SharpLink Boosts Holdings With New $264M ETH Purchase – Institutional Adoption Rising?

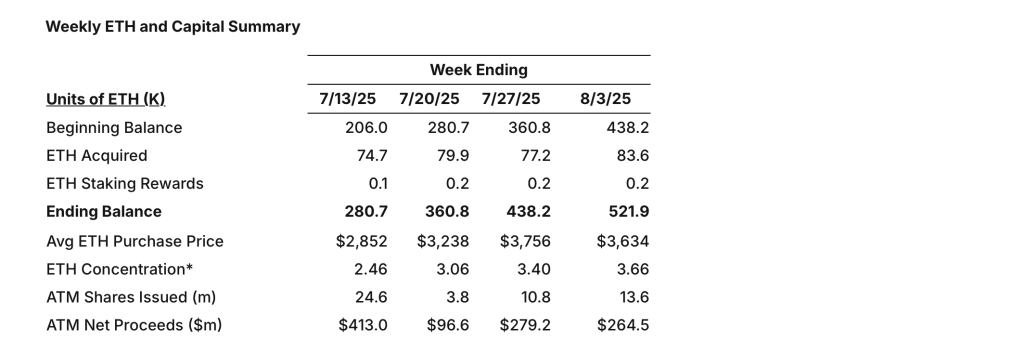

SharpLink Gaming, Inc. (Nasdaq: SBET), has expanded its Ethereum treasury by purchasing 83,561 ETH between July 28 and August 3, 2025.

The weekly accumulation, valued at $264.5 million, increased the company’s total ETH holdings to 521,939—up 19% from 438,190 ETH the prior week.

This marks another major leap in SharpLink’s aggressive treasury strategy, which began on June 2, 2025. Since the start of the program, the company has boosted its ETH holdings by more than 150%.

Average Purchase Price Declines

For the week ending August 3, the average ETH purchase price stood at $3,634, a modest decrease from the previous week’s $3,756. Despite the minor dip in price, SharpLink has accelerated its buying activity, acquiring more ETH than in any of the three preceding weeks.

Since mid-July, the company has maintained a consistent pace of large-scale ETH purchases, starting with 74,700 ETH in the week ending July 13 and growing weekly, reaching 83,600 ETH in the most recent update.

ETH Concentration Rises

SharpLink’s ETH-per-share concentration—referred to as “ETH Concentration”—rose to 3.66 from 3.40 the previous week.

This figure reflects the number of ETH per outstanding share and has increased by 83% since the treasury strategy was launched. The metric is a key indicator of how tightly SharpLink is tying shareholder value to Ethereum’s price performance and adoption.

ATM Facility Drives Capital Growth

To fund its ETH accumulation, SharpLink said it continues to rely on its At-the-Market (ATM) facility. For the week ending August 3, the company issued 13.6 million shares, generating $264.5 million in net proceeds.

This follows the $279.2 million raised the prior week and the $96.6 million the week before. Cumulatively, the company has issued over 52 million shares and raised more than $1 billion since the strategy was launched.

Adding momentum to the company’s evolving direction, Joseph Chalom—former digital asset strategist at BlackRock—officially assumed his role as Co-CEO on July 24.

Chalom reaffirmed SharpLink’s commitment to expanding its ETH treasury, stating, “SharpLink remains deeply committed to its mission of creating enduring shareholder value by building the largest and most trusted ETH treasury company.”

He added that the company is evaluating additional capital formation strategies—including debt and equity-linked instruments—to further scale its ETH holdings and reinforce alignment with Ethereum’s role in decentralized finance.

As of August 3, 100% of SharpLink’s ETH is staked, and cumulative staking rewards reached 929 ETH, further strengthening the company’s crypto-native yield generation strategy.

You May Also Like

Ethereum gas fees explained: the complete guide for beginners

KakaoBank, South Korea's largest online bank, is evaluating issuing a Korean won stablecoin.