Only Christopher Waller and Michelle Bowman supported Trump’s push to cut rates at the July Federal Reserve meeting

Only two members of the Federal Reserve board supported President Donald Trump’s push to cut rates during the central bank’s July meeting, according to minutes released Wednesday by the Fed itself.

Those two were Governor Christopher Waller and Governor Michelle Bowman, who both voted to lower the benchmark interest rate, arguing that the labor market was cooling faster than expected.

The rest of the Federal Open Market Committee (FOMC) disagreed, voting to keep the rate steady between 4.25% and 4.5%, where it has been locked since December 2024.

This was the first time in more than 30 years that multiple Fed governors dissented in a rate decision. The split showed growing tension inside the Fed as policymakers face pressure from the White House to respond more aggressively to economic slowdowns.

Trump, who regained the presidency in January 2025, has publicly criticized Chair Jerome Powell, calling him “a loser” and “stupid,” and continues to demand rate cuts to stimulate growth.

The meeting summary made it clear that while officials saw threats on both sides of their dual mandate, inflation and employment, most of them believed it was still too risky to start cutting rates.

The minutes said, “Participants generally pointed to risks to both sides of the Committee’s dual mandate, emphasizing upside risk to inflation and downside risk to employment.”

However, “a majority of participants judged the upside risk to inflation as the greater of these two risks,” while “a couple saw downside risk to employment as more salient risk.”

Tariffs and inflation uncertainty cloud Fed’s rate path

Tariffs were a major point of discussion in the meeting. Trump’s latest wave of trade actions, particularly on China and European goods, created additional inflation concerns inside the central bank.

“Regarding upside risks to inflation, participants pointed to the uncertain effects of tariffs and the possibility of inflation expectations becoming unanchored,” the Fed minutes said. Officials admitted there was “considerable uncertainty” about how strong or lasting the impact of the tariffs might be.

Internally, the Fed’s own staff described economic growth during the first half of 2025 as “tepid,” even though the unemployment rate remained low at the time of the meeting. But some participants saw early signs of weakness building in the jobs market and in consumer spending data.

Several Fed officials noted that “some incoming data pointed to a weakening of labor market conditions,” and warned that the “downside risk to employment had meaningfully increased.”

The discussion happened just two days before the Bureau of Labor Statistics released fresh payroll figures. Those numbers showed job growth in July remained weak, and previous months—June and May—were revised sharply downward, confirming that the labor market had softened more than initially believed.

The minutes also noted that if inflation were to stay elevated while the labor market kept weakening, the Fed would face “difficult tradeoffs.” Rate decisions going forward would depend on “each variable’s distance from the Committee’s goal and the potentially different time horizons over which those respective gaps would be anticipated to close.”

Trump tightens grip on Fed as Powell prepares Jackson Hole speech

The July meeting minutes were released two days before Powell is expected to deliver a major speech at the Fed’s annual Jackson Hole conference in Wyoming. Powell’s address is expected to offer hints on the Fed’s short-term direction on interest rates, as well as how the board views long-term policy options going into 2026.

But Powell isn’t just facing pressure from the markets. Trump is stacking the Fed with his own picks. Governor Adriana Kugler resigned earlier this month, giving Trump another opening to fill the board with an ally. The president has already gone after Governor Lisa Cook, demanding her resignation over accusations of mortgage fraud tied to federal housing loans she received for real estate in Georgia and Michigan.

Powell’s term as Fed Chair ends in May 2026, but he can legally stay on as a board governor until 2028. Even so, Trump and his economic team have begun floating names to replace him. The White House has identified 11 candidates, a mix of former and current Fed officials, economists, and Wall Street strategists.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

คุณอาจชอบเช่นกัน

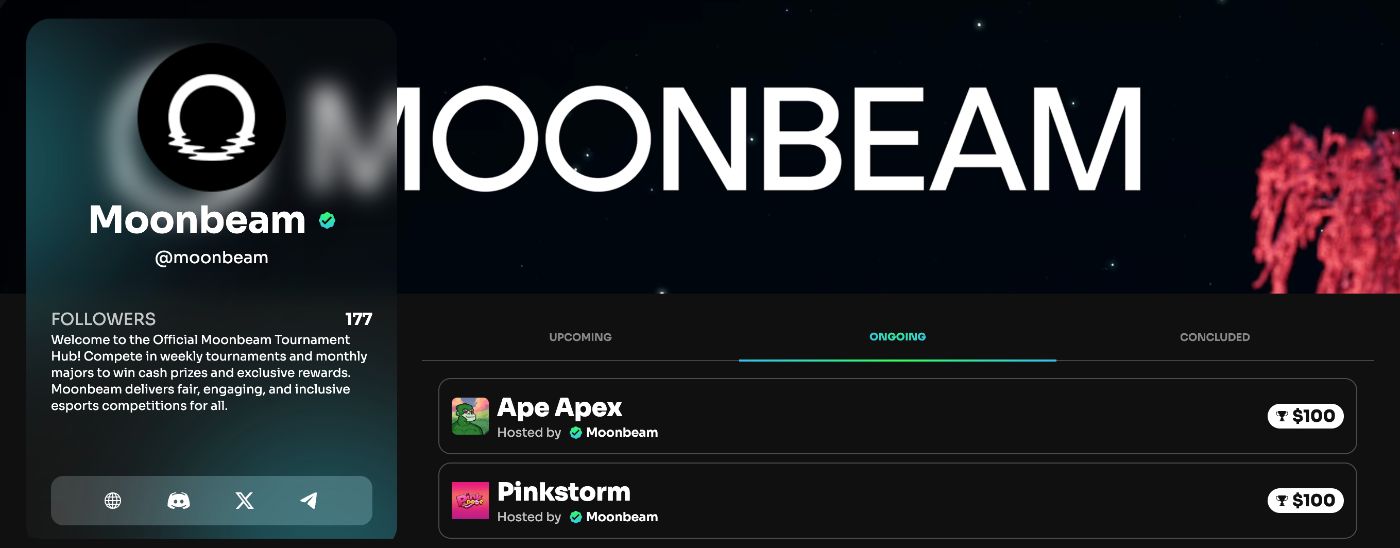

Why Web3 Gamers Are Rushing To Moondrop, Moonbeam’s GLMillionaire With 1,000,000 GLMR On The Line

Solana ETF Decision Delayed, Giving Mutuum Finance (MUTM) More Room to Eat into SOL’s Market Share