Why Is Bitcoin Price Falling Below $95,000 Today

TLDR

- Bitcoin drops below $95K, influenced by US liquidity stress and long-term selling.

- US-based investors are aggressively selling Bitcoin, impacting its market price.

- Long-term holders are selling across all age cohorts, likely due to tax reasons.

- Bitcoin’s decline is worsened by the US government shutdown and fiscal tightening.

Bitcoin’s recent price drop below $95,000 reflects a convergence of factors centered around U.S. market dynamics. CryptoQuant attributed the decline to two primary factors: U.S. liquidity stress and aggressive selling by long-term holders (LTHs). This drop, which brought Bitcoin to its lowest level since May, is compounded by broader economic concerns in the U.S. as investors respond to a tight liquidity environment and tax-driven profit-taking.

According to XWIN Research Japan, the selling pressure is particularly evident during U.S. market hours, further reinforcing the theory that U.S. investors are primarily driving the current correction. The recent dip follows a clear pattern, where Bitcoin recovers overnight but then reverses sharply during U.S. trading hours, signaling that the U.S. market is a key factor influencing its price movement.

U.S. Liquidity Stress and Long-Term Holder Selling

One of the major contributors to Bitcoin’s recent drop is liquidity stress in the U.S., amplified by the federal government shutdown. This event temporarily removed billions of dollars from the financial system, tightening market liquidity. With fewer dollars circulating, the risk appetite in the broader market diminished, spilling over into Bitcoin and other crypto assets.

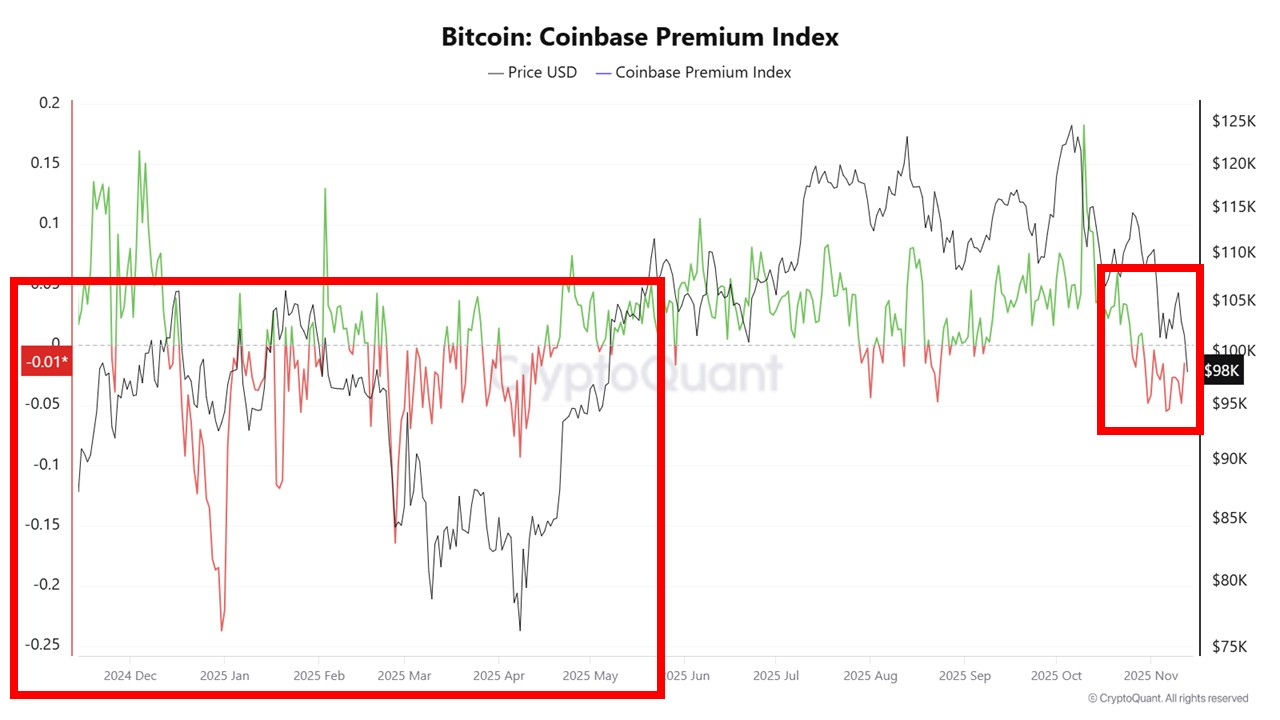

Additionally, the Coinbase Premium Index, a measure of the price difference between Bitcoin traded on Coinbase versus global exchanges, has remained deeply negative for weeks. A negative premium signals that U.S. investors are selling Bitcoin more aggressively than buyers in markets like Asia and Europe. This dynamic has led to a continued decline in Bitcoin’s price, as U.S. investors face increased pressure from both economic and liquidity constraints.

Source: Cryptoquant

Source: Cryptoquant

Long-term holders (LTHs) have also contributed significantly to the selling pressure. Research by CryptoQuant and Will Clemente has shown that selling is not isolated to a specific group of holders but spans various timeframes, from 6 months to over 7 years. This broad-based selling behavior is rare and is thought to be driven by tax optimization strategies, with U.S. investors locking in profits before the end of the year. Fidelity also confirmed that many American LTHs are engaging in this strategy, further adding to the selling pressure.

Impact of the U.S. Government Shutdown on Bitcoin

The U.S. government shutdown has further exacerbated Bitcoin’s decline, with the fiscal surplus reducing liquidity across the financial system. With federal spending halted, the flow of money into markets was constrained, weakening overall market sentiment. Bitcoin, like other risk assets, responded negatively to this tightening of liquidity.

The shutdown also had broader implications for risk appetite, affecting U.S. equities and crypto-linked stocks, which saw a 10-20% drop. As Bitcoin prices struggled to maintain their footing, crypto-linked stocks followed suit, creating a downward spiral that led to Bitcoin testing new lows. Crypto analysts have noted that this fiscal tightening played a significant role in Bitcoin’s current correction, making it harder for the cryptocurrency to find stable ground.

As liquidity pressures ease in the coming weeks, there is hope that market conditions could stabilize. However, near-term volatility is likely to continue as U.S. market dynamics remain a dominant force driving Bitcoin’s price action.

Where is the Bitcoin Price Heading Next?

Despite the current downturn, some analysts, including Ali Martinez, suggest that Bitcoin may soon find a bottom, with potential price levels ranging between $38,000 and $50,000. This projection is based on the cyclical nature of Bitcoin’s four-year price cycles, with Bitcoin possibly entering a bear market.

However, Ki Young Ju, CEO of CryptoQuant, remains optimistic, stating that Bitcoin is not in a bear market as long as capital continues to flow into the market.

He emphasized that Bitcoin’s price could rebound at any time, provided that large holders (whales) stop selling and broader market sentiment turns positive.

The post Why Is Bitcoin Price Falling Below $95,000 Today appeared first on CoinCentral.

You May Also Like

Best Crypto Presale 2025: Why Users Are Flocking to Earth Version 2 (EV2)

The DeFAI Crucible: Navigating Trust and Automation in a Nascent Market