| COINOTAG recommends • Exchange signup |

| 💹 Trade with pro tools |

| Fast execution, robust charts, clean risk controls. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🚀 Smooth orders, clear control |

| Advanced order types and market depth in one view. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 📈 Clarity in volatile markets |

| Plan entries & exits, manage positions with discipline. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| ⚡ Speed, depth, reliability |

| Execute confidently when timing matters. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧭 A focused workflow for traders |

| Alerts, watchlists, and a repeatable process. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ✅ Data‑driven decisions |

| Focus on process—not noise. |

| 👉 Sign up → |

Western Union is piloting a stablecoin-based settlement system to enhance cross-border remittances, leveraging blockchain for faster, cheaper, and more transparent transfers while maintaining compliance and customer trust. This initiative targets its 150 million customers across 200 countries, reducing reliance on outdated banking systems.

-

Stablecoin integration aims to shorten settlement times and boost efficiency in remittance processing.

-

The pilot addresses volatility concerns resolved by recent U.S. legislation like the GENIUS Act.

-

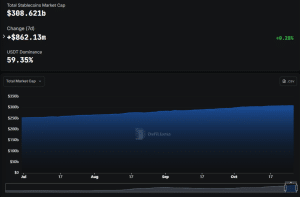

Stablecoin market growth: Currently over $300 billion, projected to hit $2 trillion by 2028 per U.S. Treasury estimates.

Western Union stablecoin pilot revolutionizes remittances with blockchain for faster global transfers. Discover efficiency gains and benefits for customers in high-inflation regions—explore modern money movement today.

What is Western Union’s Stablecoin Pilot?

Western Union’s stablecoin pilot is an innovative initiative to integrate stablecoins into its remittance operations, enabling on-chain settlements for cross-border money transfers. Launched following the company’s third-quarter earnings call, the program focuses on replacing legacy banking systems with blockchain technology to accelerate transactions and cut costs. CEO Devin McGranahan emphasized that this move provides significant opportunities for faster money movement with greater transparency, without risking compliance or customer trust.

| COINOTAG recommends • Professional traders group |

| 💎 Join a professional trading community |

| Work with senior traders, research‑backed setups, and risk‑first frameworks. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 📊 Transparent performance, real process |

| Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R:R and sizing. |

| 👉 Get access → |

| COINOTAG recommends • Professional traders group |

| 🧭 Research → Plan → Execute |

| Daily levels, watchlists, and post‑trade reviews to build consistency. |

| 👉 Join now → |

| COINOTAG recommends • Professional traders group |

| 🛡️ Risk comes first |

| Sizing methods, invalidation rules, and R‑multiples baked into every plan. |

| 👉 Start today → |

| COINOTAG recommends • Professional traders group |

| 🧠 Learn the “why” behind each trade |

| Live breakdowns, playbooks, and framework‑first education. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 🚀 Insider • APEX • INNER CIRCLE |

| Choose the depth you need—tools, coaching, and member rooms. |

| 👉 Explore tiers → |

How Do Stablecoins Benefit Remittances in High-Inflation Countries?

Stablecoins, pegged to stable assets like the U.S. dollar, offer a reliable alternative in regions plagued by currency devaluation and inflation. For Western Union’s customers in over 200 countries, this means holding dollar-denominated value that preserves purchasing power amid economic instability. According to McGranahan, “In many parts of the world, being able to hold a US dollar-denominated asset has real value as inflation and currency devaluation can rapidly erode an individual’s purchasing power.” The U.S. Treasury Department highlighted in its April announcement that the stablecoin market, now exceeding $300 billion, could expand to $2 trillion by 2028, underscoring their growing role in global finance. This pilot aligns with broader strategies to empower users with more control over their funds, facilitating near-instant transfers and reducing fees associated with traditional rails. Experts note that blockchain’s transparency further enhances security, making it ideal for remittances that process 70 million transfers quarterly for Western Union.

