Ethereum Struggles to Hold $4,000 as ETF Outflows and Selling Mount

TLDR

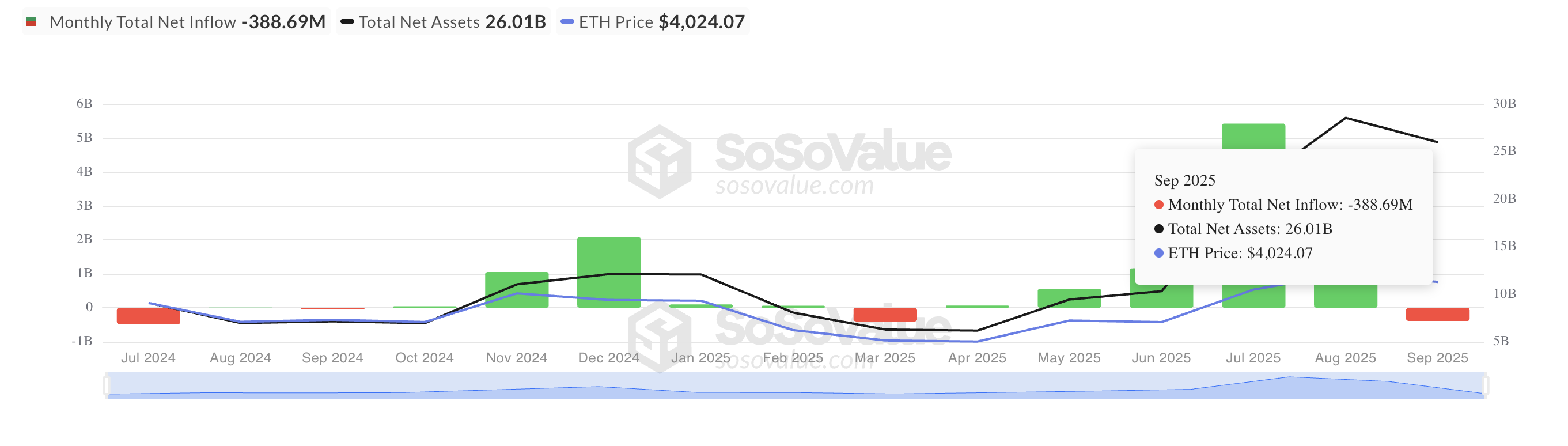

- Ethereum saw $796M in ETF outflows, signaling a drop in institutional demand.

