Arbitrum DRIP program launches to reward productive DeFi activity with ARB tokens

Arbitrum has launched the DRIP program to incentivize productive DeFi activity by rewarding users with ARB tokens for leveraging lending and looping strategies across its ecosystem.

- Arbitrum DRIP Season One incentivizes leverage looping strategies in lending markets, rewarding users with ARB tokens for borrowing and redepositing assets.

- Eligible assets for collateral include major stablecoins (e.g., USDC, syrupUSDC) and ETH derivatives such as weETH and rsETH.

- Participating protocols include Aave, Morpho, Fluid, Euler, Dolomite, and Silo, with rewards distributed across two-week epochs.

How Arbitrum DRIP program works

Arbitrum (ARB) has launched the DeFi Renaissance Incentive Program (DRIP), a $40 million initiative designed to encourage productive DeFi activity on its network. Managed by Entropy Advisors and powered by Merkl, Arbitrum DRIP program is structured across four seasons.

Season One, running from Sept. 3 to Jan. 20 focuses on leverage looping strategies in DeFi lending markets, where users can earn ARB tokens by borrowing against eligible ETH and stablecoin assets, redepositing them, and repeating the process to increase their exposure.

For example, a user could deposit syrupUSDC into a participating lending protocol, borrow USDC against it, then swap that borrowed USDC back into more syrupUSDC and redeposit it. By repeating this loop over the two-week epochs, users increase their total borrowed position, and their ARB rewards are calculated based on the time-weighted average borrow balance. Some markets also reward simply supplying assets like ETH derivatives (weETH, wstETH, rsETH) or stablecoins, not just borrowing.

To participate, users must bridge eligible assets to Arbitrum One, choose a participating market—such as Aave, Morpho, Fluid, Euler, Dolomite, or Silo—then deposit collateral, borrow and loop, and finally claim ARB rewards at the end of each two-week epoch.

Arbitrum DRIP program is designed in phases. The first two epochs serve as a discovery phase, allocating only 15% of the budget to identify which markets perform best. Following this, the performance phase rewards top-performing markets with a larger share of incentives, encouraging healthy competition and maximizing liquidity growth across Arbitrum’s DeFi ecosystem.

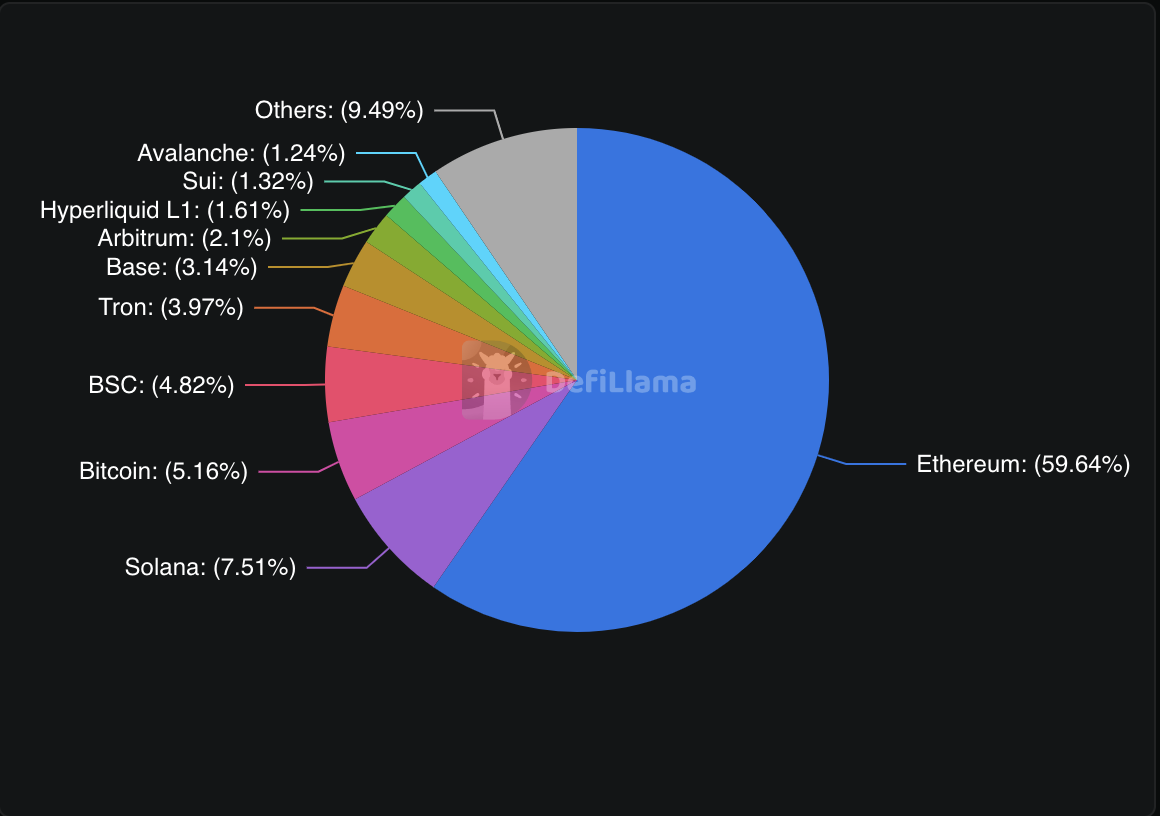

By incentivizing productive borrowing and looping activity, Arbitrum DRIP program is poised to increase the TVL across Arbitrum’s DeFi ecosystem, which currently stands at approximately $3.21 billion, according to DefiLlama. This places Arbitrum 7th in global DeFi TVL share at 2.1%, just behind Base.

Source: DefiLlama

คุณอาจชอบเช่นกัน

OpenAI opens ChatGPT Projects to free users, adding several new features

A Hyperliquid whale closed 105.26 BTC and made a profit of $449,000