Stop Being Republicans’ Lapdog’ – Crypto CEOs Face Senate Fury as Bill Stalls

Democratic senators unleashed on crypto CEOs during Thursday’s Capitol Hill meetings, with one lawmaker warning executives to stop being ‘an arm of the Republican Party‘ as negotiations over the market-structure bill reached a breaking point.

Instead of securing commitments or reassurances, the CEOs left with concerns that the legislation might drag into next year.

Politico reported that “Everyone walked away with a commitment to continue work on this in a bipartisan way, but there was a distinct difference in terms of the timeline,” noting that passage this year would require a “miracle.”

Senate Banking Chair Tim Scott (R-S.C.) told industry leaders he wants the bill through his committee before Thanksgiving.

Crypto CEOs Face Partisan Battle as Market Structure Bill Stalls

However, Democrats rejected the imposed deadlines, demanding a joint, bipartisan drafting process that gives them real input.

During their morning meeting, Democratic senators criticized CEOs for the industry’s reaction to a leaked Democratic proposal on regulating decentralized finance (DeFi).

Sen. Ruben Gallego (D-Ariz.) told executives he was “really f**king pissed” about how the leaked DeFi proposals were handled and warned: “Don’t be an arm of the Republican Party.”

The frustration stems from Democrats’ DeFi regulation proposal, designed to address illegal finance concerns, being leaked to lobbyists and media, then publicly attacked by industry officials.

The CEOs also met with GOP lawmakers, but responses varied.

Sen. John Kennedy (R-La.) opined that rushing the bill would trigger backlash and reversals under future administrations. “The worst thing we can do … is try to ram it through,” he said.

He warned that moving too fast would produce policy “designed by a heroin addict with a socket wrench.”

Crypto CEOs Claim Progress

Coinbase CEO Brian Armstrong, however, told CNBC the talks were “very productive,” calling recent bipartisan meetings a rare positive sign.

“There’s strong bipartisan support to get this market structure legislation done. It’s important for America and for the 15 million Americans involved in crypto.”

Armstrong claimed roughly 90% of disputes have been settled, with “the last 10 percent of issues” to be worked out once everyone meets together.

But behind closed doors, divisions persist.

Some Democratic senators were left furious. Leaders, including Senators Catherine Cortez Masto, Mark Warner, and Gallego, confronted industry figures about Twitter reactions and leaks, demanding genuine accountability.

Sen. Cory Booker reportedly pushed the CEOs to support bipartisan appointments to the SEC and CFTC, a contentious issue given recent executive actions to undermine agency independence.

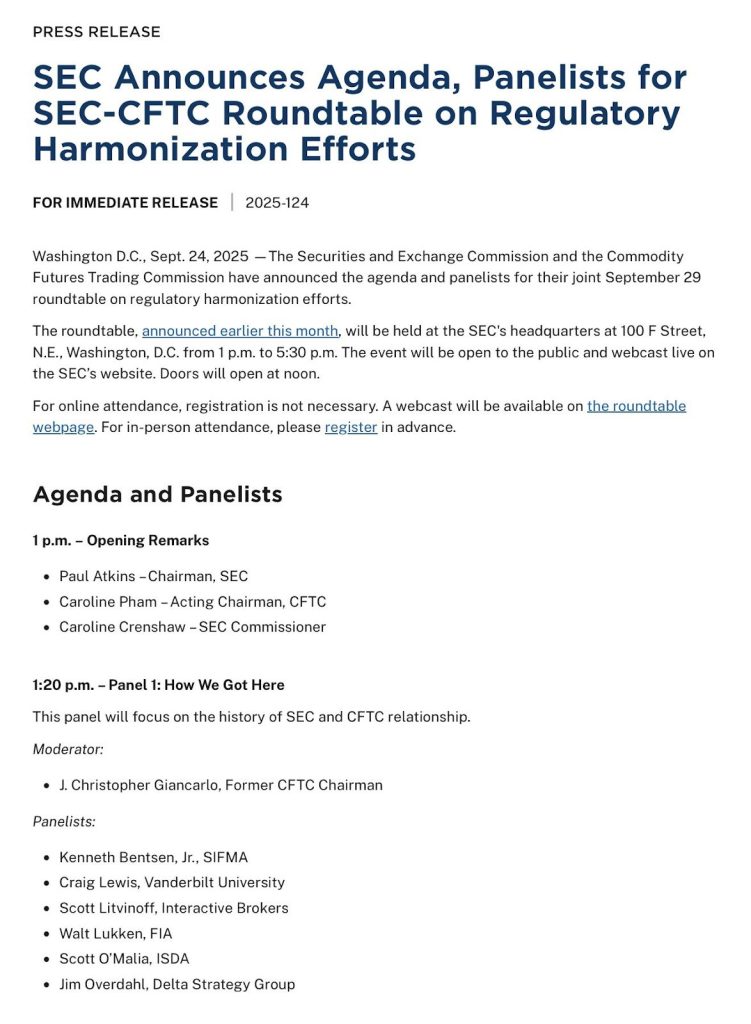

Source: Congress

Source: Congress

Earlier this week, Chainlink CEO Sergey Nazarov acknowledged tensions had risen but remained hopeful.

“The Democrats had a concern that the crypto industry is, like, an extension of the Republican Party … But I don’t actually think that’s the case,” Nazarov said.

In parallel meetings, Nazarov publicly stated that there was “a sufficient level of Democratic support,” noting that more than 10 senators were actively engaged and committed to shaping the final version.

Senate Banking Chair Tim Scott reportedly wants a markup before Thanksgiving, while Democrats have rejected deadline pressure and insist on a bipartisan co-authoring process.

Senator Cynthia Lummis (R-WY), a key backer of the market structure initiative, has also expressed confidence that Congress will pass the bill this year.

Betting Markets Turn Pessimistic

Outside the Capitol, crypto investors are losing confidence. Polymarket bettors now place odds of the CLARITY Act passing in 2025 at roughly 19%, down sharply from 87% earlier in the summer.

Additionally, the Digital Asset Market Clarity Act of 2025 passed the House on July 17 with a 294-137 vote.

Now under Senate review, the 236-page bill seeks to resolve years of regulatory uncertainty by clearly separating securities from commodities in the digital asset market.

Under the framework, digital assets on sufficiently decentralized networks would be overseen by the CFTC, while centralized or early-stage tokens would be classified as securities regulated by the SEC.

The bill addresses market manipulation, including wash trading, spoofing, pump-and-dump schemes, and insider trading, through explicit rules, stronger enforcement, and structural safeguards.

You May Also Like

OpenAI pushes Trump admin to expand Chips Act tax credit

Amazing Liquidity Tailwinds: How the End of US Shutdown Supercharges Risk Assets