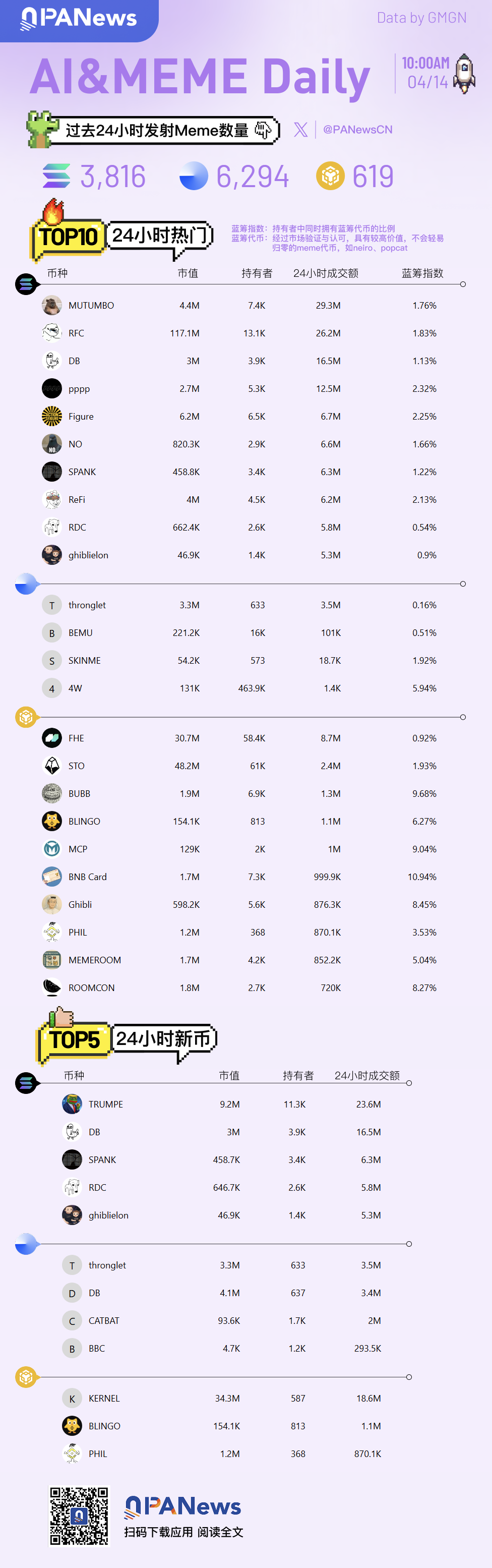

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.4.14)

2025/04/14 10:09

What happened in the past 24 hours? Take a look at the picture review of "Ai&Meme Daily"!

🗓4/14 Update:

$RFC market value exceeds 100 million, the only meme to exceed 100 million in 2 months

$DB is similar to the fartcoin spoof derivative, $MUTUMBO ugly hamster Ansen calls orders

Looking back, $Fartcoin has almost increased 10 times in a month. There is not much money left in the bear market. Choose the right time to invest!

⚠ Tips: PVP is high risk, be cautious and always DYOR!

ข้อจำกัดความรับผิดชอบ: บทความที่โพสต์ซ้ำในไซต์นี้มาจากแพลตฟอร์มสาธารณะและมีไว้เพื่อจุดประสงค์ในการให้ข้อมูลเท่านั้น ซึ่งไม่ได้สะท้อนถึงมุมมองของ MEXC แต่อย่างใด ลิขสิทธิ์ทั้งหมดยังคงเป็นของผู้เขียนดั้งเดิม หากคุณเชื่อว่าเนื้อหาใดละเมิดสิทธิของบุคคลที่สาม โปรดติดต่อ service@mexc.com เพื่อลบออก MEXC ไม่รับประกันความถูกต้อง ความสมบูรณ์ หรือความทันเวลาของเนื้อหาใดๆ และไม่รับผิดชอบต่อการดำเนินการใดๆ ที่เกิดขึ้นตามข้อมูลที่ให้มา เนื้อหานี้ไม่ถือเป็นคำแนะนำทางการเงิน กฎหมาย หรือคำแนะนำจากผู้เชี่ยวชาญอื่นๆ และไม่ถือว่าเป็นคำแนะนำหรือการรับรองจาก MEXC

