Why Investors Choose Pepeto As 2025’s Best Crypto: The Next Bitcoin Story

Desks still pass that story around because it’s proof that one coin can change everything. And the question that always follows is simple: could it happen again? Could another project climb those same levels in the years ahead? That search is why eyes keep landing on Pepeto (PEPETO), an Ethereum presale that mixes culture with working tools, a zero-fee exchange and a fast-growing base. It reads less like a meme and more like a plan. If Bitcoin drew the map, Pepeto wants the fast lane.

Before we go further, take a quick rewind on how Bitcoin moved from about $0.0025 to above $100,000, the case study every crypto team knows by heart.

Bitcoin’s Journey: From Under $1 To Above $100,000 In 10 Years

In 2009, few could guess Bitcoin’s destination. Launched on January 3, 2009, it picked up a price signal in 2010 when the pizza trade valued BTC near $0,0025, while early exchange quotes hovered at fractions of a cent. By 2011 it tagged $1 for the first time, giving a bold idea a clear price.

The first halving in 2012 cut new supply, helping momentum push toward $1,000 by 2013. A second halving in 2016 again tightened issuance and set up 2017’s run near $20,000. In the early 2020s, another halving met rising institutions and deeper global liquidity.

Market cap ultimately touched $1 trillion as major firms explored or added BTC to balance sheets. Scarcity stayed central thanks to the fixed 21 million cap and predictable supply cycles.

By 2021 Bitcoin set a $69,000 all-time high, and today it trades above $115,000, driven by a hard 21 million limit and recurring halvings that keep supply tight while demand builds.

That’s how Bitcoin moved from idea to market driver. Analysts argue Pepeto is at that same “before it happens” stage, and smart money is already leaning in, expecting it to make fast, exponential changes to portfolios. Here’s why the rush into this crypto is picking up.

Why Pepeto Could Be The Next Bitcoin Story

Let’s be honest: calling a meme coin the next bitcoin is bold, audacious, even. But look closely at Pepeto and it starts to feel possible. Like BTC early on, Pepeto sits at the start, but with key parts already live.

This Ethereum project reads like a mission: the team ships useful products, polishes details, shows up for the community, and pushes weekly. The presale price is $0.000000153 on Ethereum mainnet; more than $6,700,000 is raised; the audience already tops 100k across socials. That’s when “next bitcoin” talk sounds less like hype.

Unlike hype-only launches, Pepeto fuses culture with tools. The token will power every PepetoSwap trade, baking in real demand. A fair, transparent setup turns a meme coin moment into a crypto investment case. Next, we unpack tokenomics so readers see why this design aims for stability after launch, where bigger wallets feel confident, and following smart money stops being a guess.

