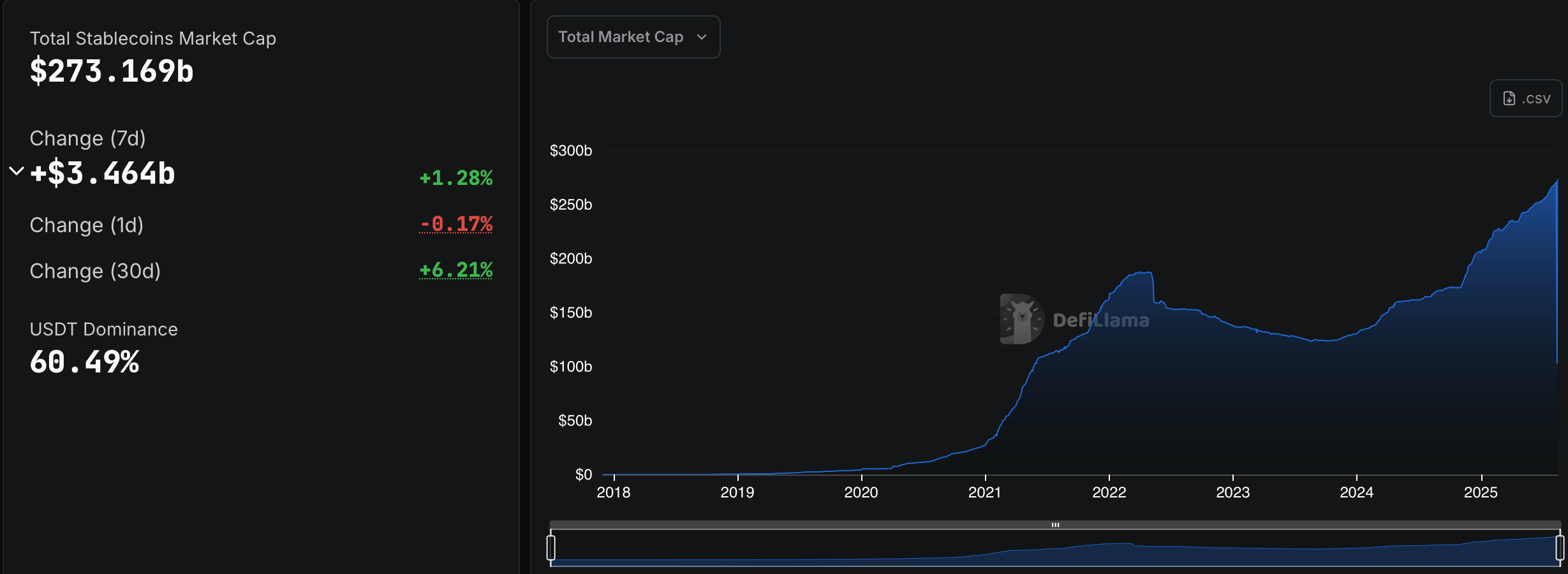

Tether Taps $165B as Stablecoin Sector Climbs to $273B

Over the past week, the stablecoin market expanded by 1.28%, adding $3.464 billion to reach a total of $273.169 billion. Tether ( USDT) remains the heavyweight, commanding 60.49% of the entire market, with its supply climbing by roughly 730 million coins during the seven-day period.

Tether and USDC Add to Market Dominance as Stablecoin Economy Pushes Higher

Tether (USDT) holds a commanding lead on the stablecoin leaderboard with a hefty $165.25 billion market cap, climbing 0.44% this week and 2.93% over the past month. In dollar terms, that’s a $4.7 billion boost to USDT’s market cap in just 30 days. USDC holds second at $66.80 billion, climbing 3.56% in seven days and 7.56% in a month.

USDC added roughly $2.29 billion to its market cap this week, bringing its 30-day growth to $4.69 billion. In third place, Ethena’s USDe shines with $10.99 billion, soaring 12.31% over the week and an eye-popping 106% for the month. Sky’s DAI holds $4.51 billion, climbing 4.38% in a week and 4.39% in a month, while its counterpart, sky dollar (USDS), sits just behind at $4.48 billion, dipping 11.22% weekly but advancing 11.24% over 30 days.

Blackrock’s BUIDL holds $2.37 billion, marking a mild 4.48% gain for the week but a steep 15.61% drop over the month. The monthly decline traces back to last month’s pullback in the tokenized treasury sector, though the market has bounced 6.46% in the past week, according to rwa.xyz stats. World Liberty Financial’s USD1 trails closely with a $2.21 billion market cap, edging up 0.51% this week and 0.12% over the past month.

Ethena’s USDtb sits at $1.46 billion, posting modest gains of 0.34% for the week and 0.76% over the month. Falcon’s USDf jumped 6.50% this week and an eye-catching 86.35% in 30 days, reaching $1.23 billion. Paypal’s PYUSD follows at $1.18 billion, climbing 15.56% weekly and 40.26% for the month. First Digital’s FDUSD has slipped out of the top ten, now holding the 11th spot with a $1.02 billion market cap. It eked out a 0.08% gain for the week but tumbled 14.73% over the past month.

You May Also Like

This new XRP rival continues to go vertical while other coins struggle in August

From Apes to Punks, NFTs roar back with triple the buyers