Nick Szabo joins fray as controversial Bitcoin Core update nears release

Cypherpunk Nick Szabo has posted on X after five years of silence, adding his views to a fierce debate between Bitcoin purists and maximalists.

Bitcoin Core developers have released the second test version of their controversial Bitcoin Core v30 update, set to usher in a new wallet format and non-monetary data inclusion sometime in October.

A new release candidate of Bitcoin Core (v30.0rc2) is available for testing, the Bitcoin Core Project stated on Sunday, labelling it as a “new major release.”

The update phases out older legacy wallet infrastructure and introduces a new simplified command system, but the main points of contention regard the policy changes around the OP_RETURN opcode, which allows embedding arbitrary data in transactions.

Read more

You May Also Like

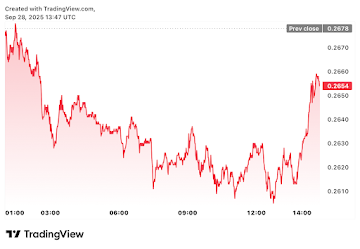

Bitcoin Holds $115K Support as Fed Cuts Rates by 25 Basis Points

Edges higher ahead of BoC-Fed policy outcome