Boom Then Bust? BTC Eyes $175K Before Catastrophic 80% Drop

TL;DR

- Bitcoin may climb to $175K before falling 70–80%, based on four past market cycles.

- $4.9T in expiring options today could bring sharp volatility across crypto and equities.

- Inverse head-and-shoulders pattern suggests a bounce from $112K could push BTC toward $130K.

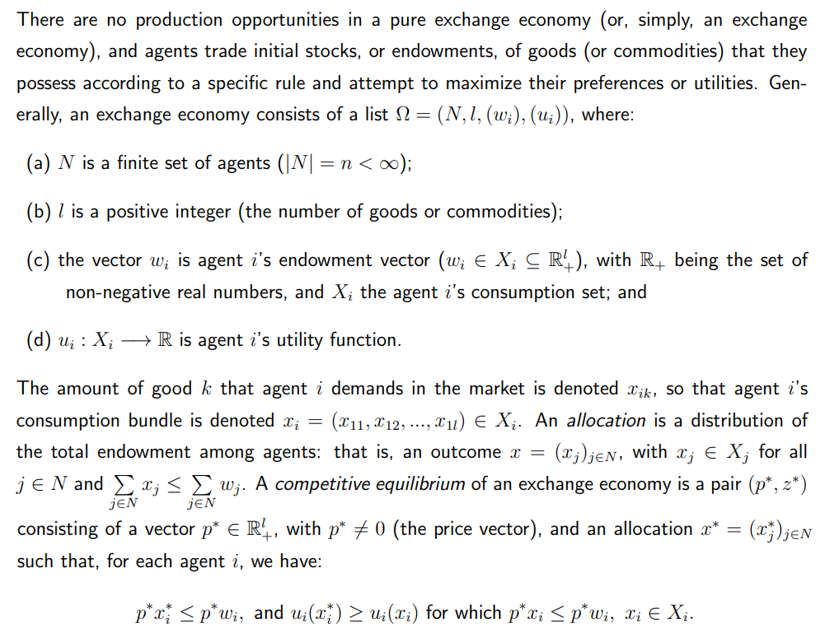

Bitcoin’s Past Cycles Show Repeated Deep Drops

Bitcoin has seen major corrections after each bull market cycle. Data reviewed by market analyst EGRAG CRYPTO shows that in 2011, the cryptocurrency fell around 93% from its peak. In 2013, the drop was around 86%, followed by 84% in 2017, and roughly 77% in 2022 after the 2021 top.

Notably, the average drawdown across these four cycles comes to around 85%. Based on this, EGRAG suggests a possible 70% to 80% decline in the next bear market. This is not guaranteed but is based on how Bitcoin has behaved over more than a decade of price history.

According to EGRAG’s market model, BTC may still have room to move higher before any major correction begins. The chart shared projects a possible peak at around $175,000. This is once again based on price structures that have formed in previous cycles.

Source: EGRAG CRYPTO/X

Source: EGRAG CRYPTO/X

If that high is reached, and a 70–80% pullback follows as in past cycles, Bitcoin could fall into the range of $35,000 to $52,000. Timing remains uncertain. The model shows that in previous cycles, peaks formed several months after similar patterns developed.

$4.9 Trillion in Expiries Could Move Markets

Around $4.9 trillion worth of stock and ETF options are set to expire today. This amount is more than 1.2 times the total crypto market cap. These large quarterly expiries, often called triple witching, have a history of driving sharp moves in both traditional and crypto markets.

Crypto Rover noted that past expiries this year were followaed by clear market reactions. After the March 2025 expiry, Bitcoin dropped by about 17% over the next few weeks. The June expiry saw BTC fall below $100,000 shortly after. With the current expiry in play, some traders are preparing for increased volatility in the days ahead.

Technical Pattern Could Signal Short-Term Path

Ali Martinez shared a chart that shows a potential inverse head-and-shoulders formation on Bitcoin’s 4-hour chart. The left shoulder formed in late August, the head in early September, and the right shoulder may be developing now.

He noted that Bitcoin might dip to around $112,000–$113,000 before rebounding. He added that “a rally to $130,000” could follow if the price breaks above the $117,950 neckline. Key resistance levels to watch in that case are $121,000, $125,000, and $127,000.

Source: Ali Martinez/X

Source: Ali Martinez/X

At the time of writing, Bitcoin was trading at around $116,800, with a slight 24-hour drop and a 7-day gain of 1%. Trading volume over the last day stood at $36.7 billion.

The post Boom Then Bust? BTC Eyes $175K Before Catastrophic 80% Drop appeared first on CryptoPotato.

คุณอาจชอบเช่นกัน

Adoption Leads Traders to Snorter Token

Intel rose nearly 20% in pre-market trading, while Nvidia rose 2.34%.