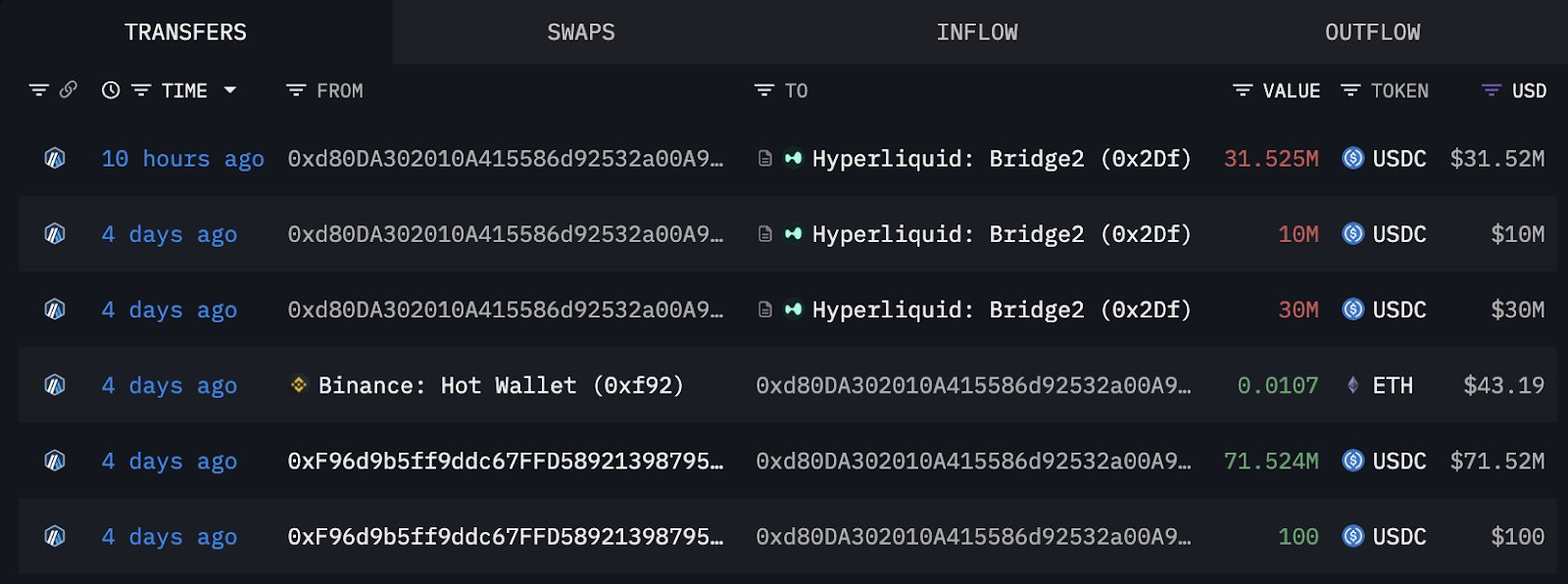

One notable whale, wallet “0xd80D,” acquired $31 million worth of XPL tokens earlier this week, boosting its holdings to over $40 million, according to blockchain data from Lookonchain. Despite this accumulation, upcoming token unlocks scheduled for October 25 threaten further market volatility, with an estimated $90 million worth of XPL set to unlock, potentially increasing selling pressure.

Source: Lookonchain

Source: Lookonchain

Market watchers note that these large unlocks could produce short-term downward pressure, adding to the complexity of Plasma’s price recovery prospects. Overall, investor sentiment remains cautiously optimistic, with whales positioning themselves for potential gains amid ongoing volatility in crypto markets and DeFi tokens.

This article was originally published as Machi Big Brother’s $44M Profit Turns to $9M Loss After Hyperliquid Ripoff on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

16,380,000,000 Dogecoin Might Set DOGE Price up for 'Uptober'

UK Central Bank Looks to Stablecoins to Cut Bank Dependency