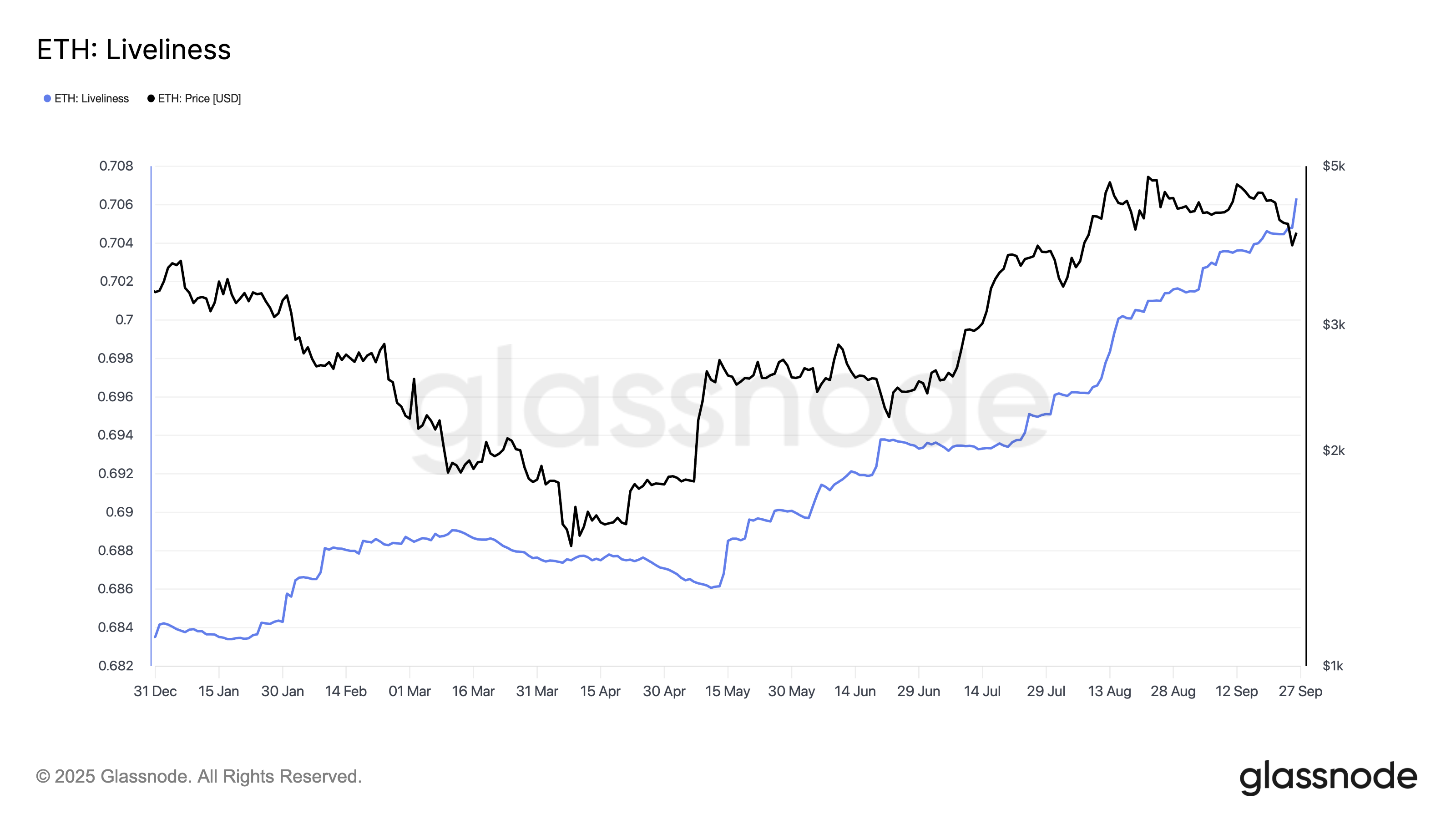

- Ethereum’s Liveliness metric hits a 2023 high, reflecting long-term holder selling.

- Ethereum struggles to hold the $3,875 support level amid increasing bearish pressure.

- A continued lack of demand could push Ethereum’s price to $3,626 or lower.

Ethereum’s recovery is showing signs of fragility as it hovers around the $4,000 mark. Despite a modest 1% gain, data suggests institutional demand is weakening, with significant outflows from ETH ETFs. Meanwhile, long-term holders are selling off their positions, putting additional pressure on Ethereum’s price. If demand fails to pick up, ETH could face a drop below its key support level. Ethereum’s $4,000 recovery is facing growing challenges as key metrics signal bearish trends.

Ethereum’s Modest Rebound Faces Challenges

Ethereum has seen a slight increase of about 1%, trading just under $4,000. The broader crypto market showed signs of improvement, contributing to the uptick in ETH’s price.

However, despite this brief recovery, underlying factors indicate that Ethereum’s upward movement could be short-lived. One of the main concerns is the outflows from Ethereum-based exchange-traded funds (ETFs), which could signal waning institutional interest.

Recent data from SosoValue highlights that ETH ETFs experienced a net outflow of $796 million this week alone. This brings the total month-to-date outflow to $388 million, marking a significant decline in institutional demand. If these outflows continue, September could be the first month since March to show net outflows from Ethereum ETFs, which may contribute to a further weakening of Ethereum’s price in the short term.

Liveliness Metric Reflects Increased Selling Pressure

The Liveliness metric for Ethereum has also seen a notable rise, reaching a year-to-date high of 0.70. This metric tracks the movement of long-term holders’ assets, with higher values suggesting that these holders are selling or moving their ETH. According to Glassnode, a climbing Liveliness number is often linked to profit-taking activity.

As more long-term holders sell their assets, this trend adds additional downward pressure on Ethereum’s price. It shows that investors who have held Ethereum for a longer period are increasingly willing to exit their positions. This could further dampen Ethereum’s chances of maintaining its recovery, as these sales could signal a shift in market sentiment.

Ethereum’s Key Support at $3,875

Currently, Ethereum is holding the $3,875 support level, but this price floor may not hold for long if buying pressure doesn’t strengthen. The growing sell-off activity and institutional outflows could lead to a decline if demand remains weak. Should Ethereum fail to rally, the price could drop to $3,626, a critical support level that could signal further losses.

Technical indicators show that Ethereum’s ability to stay above the $3,875 level is under threat. If the selling trend continues, the next major support point could be at $3,626. This level represents a critical threshold for Ethereum’s price, and a drop below it could signal the start of a deeper correction.

Looking Ahead: A Fragile Recovery

Ethereum’s recovery above $4,000 appears fragile at best, given the current market dynamics. The outflows from ETH ETFs and the increased selling activity from long-term holders create a challenging environment for Ethereum’s price. While the broader market shows signs of improvement, these internal pressures could weigh on Ethereum in the near term.

The next few days will be crucial for Ethereum. If buying interest picks up, the price may push towards $4,211. However, without renewed demand, Ethereum could face further losses and struggle to maintain its current levels. Investors will be closely monitoring key technical levels, including the $3,875 and $3,626 support zones, to gauge the next moves in the market.

The post Ethereum Struggles to Hold $4,000 as ETF Outflows and Selling Mount appeared first on CoinCentral.

คุณอาจชอบเช่นกัน

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?

Taiko Makes Chainlink Data Streams Its Official Oracle