XXKK Exchange Strengthens AML and KYC Systems to Elevate Compliance Standards

[PRESS RELEASE – Denver, USA, September 15th, 2025, Chainwire]

As a globally leading digital asset trading platform, XXKK Exchange is committed to creating a secure, transparent, and compliant trading environment. With the rapid growth of the global digital asset market and the increasing complexity of cross-border transactions, regulatory compliance and risk management have become critical priorities for exchanges. To address these challenges and safeguard user funds and privacy, XXKK Exchange has announced a comprehensive upgrade of its Anti-Money Laundering (AML) and Know Your Customer (KYC) systems, leveraging technological innovation and process optimization to enhance platform risk controls, improve trading transparency, and fully comply with global regulatory standards.

As the digital asset industry continues to expand, compliance and security have become core competitive advantages for exchanges, while also being essential for earning user trust and supporting sustainable growth. The recent upgrades at XXKK Exchange include:

Intelligent AML Monitoring System

The platform has integrated advanced AI and big data analytics to monitor transactions in real-time and assess risks. The system can automatically detect suspicious patterns, generate risk reports, and respond promptly to potential money laundering activities. Cross-border transactions are reviewed to ensure compliance with international regulations.

Comprehensive KYC Verification

XXKK Exchange has optimized its user identity verification process by implementing multi-level authentication. Combining government-issued ID verification, facial recognition, and dynamic risk assessments, the platform ensures the authenticity of user identities while effectively preventing fraudulent accounts and illegal transactions.

Enhanced Risk Control and Compliance Team

The exchange has expanded its team of compliance and risk management experts, operating a 24/7 monitoring and response system. Continuous oversight and timely handling of potential risk events enhance overall transaction security, providing users with reliable protection.

Alignment with International Compliance Standards

XXKK Exchange adheres to international regulatory frameworks, including FATF recommendations, optimizing cross-border compliance procedures to ensure a secure and transparent trading experience for users worldwide.

Global Regulatory Licenses

XXKK Exchange holds multiple international licenses, including: US MSB (License No. 31000222694535), Canada MSB (License No. M22420435), and St. Vincent FSA (License No. 3393), further demonstrating the platform’s commitment to compliance and security.

Emmalyn, spokesperson for XXKK Exchange, stated: “As a licensed exchange, we prioritize compliance and security in every aspect of our platform. With these upgrades to our AML and KYC systems, we aim to provide users with the highest standards of protection while showcasing our professional capabilities in global regulatory operations.”

This comprehensive upgrade underscores XXKK Exchange’s dedication to compliant operations and marks a significant step in enhancing service quality and risk management in the global digital asset industry.

About XXKK Exchange

XXKK Exchange is a globally leading digital asset trading platform dedicated to providing users with safe, efficient, and compliant digital asset trading services. Covering a wide range of major cryptocurrency trading pairs, the platform offers advanced risk control and compliance solutions to ensure a secure trading experience for users worldwide.

Official Website: www.xxkk.com

The post XXKK Exchange Strengthens AML and KYC Systems to Elevate Compliance Standards appeared first on CryptoPotato.

คุณอาจชอบเช่นกัน

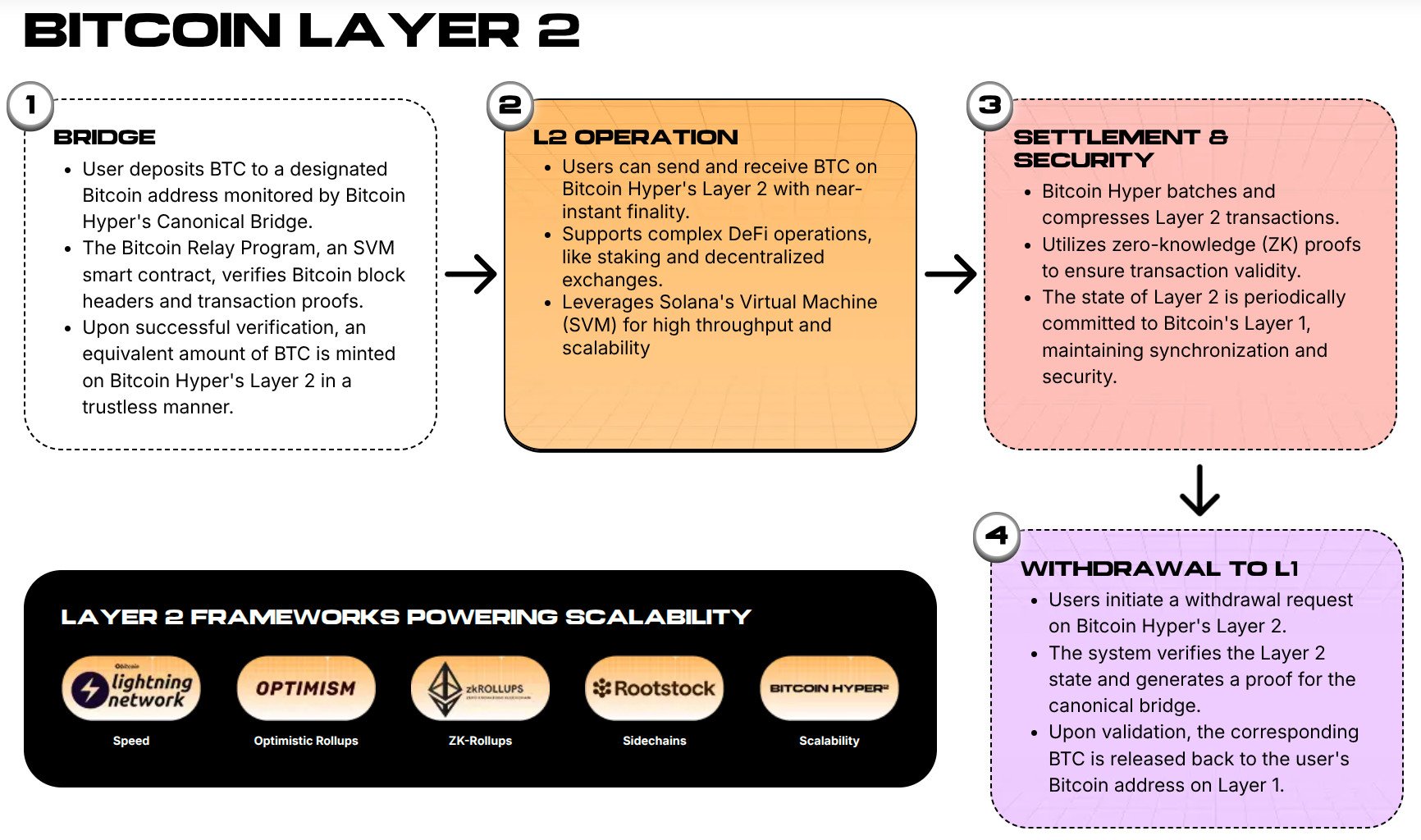

Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?

Recession Cancelled? Experts Weigh In