ECB advisor sounds alarm on growing dominance of dollar-denominated stablecoins

ECB advisor Jürgen Schaaf warns that the rapid rise of dollar-backed stablecoins threatens Europe’s financial stability and the euro’s global standing unless strategic action is taken.

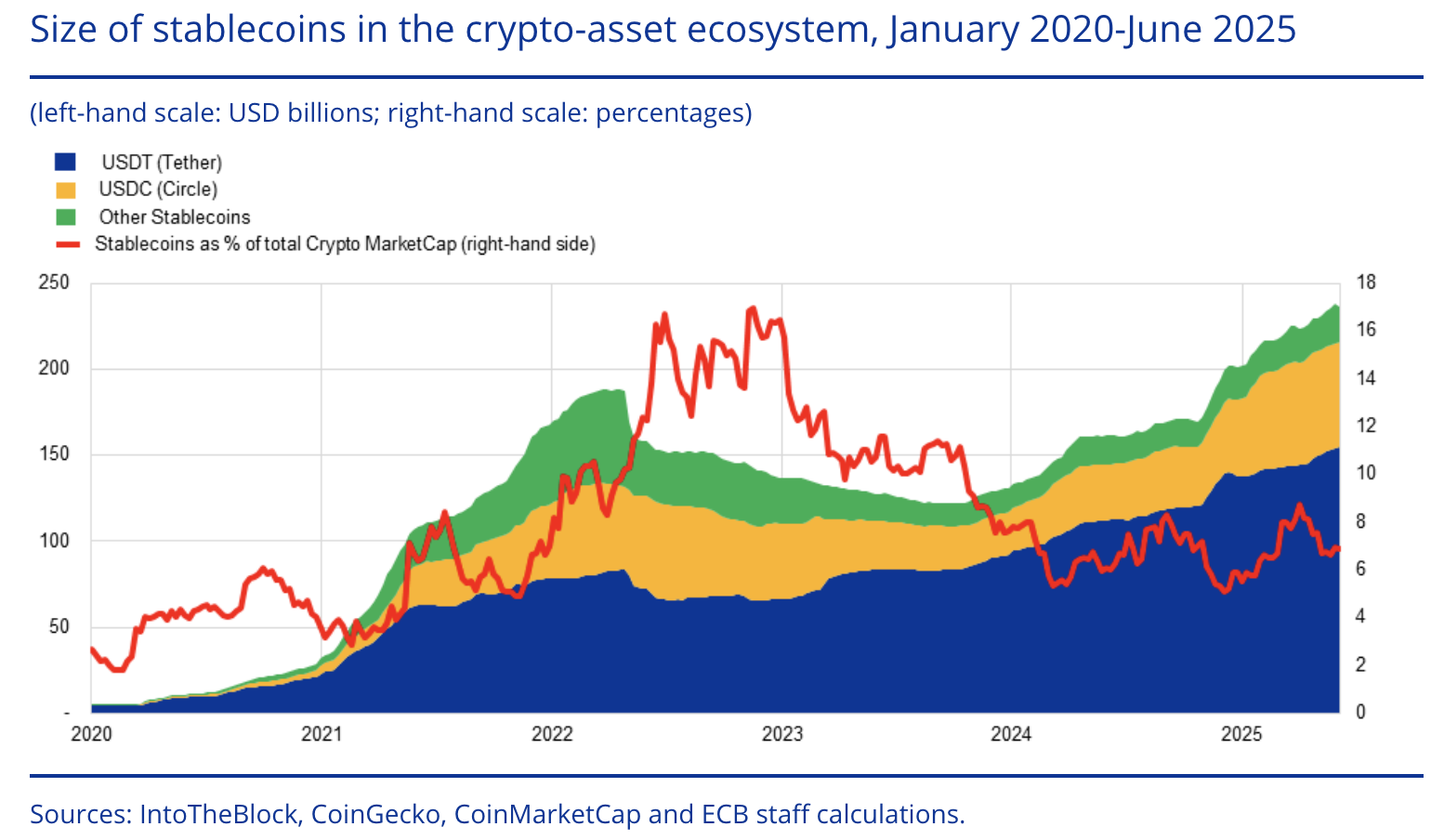

- US dollar-backed stablecoins make up 99% of the market, while euro-based stablecoins remain negligible.

- Growing adoption of stablecoins for payments, settlements, and savings could weaken the ECB’s control over monetary policy.

- Interest-bearing stablecoins risk diverting deposits from traditional banks, threatening credit availability in Europe.

- Schaaf’s call to action includes supporting euro-based stablecoins, advancing the digital euro, and innovating cross-border payments with distributed ledger technology.

In a new blog post on the European Central Bank’s website titled “From Hype to Hazard: What Stablecoins Mean for Europe,” ECB advisor Jürgen Schaaf says that stablecoins pose a strategic threat to the euro’s global standing, warning that “without a strategic response, European monetary sovereignty and financial stability could erode.”

Stablecoins, led by Tether (USDT) and Circle’s USD Coin (USDC), now account for 99% of the stablecoin market cap, nearly all denominated in US dollars. Euro-denominated stablecoins remain marginal, with a combined market cap of less than €350 million.

The danger, Schaaf warns, is not just speculative. As stablecoins become more widely adopted for payments, settlement, and even savings, they increasingly bypass traditional financial systems—potentially undercutting the ECB’s ability to implement effective monetary policy.

“The larger their footprint, the harder these [dollar-dominated stablecoins] would be to unwind,” Schaaf writes. “This would mean higher financing costs relative to the United States, reduced monetary policy autonomy and geopolitical dependency” for Europe.

Stablecoins’ growing real-world impact and risks to banks

Schaaf points out that stablecoins are already being tested for real-world applications beyond crypto trading, including remittances, e-commerce, and institutional settlement. U.S. firms such as Amazon and Walmart are exploring stablecoin integrations, while global payment giants Visa and Mastercard are rolling them into international services.

Moreover, stablecoins begin to offer interest-like features, such as yield from lending or liquidity provision, which poses a threat to traditional banking models, especially in deposit-heavy economies like the euro area.

“If interest-bearing stablecoins became common… they could divert deposits from traditional banks, which could jeopardise financial intermediation and hamper credit availability,” Schaaf writes.

Schaaf’s call to action to protecting the euro

To tackle the risks posed by stablecoins, Schaaf lays out several practical steps Europe should take to protect its financial system and strengthen the euro’s global role.

His main suggestion is to support well-regulated, euro-based stablecoins. Such stablecoins, he argues, could not only “serve legitimate market needs” but also help “reinforce the international role of the euro,” offering a viable alternative to the growing dominance of dollar-based tokens.

Another key part of the plan is the digital euro, which Schaaf sees as “a robust line of defence of European monetary sovereignty,” especially for everyday payments like shopping and online purchases.

Schaaf also points to the need for innovation in larger, behind-the-scenes payments between banks and financial institutions. Cross-border payments are still slow and expensive. Schaaf argues that distributed ledger technology (DLT) could fix this by allowing faster, more direct settlement of tokenised assets using central bank money. He highlights two new projects from the European Central Bank—Pontes and Appia—as important steps forward.

Finally, Schaaf stresses the importance of global cooperation. Without common rules, he warns, “we risk fuelling instability, regulatory arbitrage and global US dollar dominance.”

You May Also Like

Viewpoint: Stablecoin value is at risk of returning to zero in extreme market environments

SEC votes to allow in-kind redemptions for crypto ETPs