Detail: https://coincu.com/news/tether-launches-usat-stablecoin/Detail: https://coincu.com/news/tether-launches-usat-stablecoin/

Tether Introduces USA₮ with Integration Plans at TOKEN 2049

2025/10/03 03:59

ข้อจำกัดความรับผิดชอบ: บทความที่โพสต์ซ้ำในไซต์นี้มาจากแพลตฟอร์มสาธารณะและมีไว้เพื่อจุดประสงค์ในการให้ข้อมูลเท่านั้น ซึ่งไม่ได้สะท้อนถึงมุมมองของ MEXC แต่อย่างใด ลิขสิทธิ์ทั้งหมดยังคงเป็นของผู้เขียนดั้งเดิม หากคุณเชื่อว่าเนื้อหาใดละเมิดสิทธิของบุคคลที่สาม โปรดติดต่อ service@mexc.com เพื่อลบออก MEXC ไม่รับประกันความถูกต้อง ความสมบูรณ์ หรือความทันเวลาของเนื้อหาใดๆ และไม่รับผิดชอบต่อการดำเนินการใดๆ ที่เกิดขึ้นตามข้อมูลที่ให้มา เนื้อหานี้ไม่ถือเป็นคำแนะนำทางการเงิน กฎหมาย หรือคำแนะนำจากผู้เชี่ยวชาญอื่นๆ และไม่ถือว่าเป็นคำแนะนำหรือการรับรองจาก MEXC

แชร์ข้อมูลเชิงลึก

คุณอาจชอบเช่นกัน

Sweden Seeks to Join Bitcoin ‘Digital Arms Race’

Swedish legislators are considering the creation of a national Bitcoin reserve to spread assets and hedge inflation, with the goal of moving to global digital finance. Swedish politicians of the Swedish Democrats party have introduced a bill to create a national Bitcoin depository. This proposal calls on the government to research the potential of Bitcoin […] The post Sweden Seeks to Join Bitcoin ‘Digital Arms Race’ appeared first on Live Bitcoin News.

แชร์

LiveBitcoinNews2025/10/03 06:00

แชร์

Solana Treasury Stocks: Why Are These Companies Buying Up SOL?

The post Solana Treasury Stocks: Why Are These Companies Buying Up SOL? appeared on BitcoinEthereumNews.com. In 2020, everyone watched Strategy (called Microstrategy back then) scoop up Bitcoin and turn corporate crypto treasuries into a mainstream story. Now, a new wave is forming. And it’s centered on Solana. Dozens of companies are holding SOL as a bet on price. Except they’re not just holding. They’re building what’s being called Solana treasuries or Digital Asset Treasuries (DATs). These aren’t passive vaults. They’re active strategies that stake, earn yield, and tie into the fast-growing Solana ecosystem. Forward Industries, a Nasdaq-listed firm, recently bought more than 6.8 million SOL, making it the world’s largest Solana treasury company. Others like Helius Medical, Upexi, and DeFi Development are following a similar playbook, turning SOL into a centerpiece of their balance sheets. The trend is clear: Solana treasury stocks are emerging as a new class of crypto-exposed equities. And for investors, the question isn’t just who’s buying but why this strategy is spreading so fast. Key highlights: Solana treasuries (DATs) are corporate reserves of SOL designed to earn yield through staking and DeFi. Companies like Forward Industries, Helius Medical, Upexi, and DeFi Development Corp now hold millions of SOL. Public firms collectively own 17.1M SOL (≈$4B), which makes Solana one of the most adopted treasuries. Unlike Bitcoin treasuries, Solana holdings generate 6–8% annual rewards. It makes reserves into productive assets Solana treasury stocks are emerging as a new way for investors to gain indirect exposure to SOL. Risks remain: volatility, regulation, and concentrated holdings. But corporate adoption is growing fast. What is a Solana treasury (DAT)? A Solana treasury, sometimes called a Digital Asset Treasury (DAT), is when a company holds SOL as part of its balance sheet. But unlike Bitcoin treasuries, these usually aren’t just static reserves sitting in cold storage. The key difference is productivity. SOL can be staked directly…

แชร์

BitcoinEthereumNews2025/09/21 06:09

แชร์

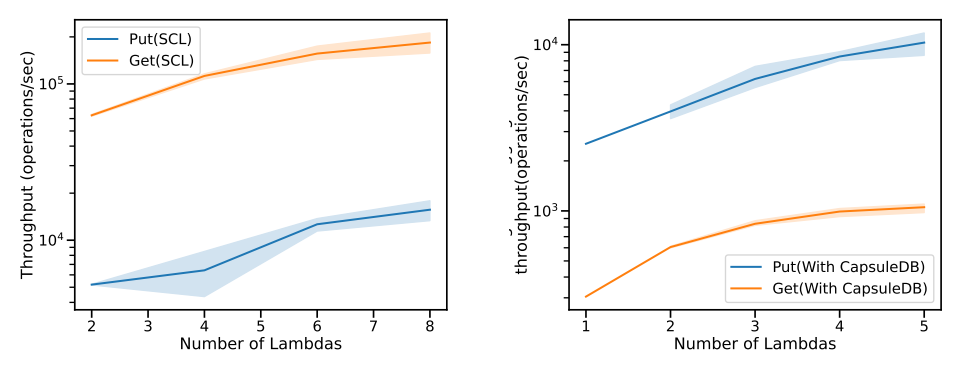

Is SCL the Key to Faster, Safer Serverless Apps? Here’s What Benchmarks Say

This article presents a comprehensive evaluation of Secure Capsules Layer (SCL) using DataCapsules for inter-enclave communication. Benchmarks on Intel NUCs examine its performance as a key-value store, replication overhead, and the efficiency gains from circular buffers. Results show reduced communication costs compared to SGX SDK and HotCall, while replication introduces scalability limits. Lambda launch latency, dominated by attestation delays, is analyzed, and a fog robotics case study demonstrates SCL’s potential for scaling distributed, enclave-protected applications in real-world use cases.

แชร์

Hackernoon2025/10/03 05:30

แชร์