Stellar Price Forecast: XLM downtrend likely to continue as bearish bets surge

- Stellar continues to trade within a falling channel on the 4-hour chart, risking a steeper correction below the 200-period EMA.

- Open Interest has decreased by 9% in the last 24 hours, indicating a decline in optimism among traders.

- Short positions in XLM derivatives have increased to 54% over the last 24 hours.

Stellar (XLM) depreciates by nearly 2% at press time on Wednesday as it continues to trade within a falling channel pattern on the 4-hour time frame. Investors anticipate a steeper correction as optimism in XLM derivatives wanes, with bearish bets rising and open interest declines.

XLM traders bet against recovery as Open Interest declines

Investors are losing confidence in Stellar as capital outflows surge from the XLM derivatives market amid the broader market pullback.

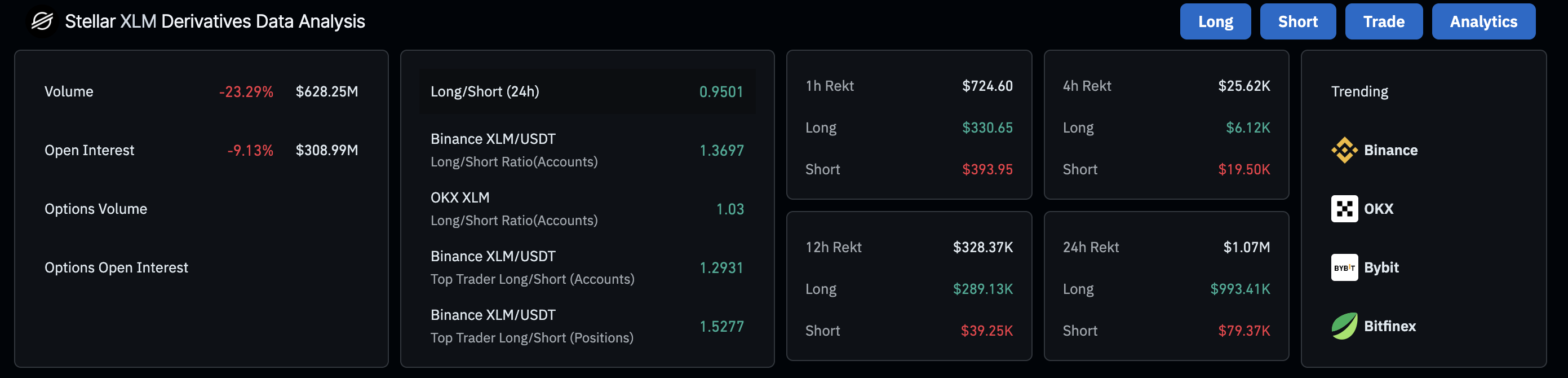

CoinGlass data shows that Open Interest (OI) has decreased by 9% over the last 24 hours, reaching $308.99 million. A pullback in OI reflects capital outflow from the futures and options, suggesting investors are adopting a wait-and-see approach to avoid losses.

XLM Open Interest. Source: Coinglass

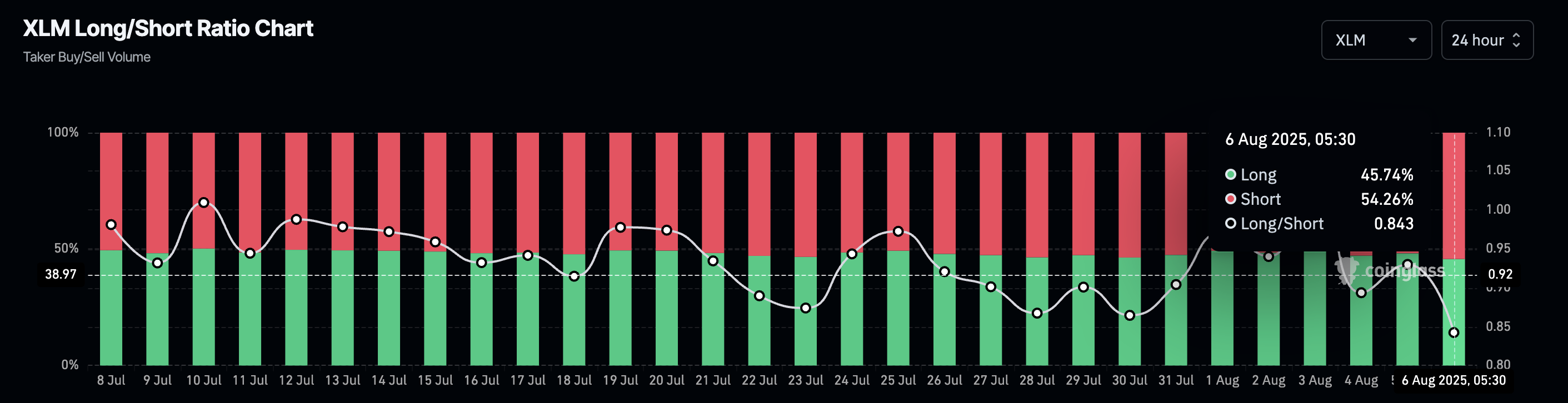

Traders with a higher risk appetite are betting against the XLM recovery chances by holding bearish positions. According to the XLM long-to-short ratio chart, short positions have increased to 54.26% from 51.81% on Tuesday.

XLM long/short ratio chart. Source: Coinglass

Stellar risks 11% pullback within falling channel

Stellar tests the 200-period Exponential Moving Average (EMA) at $0.3884 on the 4-hour chart, extending the 4.30% drop from the previous day. The declining trend steps below the 23.6% Fibonacci level at $0.3980, drawn from the $0.5166 peak on July 14 to the 0.3613 low on Sunday.

A decisive close below the said dynamic support could extend the decline to the $0.3613 support.

However, the bearish pattern highlights the risk of XLM retesting the lower support trendline near $0.3460. This pullback would account for an 11% drop from the current market price.

The technical indicators maintain a neutral stance as the Moving Average Convergence Divergence (MACD) line crossed below its signal line, but moves sideways closely, indicating low momentum.

A decline in buying pressure causes the Relative Strength Index (RSI) to drop to 44 on the 4-hour chart, below the halfway line. If RSI extends the declining trend, it could increase the chances of a double-digit fall.

XLM/USDT daily price chart.

On the contrary, if XLM bounces off the 200-period EMA, it should surpass the 100-period EMA at $0.4082 at the overhead trendline, to reinforce an uptrend. In such a case, Stellar could extend the rally to the 50% retracement level at $0.4389.

You May Also Like

The largest attack in 48 hours, the Israeli army said Iran launched more than 20 missiles at Israel

Grayscale Space and Time (SXT) Trust Registered in Delaware