คุณอาจชอบเช่นกัน

South Korea to advance stablecoin push with new regulation: report

Efforts to launch a won-denominated stablecoin in South Korea are gaining traction as financial regulators prepare to publish a detailed proposal for the assets. On August 18, local media outlet MoneyToday reported that the Financial Services Commission (FSC) of South…

แชร์

Crypto.news2025/08/19 01:27

Pepe price teeters on edge of a breakdown as risky pattern forms

Pepe price has underperformed the market recently amid weak demand, and a risky chart pattern points to a bearish breakdown. Pepe Coin (PEPE) was trading at $0.00001070 on Monday, Aug. 19, much lower than the July high of $0.00001470. Risky…

แชร์

Crypto.news2025/08/19 01:26

Altcoin Season Shock: These Three Coins Could Make Portfolios Pop – If Rotation Holds

The altcoin season remains selective , but three names are capturing attention for different reasons. Chainlink provides infrastructure support, Pi draws speculative interest, and Solana benefits from ecosystem activity. Market conditions suggest traders are still cautious. Bitcoin dominance remains above 60%, and Ethereum flows continue to drive attention toward DeFi and Layer-2 networks. In that context, rotation into altcoins has been narrow, but tokens with liquidity, narratives, or active infrastructure use are beginning to stand out. Chainlink Holds Infrastructure Value Chainlink (LINK) is trading near $25 , with daily volume around $3.2 billion and a market cap close to $17.4 billion, according to CoinMarketCap. The token has gained about 15% over the past week. Analysts expect the August price range to stay between $15.90 and $18.10, with wider projections ranging from $26 to $32 by the end of the year. These figures come from sources like CoinCodex and Cryptopolitan, providing a consistent basis for the outlook. Today, @SergeyNazarov was featured on @Visa ’s Tokenized podcast: • Chainlink’s work with Intercontinental Exchange (ICE) • How policy changes are driving institutional adoption • How Chainlink is unlocking cross-border transactions for ANZ and Fidelity International And much… https://t.co/Wpb3KmWPFz — Chainlink (@chainlink) August 18, 2025 LINK’s role as a DeFi utility token underpins its steady movement. Its price action reflects usage trends like oracle demand rather than speculative cycles. Supply remains stable, and governance still anchors protocol behavior. Pi Coin Remains Speculative Pi (PI) is sitting near $0.36 , with volatility but no clear breakout. The trading range between $0.32 and $0.37 remains intact unless momentum pushes above the 20-day EMA, currently near $0.40. Forecasts see limited movement in the short term, with the RSI indicating that momentum has stalled. Pi’s activity derives from community attention and narrative rather than real-world utility. Despite occasional spikes, it continues to trade within a baseline range. Solana Gains on Activity Solana (SOL) trades close to $181, showing a mere 1% weekly gain. Daily volume exceeds $6.2 billion, and market value is near $98 billion. Exchange listings and on-chain metrics indicate growing developer activity across NFTs and DeFi. Solana Price (Source: CoinMarketCap) Technical indicators place support near $175–$185, and resistance levels lie in the $209–$213 zone. Some forecasters expect breakout moves if volume persists, though trading signs remain moderate. What That Means for Altcoin Season Chainlink rides practical infrastructure use, Pi offers a speculative angle, and Solana brings ecosystem depth. Each is drawing interest differently during this selective altseason. Rotations are not driven by hype. Instead, token flows align with usage patterns and ecosystem signs. As weekend liquidity arrives, volume and open interest patterns may confirm whether capital is shifting more broadly. If inflows continue, tokens favored in this scenario may receive proportionate attention. Chainlink’s price is linked to DeFi demand, Pi’s narrative traction, and Solana’s on-chain velocity offer distinct entry points. A broader altcoin season will likely follow if data supports rotation . Until then, these three provide insights into how capital is distributed in this phase—one token demonstrates infrastructure resilience, another speculative movement, and the third growing ecosystem activity.

แชร์

CryptoNews2025/08/19 00:52