Ethereum stablecoin monthly trading volume hit a record high of approximately $2.82 trillion.

PANews reported on November 3rd that, according to The Block , Ethereum stablecoin on-chain transaction volume reached approximately $ 2.82 trillion in October , a month-on-month increase of about 45% , setting a new all-time high. USDC led the way with approximately $ 1.62 trillion in transaction volume, followed by USDT at approximately $ 895.5 billion; DAI saw a decrease from September at approximately $ 136 billion. Analysts suggest that during the market pullback, traders utilized stablecoins for liquidity management and yield strategies. Stablecoin issuers contributed approximately 65%-70% of the daily revenue of crypto protocols in October , primarily from interest income from low-risk assets such as US Treasury bonds. Bitcoin and Ethereum fell by approximately 11.5% and 16.4% respectively during the month.

Ayrıca Şunları da Beğenebilirsiniz

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

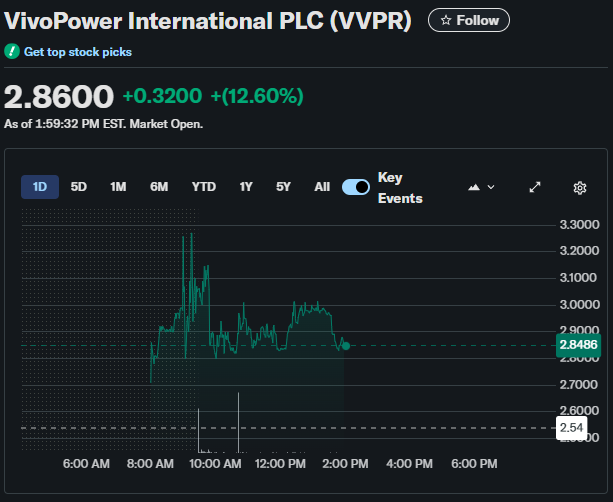

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally