The Smarter Web Company boosts Bitcoin holdings to 346 BTC after doubling fundraising target

The Smarter Web Company has expanded its BTC treasury to over 346 coins, following a a highly successful fundraise that brought in nearly double its initial target.

On June 19, London-listed technology firm The Smarter Web Company announced that it had expanded its Bitcoin (BTC) treasury with the acquisition of 104.28 BTC at an average price of £77,751 ($104,451) per coin. The purchase, totaling £8,108,114, brings the company’s total BTC holdings to 346.63 BTC.

Altogether, the company has spent £27.2 million on Bitcoin so far, with an average purchase price of £78,480 ($105,430) per BTC.

The acquisition follows a recently completed fundraise, announced on June 16, which was done through a mix of institutional bookbuilding and qualified investor subscriptions. The fundraising target was at least £15 million, but due to strong demand, they raised approximately £29.3 ($37.1) million — nearly double that amount.

However, the capital raise resulted in a 7.39% dilution for existing shareholders, including directors, who maintained their share counts but saw slight decreases in ownership percentages.

The Smarter Web Company regularly adds to its Bitcoin stash as part of its long-term “10 Year Plan,” which centers on keeping an active Bitcoin treasury as a key part of its financial strategy.

Just a few days before the latest fundraising, on June 13, they bought 74.27 BTC for £5.98 million, bringing their total to 242.34 BTC at that point. With the latest purchase of 104.28 BTC, their Bitcoin holdings have jumped by 43% since that last buy.

Other UK companies are also expanding their BTC holdings. Most notably, London-based investment firm Abraxas Capital recently acquired approximately 2,949 BTC, worth over $250 million, taking advantage of a market dip.

Meanwhile, more UK firms are embracing a Bitcoin treasury strategy inspired by Michael Saylor’s Strategy. For example, Bluebird Mining Ventures Ltd., a London-listed gold miner, recently announced plans to convert revenue from its gold operations directly into BTC, making it the first UK mining company to formally adopt a “gold-to-digital-gold” treasury approach.

คุณอาจชอบเช่นกัน

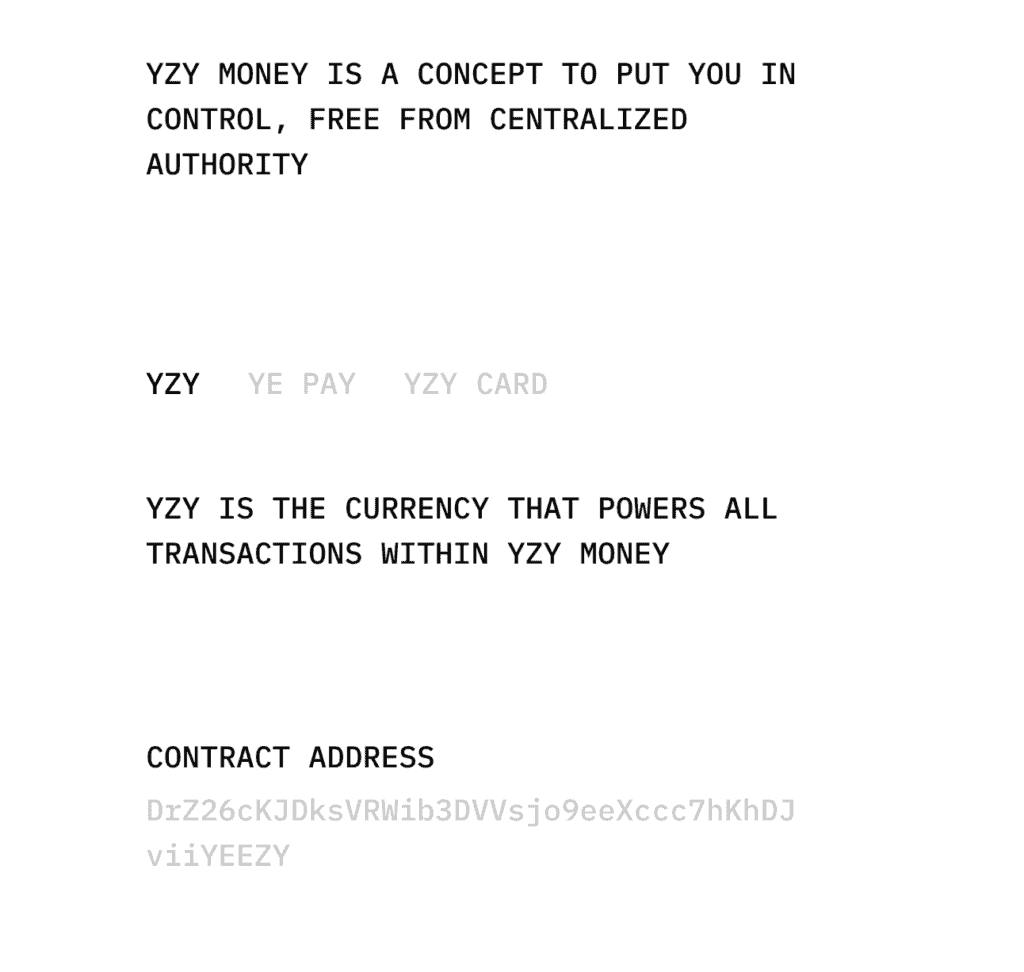

Kanye West Unveils Official “YZY Money” Ecosystem on Solana

US Government Wallet Acquires Ethereum (ETH) from Coinbase! Here’s Why!