MetaMask Token Launch ‘Coming Soon’ – Best Crypto Wallet Native Coin To Watch?

Popular decentralized cryptocurrency wallet MetaMask is coming up with its own native crypto. According to ConsenSys founder Joseph Lubin, it will happen very soon.

MetaMask has always been the first choice for most cryptocurrency enthusiasts when it comes to swapping digital assets. While its core use cases aren’t simple, the platform has earned renown for its protective and future-centric features that emphasize accessibility and innovation in equal measure.

With the announcement of the token, conversations have started about which is the best crypto wallet native token to watch.

MetaMask: A Leading Crypto Platform With a Lengthy History

MetaMask could be considered one of the oldest decentralized wallets on the market. According to its website, it is regarded as one of the best ways to interact with Web3. While the DEX wallet has a decentralized core, which meant some of its technical nuances initially made it difficult for standard users to leverage properly, it has gone through multiple changes.

MetaMask has recently added the buy crypto utility, which makes it possible for users to purchase and sell crypto using fiat, a unique aspect for a DEX wallet. It also features an earn program, which is part of MetaMask’s self-custodial staking service that offers users passive income.

Other features of MetaMask include swaps and snaps. The latter allows users to integrate third-party apps with the wallet to enhance its functionality. It even has its own credit card, enabling users to leverage crypto for daily purchases.

The MASK Token is Coming: Consensys CEO

The news of the arrival of MASK token, was broken out by Consensys CEO Joseph Lubin during talks with a popular crypto publication site.

“MASK token is coming. It may come sooner than you would expect right now,” the CEO told the publication, “And it is significantly related to the decentralization of certain aspects of the MetaMask platform.”

It is important to know that the buzz around the MetaMask wallet’s native crypto has been going on since May. Back in May, MetaMask’s co-founder, Dan Finlay, said that if the token arrives, it will launch directly on the wallet.

However, so far the token’s emergence is purely speculation since there have been no developments other than a few comments on tweets. In fact, MetaMask’s official website also has not given any information about it. The only token-related information to be found on the website is about MetaMask USD, a stablecoin developed on the DEX in partnership with Bridge and M0.

Invest in this Crypto Wallet Native Coin While Waiting for MASK

Reactions to the announcement have been mixed. Some have lauded MetaMask’s courage to launch a native crypto. Pudgy Penguins devs have been among the more vocal supporters of the token, posting on X that doing all those swaps was worth it.

On the other hand, some have comedically asked if anyone even uses the wallet.

Regardless of the reactions, there is anticipation. And while users wait, there is another crypto wallet native coin that investors should be focusing on: Best Wallet Token.

Best Wallet Token powers Best Wallet, a decentralized cryptocurrency wallet that has been lauded as a strong crypto app by many publications, including the New York Post.

The wallet is known to be the center of multiple innovations, and one of the best among them is the token launchpad that lets users invest in presale cryptos while they are at zero stage. Other perks that Best Wallet has include staking, an interactive interface, and the ability to buy and sell crypto using fiat, much like MetaMask.

Since Best Wallet is a decentralized ecosystem, it has gone through multiple innovations already. Recently, it added support for the Solana blockchain and Bitcoin swaps. It has also added a unique gamified ecosystem that allows users to earn points by simply opening the Best Wallet app daily.

Additional upgrades like portfolio management and market insights are also coming within the Best Wallet ecosystem.

So, what role does Best Wallet Token (BEST) play? It enhances all the features. By holding the token, users can invest in crypto presales even earlier, get additional staking perks, and earn discounts on transaction fees. They will also get early access to upcoming features.

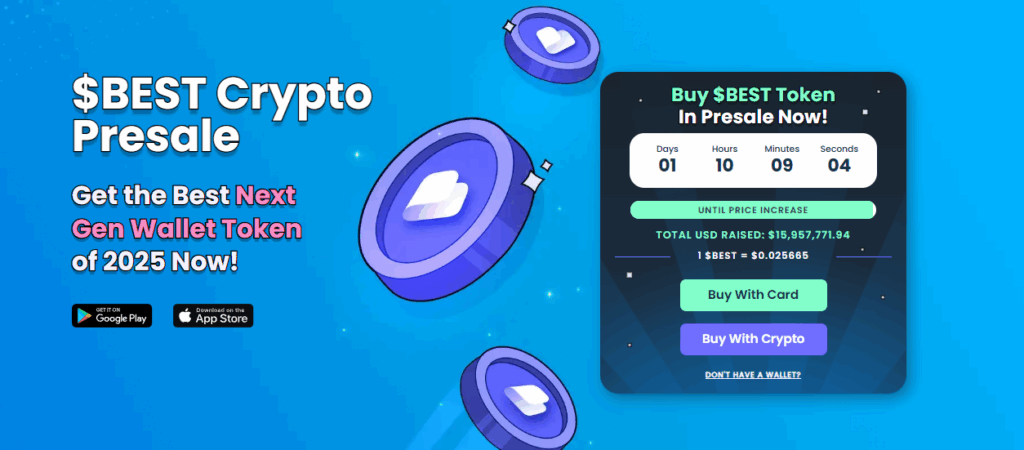

Currently in presale, Best Wallet Token has raised close to $16 million already. Analysts like Crypto Borch have called it one of the better crypto presales on the market. Its utility makes it stand out, and the fact that the wallet belongs to an already active project means it already has the market’s trust, similar to MetaMask.

Conclusion

The announcement of a MetaMask-native crypto is very positive for a market where wallet- or exchange-native cryptocurrencies, such as MYX or ASTER, often grab the top gainer spot on CoinMarketCap.

However, it is only an announcement at this moment and nothing substantial has surfaced yet. So, while waiting for the “MASK” token to arrive, investors should check out the offerings that are already available. A leading one among them is Best Wallet Token. Currently in presale, it is being offered at a discount price of just $0.025665.

Buy Best Wallet Token | Visit Best Wallet

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

You May Also Like

Solana ETFs Market Grows with Fidelity and Canary Marinade’s New Funds

U.S. Considers Bitcoin Reserve; Discusses Funding Options