US Platform Blue Ocean Eyes Tokenized Stocks For 24/7 Trading

On Oct. 10, Blue Ocean, an off-exchange platform for overnight US stock trading, announced its official entry into blockchain-based equity offerings.

Blue Ocean allows investors to buy and sell blue-chip stocks like Apple and Tesla after Wall Street closes, bridging the gap between global time zones.

According to Reuters, the company’s latest blockchain push follows a system overload incident in August, which prompted an upgrade on infrastructure, relying on major retail brokers like Robinhood, Schwab, and Interactive Brokers to expand capacity.

With its latest move, Blue Ocean is set to list stocks directly on the blockchain, making them tradable 24/7, in smaller, more accessible fractions. This model could democratize equity ownership, making global round-the-clock markets a reality for retail traders and institutions.

Blue Ocean’s Crypto Move Aligns With Other Prominent US Trading Platforms

Blue Ocean’s venture into asset tokenization mirrors a broader institutional trend as major US trading platforms increasingly lean toward cryptocurrencies amid improving regulatory clarity.

Earlier this month, Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, acquired Polymarket in a landmark $2 billion deal.

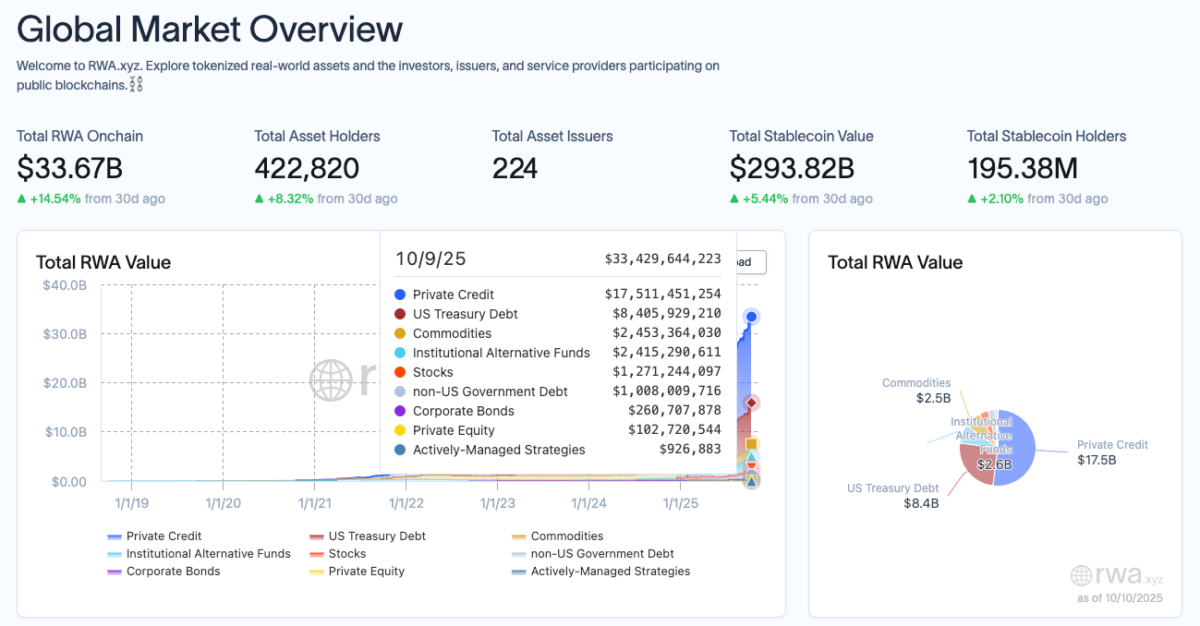

Global Real-World Asset (RWA) sector rises 14.7% in 30 days to hit $33 billion on October 10, 2025 | Source: RWA.XYZ

According to Rwa.xyz, the global asset tokenization sector has surpassed $33 billion in total on-chain assets, with private credit leading at $17.5 billion, representing 53% of the total tokenized market. US Treasuries rank second with $8.4 billion, or 24% market share, emphasizing the rising demand for yield-bearing assets popular among institutional investors.

Meanwhile, Nasdaq recently filed a proposal with the US Securities and Exchange Commission (SEC), tweaking its rules to enable trading of listed stocks and exchange-traded products in either traditional or tokenized form.

Pepe Node Presale Gains Momentum as Tokenized Markets Expand

As Blue Ocean’s latest move deepens Wall Street’s growing involvement in crypto, community-driven crypto projects like Pepe Node are also drawing investor interest.

Pepe Node allows users to own virtual meme coin mining rigs, combine nodes for higher yields, and earn bonus rewards from network participation.

Pepe Node Presale

Currently priced at $0.0010, the Pepe Node presale has already raised over $1.16 million of its $1.3 million target. Investors can still join through the official Pepe Node website before the next price tier unlocks.

nextThe post US Platform Blue Ocean Eyes Tokenized Stocks For 24/7 Trading appeared first on Coinspeaker.

คุณอาจชอบเช่นกัน

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise

Stellar’s Flagship Meridian Conference Focused on RWAs and Emerging Markets