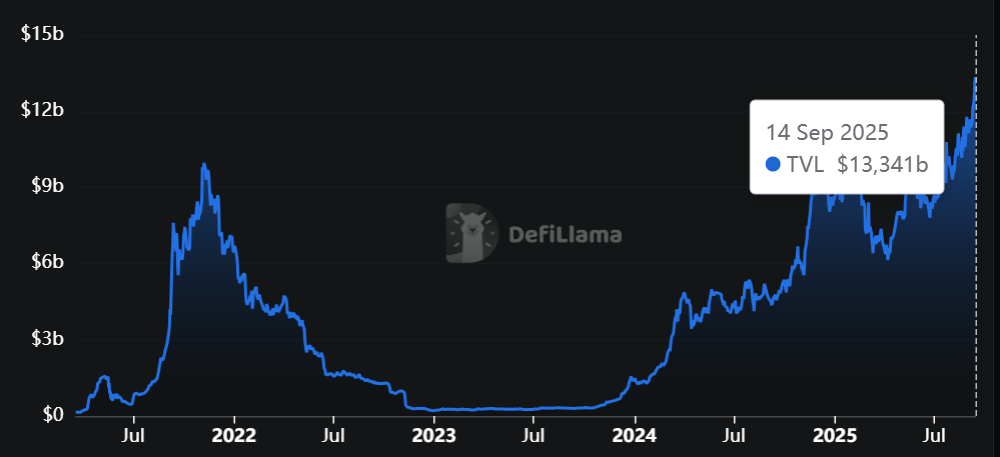

Solana DeFi TVL Hits $13.34B, Breaking All-Time Records

- Solana’s DeFi TVL just reached an all-time high of $13.34 billion, signaling deeper ecosystem engagement and on-chain activity.

- Institutional interest and rising staking demand are pushing Solana’s DeFi ecosystem to unprecedented total value locked levels.

Solana’s DeFi ecosystem has hit a new milestone, with total value locked (TVL) reaching $13.34 billion, according to DefiLlama. This figure not only reflects growth in terms of volume but also marks a significant shift in the flow of liquidity into this Proof-of-History based blockchain ecosystem.

This surge is driven by increased interest in staking, yield farming, and trading activities across various Solana-based decentralized exchange protocols.

Source: DefiLlama

Source: DefiLlama

Furthermore, the rise in the tokenization sector and the emergence of new DeFi protocols have also contributed to the accumulation of locked funds.

Some market participants even consider this achievement a real validation of Solana’s resilience, after it was previously criticized for experiencing downtime in the past.

Institutional Demand and Network Power Fuel Solana’s Momentum

Interestingly, this TVL surge coincides with increased interest from publicly traded companies. A previous CNF report indicated that 13 companies currently publicly hold SOL tokens, with a total accumulated holding approaching $1.8 billion. Of the listed, Upexi is listed as the largest holder with 2,000,518 SOL.

Meanwhile, whale participation has not abated. Many large investors have chosen to maintain their positions and even increase their holdings, especially after the SOL price broke through the $240 level.

Furthermore, the technical performance of the Solana network has also attracted attention. In mid-August, Mert Mumtaz revealed that the network was capable of recording a throughput of up to 107,540 transactions per second (TPS) in a stress test simulation.

This performance further confirms that Solana’s architecture is not just a gimmick. Furthermore, the network is now also home to a number of meme coins such as BONK, WIF, and MEW, further adding to the transaction frenzy within it.

Weekly Breakout: Could SOL Soar Again?

Technically, the SOL price is also attractive. At the time of writing, SOL is trading at about $246, recording a 1.98% increase in 24 hours and 20.88% in the last 7 days. The weekly candlestick will soon close in full green.

According to analyst Master Ananda, this pattern is usually not a closing pattern, but rather a precursor to a major movement to come.

Source: Master Ananda on TradingView

Source: Master Ananda on TradingView

There are several observable signs: first, the price has broken through the medium-term resistance pattern. Second, confirmation of the breakout is just waiting for the close of today’s active session. Third, the continuation phase will soon begin.

While this doesn’t mean the chart will rise straight up without correction, small fluctuations over one to three days are considered part of normal market noise. In this type of pattern, additional waves of growth usually emerge after a temporary red phase.

Ananda projects a price target of $419 and even $620 in the next rally. But of course, this all depends on how the market absorbs the current momentum.

You May Also Like

Solana’s rally looks stronger this time: 2 reasons behind SOL’s $250 push

Asia Morning Briefing: Native Markets Wins Right to Issue USDH After Validator Vote