HBAR, TON rally while BTC holds $115k: Could XYZVerse be the hidden gem of the altseason?

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Bitcoin steadies at $115k, sharp gains in HBAR and TON are drawing eyes to XYZVerse, a rising memecoin blending sports culture and web3 momentum.

Table of Contents

- XYZ aims for the top as early investors eye significant ROI

- Hedera’s momentum weakens

- Toncoin loses steam

- Conclusion

- HBAR and TON see strong gains while Bitcoin holds steady at $115k, signaling shifting market interest.

- XYZVerse emerges as a standout, combining sports fandom and web3 features to attract early investor buzz.

- With up to 1,000x potential returns, XYZVerse’s presale momentum and ecosystem plans make it a project to watch.

HBAR and TON have seen sharp price gains, while Bitcoin’s value remains steady at $115,000. Amid the surge of these coins, attention has started shifting to a little-known token, XYZVerse. Could this new player become the next breakout favorite? The answer may surprise those watching the current rally.

XYZ aims for the top as early investors eye significant ROI

XYZVerse (XYZ) is positioning itself as a standout entrant in the memecoin sector, combining the cultural pull of global sports with the high-growth dynamics of web3. Targeting fans of football, basketball, MMA, and esports, the project is not just token-driven, it’s building a broader ecosystem centered around digital fandom and utility.

The project’s ambition is underscored by its “Greatest of All Time” (G.O.A.T.) vision, a branding statement aimed at long-term relevance rather than short-term market noise. That vision has already earned recognition, with XYZVerse recently named “Best New Meme Project.”

Unlike many meme tokens that depend solely on viral momentum, XYZVerse operates with a detailed roadmap, a deflationary token model, and a focus on ecosystem expansion. Its community, which continues to grow rapidly, plays an integral role in the token’s progress and positioning.

Pre-launch momentum signals early confidence

The presale structure for XYZ has attracted considerable attention:

- Launch price: $0.0001

- Current stage 13 price: $0.005

- Next stage: $0.01

- Final presale price: $0.02

- Target listing price: $0.10

With over $15 million raised and two presale stages remaining, XYZVerse is advancing toward its target raise with strong investor support. Should the token debut at $0.10, early participants could realize returns of up to 1,000x from initial entry points, contingent on broader market conditions and execution.

The accelerating demand for XYZ suggests strong retail interest and confidence in the project’s post-launch plans, which include exchange listings, gamified dApps, and ongoing token burns.

Hedera‘s momentum weakens

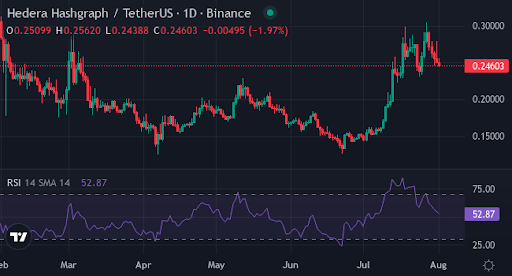

Over the past week HBAR added 3.16%, a calm move after a huge 70.25% surge in the last month. Even so, the coin still sits 13.36% lower than six months ago. The price now trades between 0.25 and 0.32, close to the 10-day average at 0.25 and just under the 100-day line at 0.27.

Momentum looks weak but near exhaustion. The RSI at 32.73 and the stochastic at 16.42 both point to oversold levels. MACD shows a small negative read of ‑0.0044, hinting that sellers are losing force. If buyers step in, the short-term trend could flip upward.

A push above 0.32 could open a run to the first ceiling at 0.35, roughly a 20% jump from 0.29. Beating that may clear space for 0.42, about 45% higher. On the other side, the 0.20 floor stands 25% below current trade; breaking it could drag the pair toward the deeper base at 0.128, a slide near 55%. The chart shows room for recovery, yet the coin must first reclaim 0.35 to prove new strength.

Toncoin loses steam

Toncoin trades between $3.06 and $3.64 today. The token bounced 7.95% this week and 20.76% in a month, yet it still lags 26.81% over six months. RSI at 32.7 and a Stochastic near 7.9 show heavy oversold mood. The MACD edge stays negative but shallow, hinting that sellers are losing steam.

Short term bulls eye $3.91. A close above that line would add roughly 10% from the upper bound and could pull the price toward $4.49, another 25% jump. The 10-day moving average at $3.48 has crept above the 100-day at $3.39, giving a mild upward tilt. Support holds at $2.75; break it and $2.17 sits next, a slide of about 40% from the top of the present band.

Momentum favors a cautious climb. Weekly and monthly gains show buyers returning, and oversold signals leave room for a squeeze higher toward the first resistance. Failure to clear $3.91 would likely trap TON in a sideways channel near $3.3. Clearing $4.49 could revive a medium-term rally and erase much of the six-month loss.

Conclusion

HBAR and TON look strong in this market, but XYZVerse stands out. As the first all-sport memecoin, XYZ brings fans together and targets big gains. Community focus, early entry, and strong growth plans make XYZVerse a key project to watch in this bull run.

To learn more about XYZVerse, visit the website, Telegram, and Twitter.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Social gaming platform STAN completes $8.5 million in funding, with participation from Google and others

A trader bought 67.98 WBTC in the early morning, with a total value of US$6.95 million