James Wynn’s memecoin play turns as YEPE insiders sell

On-chain analytics indicate that insiders are starting to sell YEPE, which prominent trader James Wynn promoted.

- YEPE, memecoin tied to James Wynn, fell 25% after insiders started selling

- At launch, insiders likely controlled more than 60% of the token, on-chain data shows

- So far, insiders have made $1,4 million in profits, and still hold more than 50% of the supply

Memecoin season, especially on BNB, seems to be coming back. But with it, there’s also an explosion of questionable projects. On Thursday, October 9, Yellow Pepe, also known as YEPE, linked to James Wynn, saw a significant correction after apparent insiders started selling.

The BNB-based (BNB) memecoin dropped 25%, from 0.4% to 0.3%, after gaining more than 400% in just days since its launch. Likely the main driver of its rally was the endorsement of a high-profile trader, James Wynn, known for his ultra-leveraged trades, leading both to giant gains and losses.

In an X post, Wynn shared the token’s address, claiming that “YEPE is flying,” and that the “market has spoken”. Predictably, this led to his followers investing in this new memecoin.

YEPE token shows red flags since launch

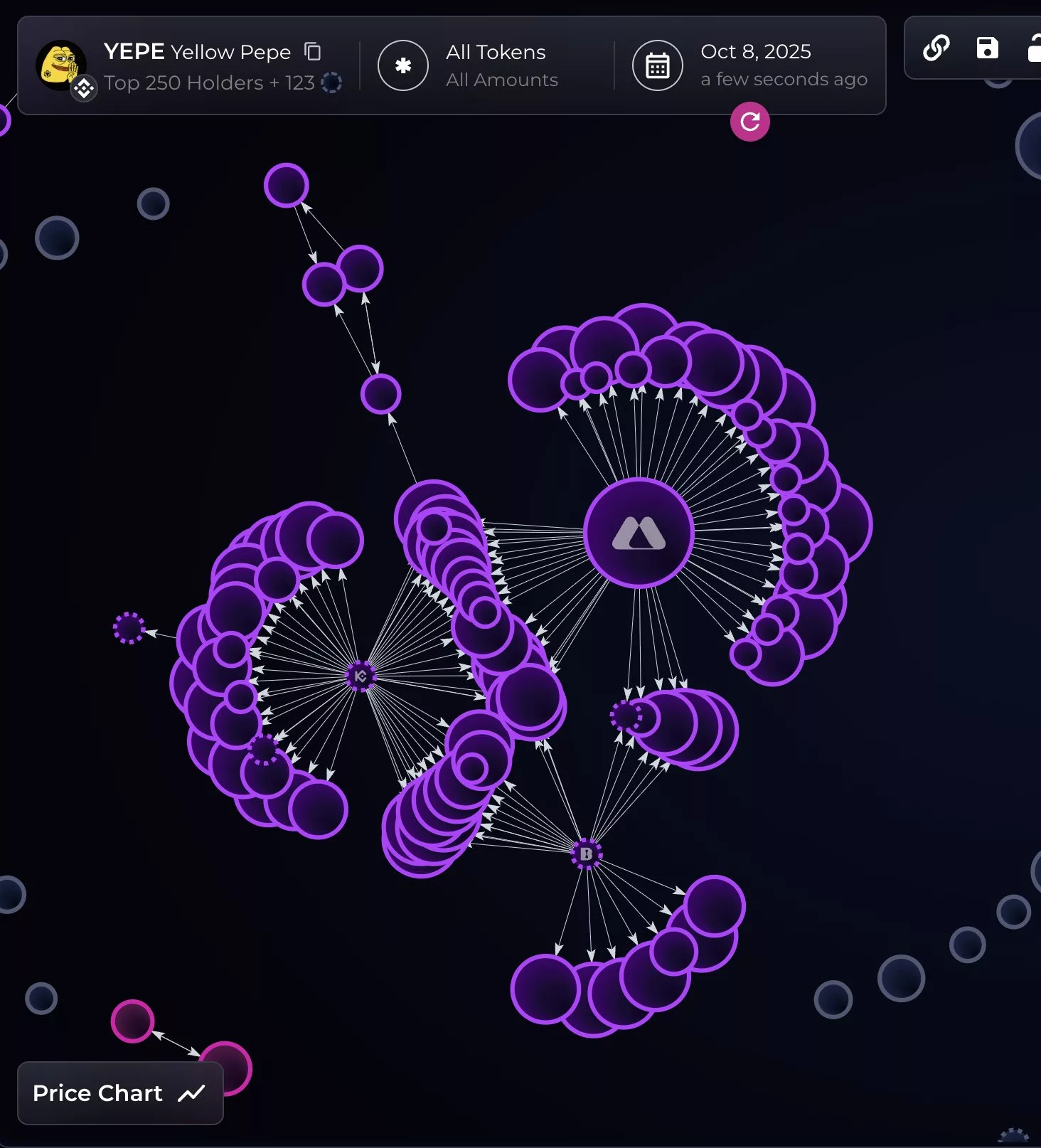

Still, the token displayed red flags from its launch. Blockchain analytics platform Bubble Maps revealed on October 5, the day of its launch, that insiders held 60% of YEPE. Such a high concentration is usually a red flag and can lead to significant pressure on the price as insiders start selling.

Predictably, this is exactly what happened. On October 8, insiders started dumping their YEPE positions, making $1.4 million in profits by the next day. What’s more, despite this selling spree, insiders still hold more than 50% of the token’s supply, according to Bubble Maps.

คุณอาจชอบเช่นกัน

Solana Company could acquire more than 5% of SOL supply and pursue a Hong Kong secondary listing

Eurozone rate cuts on hold as ECB weighs risks