Western Union processes around 70 million transfers each quarter. Blockchain technology could offer significant advantages over traditional remittance rails and could benefit its customers located in more than 200 countries.

| COINOTAG recommends • Exchange signup |

| 📈 Clear interface, precise orders |

| Sharp entries & exits with actionable alerts. |

| 👉 Create free account → |

| COINOTAG recommends • Exchange signup |

| 🧠 Smarter tools. Better decisions. |

| Depth analytics and risk features in one view. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🎯 Take control of entries & exits |

| Set alerts, define stops, execute consistently. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🛠️ From idea to execution |

| Turn setups into plans with practical order types. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 📋 Trade your plan |

| Watchlists and routing that support focus. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| 📊 Precision without the noise |

| Data‑first workflows for active traders. |

| 👉 Sign up → |

The remittance platform’s latest remarks on crypto come a little over three months after it first hinted at plans to integrate stablecoins for cross-border transfers.

| COINOTAG recommends • Traders club |

| ⚡ Futures with discipline |

| Defined R:R, pre‑set invalidation, execution checklists. |

| 👉 Join the club → |

| COINOTAG recommends • Traders club |

| 🎯 Spot strategies that compound |

| Momentum & accumulation frameworks managed with clear risk. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🏛️ APEX tier for serious traders |

| Deep dives, analyst Q&A, and accountability sprints. |

| 👉 Explore APEX → |

| COINOTAG recommends • Traders club |

| 📈 Real‑time market structure |

| Key levels, liquidity zones, and actionable context. |

| 👉 Join now → |

| COINOTAG recommends • Traders club |

| 🔔 Smart alerts, not noise |

| Context‑rich notifications tied to plans and risk—never hype. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🤝 Peer review & coaching |

| Hands‑on feedback that sharpens execution and risk control. |

| 👉 Join the club → |

McGranahan said Western Union initially refrained from crypto due to concerns around volatility, regulatory uncertainty and customer protection — however, passage of the GENIUS Act has changed that course.

Frequently Asked Questions

What Are the Key Features of Western Union’s Stablecoin Remittance Pilot?

Western Union’s stablecoin pilot leverages on-chain settlement to minimize dependency on correspondent banking, shortening settlement windows from days to minutes and improving capital efficiency. It ensures compliance through established protocols, serving over 150 million customers with secure, low-cost transfers. This fact-based approach, as outlined in the Q3 earnings call, prioritizes transparency and speed without speculation on future outcomes.

Why Is Western Union Adopting Stablecoins for Cross-Border Payments?

Western Union is turning to stablecoins to modernize remittances, offering customers in inflation-hit areas a stable store of value like USDC or similar assets. As CEO McGranahan explained during the earnings discussion, this innovation reduces costs and enhances control, making it easier to send and receive money globally. It’s a practical step forward, supported by regulatory clarity from acts like GENIUS.

Key Takeaways

- Blockchain Efficiency: The pilot uses on-chain rails to cut settlement times and legacy system dependencies, processing 70 million quarterly transfers more effectively.

- Market Growth Potential: Stablecoins’ $300 billion market, per U.S. Treasury data, signals a shift toward institutional adoption, with projections to $2 trillion by 2028.

- Customer Empowerment: Users gain options for holding stable assets against inflation, aligning with Western Union’s strategy for inclusive financial services worldwide.

Conclusion

Western Union’s stablecoin pilot marks a pivotal step in integrating stablecoins into mainstream remittances, addressing long-standing challenges in cross-border transfers with blockchain’s speed and transparency. By focusing on compliance and customer protection, as reinforced by the GENIUS Act, the company positions itself at the forefront of financial innovation. As the stablecoin ecosystem expands, this initiative promises greater accessibility for millions, encouraging further exploration of digital assets in everyday finance—stay informed on evolving remittance solutions for a more connected global economy.

| COINOTAG recommends • Exchange signup |

| 📈 Clear control for futures |

| Sizing, stops, and scenario planning tools. |

| 👉 Open futures account → |

| COINOTAG recommends • Exchange signup |

| 🧩 Structure your futures trades |

| Define entries & exits with advanced orders. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🛡️ Control volatility |

| Automate alerts and manage positions with discipline. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ⚙️ Execution you can rely on |

| Fast routing and meaningful depth insights. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 📒 Plan. Execute. Review. |

| Frameworks for consistent decision‑making. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🧩 Choose clarity over complexity |

| Actionable, pro‑grade tools—no fluff. |

| 👉 Open account → |

Financial services company Western Union is set to pilot a stablecoin-based settlement system to modernize its remittance operations for its more than 150 million customers.