Pepeto Tokenomics And Utility: The Ethereum Project Built To Last

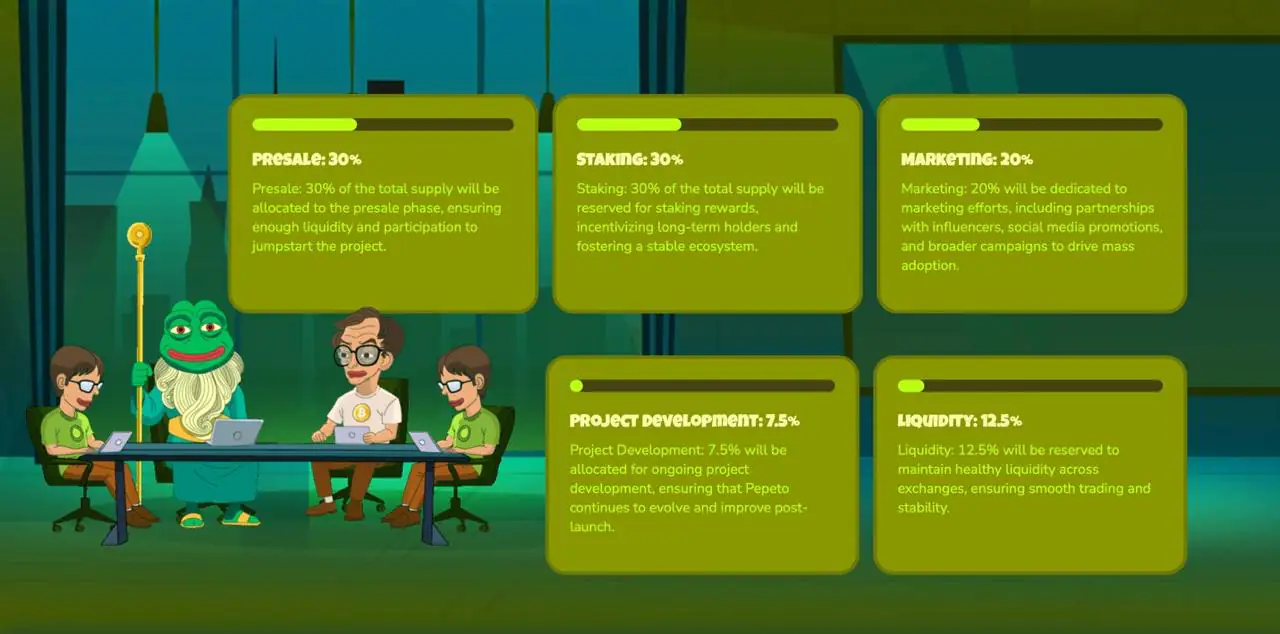

Determined teams leave fingerprints in the numbers, and that’s the case here. Pepeto’s tokenomics are set with intent: a total supply of 420 trillion split into 30% Presale, 30% Staking, 20% Marketing, 12.5% Liquidity, and 7.5% Development. Pepeto’s tokenomics look like they were built after studying what made past launches fail. Too many projects faded right after TGE under a flood of unlocked supply; this design answers that with discipline. A meaningful share goes to staking, which trims circulating tokens and rewards early holders while the team polishes the product and times the market. Add the price ladder, each presale stage set higher than the last, and early believers secure a lower cost basis from day one. When the token lists, they’re positioned to start ahead, making the next Bitcoin claim feel closer.

The core strength is utility you can count on, the kind that makes a meme coin feel like investing, not gambling. PepetoSwap is a zero-fee exchange where every trade runs through the Pepeto token, guaranteeing real usage instead of artificial buzz. Already 850+ projects have applied to list, a strong signal for future volume. A built-in cross-chain bridge adds smart routing that unifies liquidity, cuts extra hops, reduces slippage, and turns usage into steady token demand. Two audits, SolidProof and Coinsult, boost trust, while staking reaches up to 228% APY. Miss this crypto presale and you could miss the next millionaire coin.

Final Take: Can Pepeto Really Be The Next Bitcoin?

There’s a real case that Pepeto (PEPETO) can mirror Bitcoin’s path if it times launch right, and the team clearly aims at that window. Bitcoin needed years to move from idea to global force; in hot markets, Shiba inu and pepe coin proved wild runs can arrive in months. Pepeto wants both: cycle energy and real tools. With a low presale price at $0,000000153, it sits where life-changing returns often start. If Pepeto follows Bitcoin’s upward lane, early buyers could step into millionaire territory.

For opportunity hunters, Pepeto stands out. The parts are in place, momentum is building, and the entry is still small. Many market analysts point to $0.0000075 by 2025, about 5,000% from here, with more room into 2026 or 2030 if major listings and swap volume expand. Catch the presale while it’s early; a run alongside Bitcoin could carry you much higher in 2025. If Pepeto tracks Bitcoin’s arc, we could witness a new legendary meme coin, rare in today’s crypto market, that nobody should miss.

To Buy Pepeto Now Make Sure You Use The Official Website:https://pepeto.io

For More Information About PEPETO: Website: https://pepeto.io / Instagram: https://www.instagram.com/pepetocoin/ / Telegram: https://t.me/pepeto_channel

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Why Investors Choose Pepeto As 2025’s Best Crypto: The Next Bitcoin Story appeared first on Coindoo.

You May Also Like

Cloud mining is gaining popularity around the world. LgMining’s efficient cloud mining platform helps you easily deploy digital assets and lead a new wave of crypto wealth.

Bitcoin Institutional Adoption: Why Saylor Predicts a Crucial Shift in BTC Price Action