During Western Union’s third-quarter earnings call on Thursday, CEO Devin McGranahan said the pilot is “focused on leveraging onchain settlement rails to reduce dependency on legacy correspondent banking systems, shorten settlement windows, and improve capital efficiency.”

| COINOTAG recommends • Members‑only research |

| 📌 Curated setups, clearly explained |

| Entry, invalidation, targets, and R:R defined before execution. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧠 Data‑led decision making |

| Technical + flow + context synthesized into actionable plans. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 🧱 Consistency over hype |

| Repeatable rules, realistic expectations, and a calmer mindset. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🕒 Patience is an edge |

| Wait for confirmation and manage risk with checklists. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 💼 Professional mentorship |

| Guidance from seasoned traders and structured feedback loops. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧮 Track • Review • Improve |

| Documented PnL tracking and post‑mortems to accelerate learning. |

| 👉 Join now → |

“We see significant opportunities for us to be able to move money faster with greater transparency and at lower cost without compromising compliance or customer trust.”

The announcement also reflects the broader institutional adoption of stablecoins.

| COINOTAG recommends • Exchange signup |

| 🎯 Focus on process over noise |

| Plan trades, size positions, execute consistently. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🛠️ Simplify execution |

| Keep decisions clear with practical controls. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| 📊 Make data your edge |

| Use depth and alerts to avoid guesswork. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧭 Be prepared, not reactive |

| Turn setups into rules before you trade. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| ✍️ Plan first, then act |

| Entries, exits, and reviews that fit your routine. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🧩 Consistency beats intensity |

| Small, repeatable steps win the long run. |

| 👉 Sign up → |

Stablecoins could help those in high-inflation countries

Western Union said the stablecoin offering would give its customers more choice and control in how they manage and move their money — particularly those in inflation-torn countries.

“In many parts of the world, being able to hold a US dollar-denominated asset has real value as inflation and currency devaluation can rapidly erode an individual’s purchasing power. These innovations align closely with our broader strategy to modernize the movement of money.”

| COINOTAG recommends • Premium trading community |

| 🏛️ WAGMI CAPITAL — Premium Trading Community |

| Strategic insights, exclusive opportunities, professional support. |

| 👉 Join WAGMI CAPITAL → |

| COINOTAG recommends • Premium trading community |

| 💬 Inner Circle access |

| See members share real‑time PnL and execution notes in chat. |

| 👉 Apply for Inner Circle → |

| COINOTAG recommends • Premium trading community |

| 🧩 Turn theses into trades |

| Reusable templates for entries, risk, and review—end to end. |

| 👉 Join the club → |

| COINOTAG recommends • Premium trading community |

| 💡 Long‑term mindset |

| Patience and discipline over noise; a process that compounds. |

| 👉 Get started → |

| COINOTAG recommends • Premium trading community |

| 📚 Education + execution |

| Courses, playbooks, and live market walkthroughs—learn by doing. |

| 👉 Get access → |

| COINOTAG recommends • Premium trading community |

| 🔒 Members‑only research drops |

| Curated analyses and private briefings—quality over quantity. |

| 👉 Join WAGMI CAPITAL → |

Western Union competitors have been making similar moves

Early Warning Services, the parent company of payments platform Zelle, said on Friday that stablecoins will be integrated into Zelle to facilitate cross-border transactions for money flowing to and from the United States.

Related: Rumble partners with Tether to add Bitcoin tips for content creators

| COINOTAG recommends • Exchange signup |

| 🧱 Execute with discipline |

| Watchlists, alerts, and flexible order control. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🧩 Keep your strategy simple |

| Clear rules and repeatable steps. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧠 Stay objective |

| Let data—not emotion—drive actions. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ⏱️ Trade when it makes sense |

| Your plan sets the timing—not the feed. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🌿 A calm plan for busy markets |

| Set size and stops first, then execute. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 🧱 Your framework. Your rules. |

| Design entries/exits that fit your routine. |

| 👉 Sign up → |

Meanwhile, MoneyGram confirmed it would soon roll out its crypto app in Colombia, allowing locals to save in the Circle’s USDC stablecoin and receive and transfer it overseas nearly instantly.

Magazine: Cliff bought 2 homes with Bitcoin mortgages: Clever… or insane?

| COINOTAG recommends • Members‑only research |

| 📌 Curated setups, clearly explained |

| Entry, invalidation, targets, and R:R defined before execution. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧠 Data‑led decision making |

| Technical + flow + context synthesized into actionable plans. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 🧱 Consistency over hype |

| Repeatable rules, realistic expectations, and a calmer mindset. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🕒 Patience is an edge |

| Wait for confirmation and manage risk with checklists. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 💼 Professional mentorship |

| Guidance from seasoned traders and structured feedback loops. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧮 Track • Review • Improve |

| Documented PnL tracking and post‑mortems to accelerate learning. |

| 👉 Join now → |

Source: https://en.coinotag.com/western-union-pilots-stablecoins-for-faster-cross-border-remittances/