Why Bitcoin Price Top Indicators Failed This Cycle

Bitcoin Magazine

Why Bitcoin Price Top Indicators Failed This Cycle

Bitcoin price’s most popular top-calling indicators failed to trigger during the latest bull market, leaving observers questioning whether the underlying data is now broken. This analysis examines several widely used tools, explores why they underperformed this cycle, and outlines how they can be adapted to Bitcoin’s evolving market structure.

Table of Contents

- Bitcoin Price Forecast Tools

- Bitcoin Price: From Fixed Thresholds to Dynamic Signals

- Bitcoin Price: Faster-Reaction Metrics for Today’s Cycle

- Bitcoin Price Spent Output Profit Ratio (SOPR)

- Bitcoin Price Cycle Conclusion: Adapt or Fall Behind

Bitcoin Price Forecast Tools

On the Bitcoin Magazine Pro Price Forecast Tools indicator, the latest bull market never reached several historically reliable top models such as Delta Top, Terminal Price, and Top Cap, with the latter not even touched in the prior cycle. The Bitcoin Investor Tool, which uses a 2-year moving average multiplied by 5, also remained untested, and the Pi Cycle Top Indicator failed to provide precise timing or price signals despite being closely watched by many traders. This has led to understandable questions around whether these models have stopped working or whether Bitcoin’s behavior has outgrown them.

Figure 1: Historically reliable top models, such as Top Cap, Delta Top, and Terminal Price, were not attained in the bull cycle. View Live Chart

Figure 1: Historically reliable top models, such as Top Cap, Delta Top, and Terminal Price, were not attained in the bull cycle. View Live Chart

Bitcoin is an evolving asset with a changing market structure, liquidity, and participant mix. Rather than assuming the data is broken, it may be more appropriate to adapt the metrics to a different lens and time horizon. The goal is not to abandon these tools, but to make them more robust and responsive to a market that no longer delivers the same exponential upside and violent cycle tops as earlier years.

Bitcoin Price: From Fixed Thresholds to Dynamic Signals

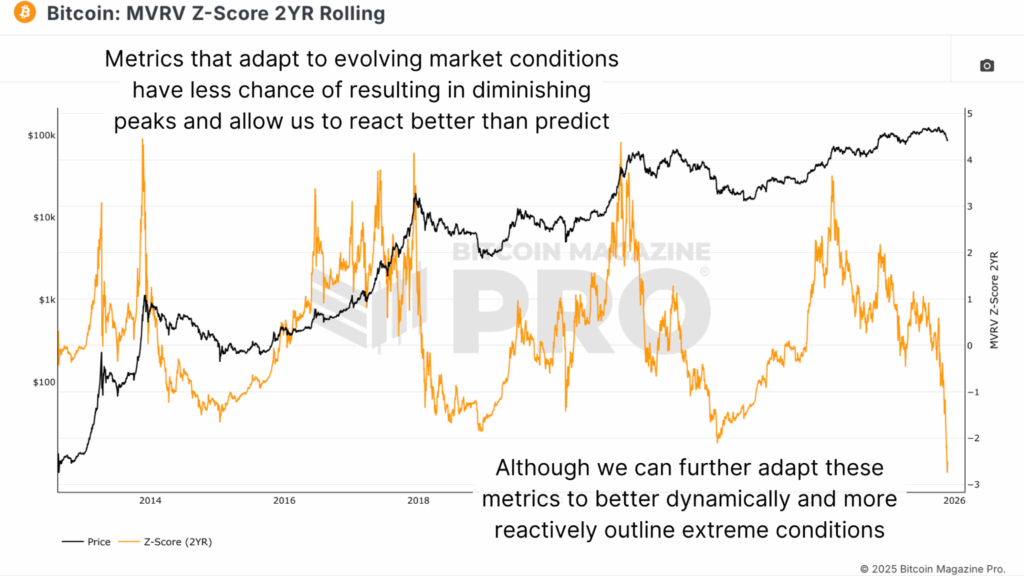

The MVRV Z-Score 2-Year Rolling metric has been a core tool for identifying overheated conditions, but in this cycle, it did not call the bull market peak particularly well. It registered a major spike as Bitcoin first pushed through the $73,000–$74,000 zone, yet failed to give a clean exit signal for the later stages of the advance. Currently, the metric is printing the most oversold readings on record.

Figure 2: The usually reliable MVRV Z-Score 2YR Rolling metric failed to trigger exit signals in the latter stages of the cycle.

Figure 2: The usually reliable MVRV Z-Score 2YR Rolling metric failed to trigger exit signals in the latter stages of the cycle.

View Live Chart

To address this shortcoming, the MVRV Z-Score can be recalibrated on a 6-month rolling basis rather than two years, making it more sensitive to recent conditions while still anchored in realized value dynamics. Alongside the shorter lookback, it is helpful to move away from fixed thresholds and instead use dynamic distribution-based bands. By mapping the percentage of days spent above or below different Z-Score levels, it becomes possible to mark zones such as the top 5%, as well as the bottom 5% on the downside. During this cycle, Bitcoin did register signals in the upper bands as it first broke above $100,000, and historically, moves into the top 5% region have coincided reasonably well with cycle peaks, even if they did not capture the exact tick high.

Figure 3: A recalibrated 6-month MVRV Z-Score with targeted upper and lower percentiles delivers more timely buy/sell signals.

Figure 3: A recalibrated 6-month MVRV Z-Score with targeted upper and lower percentiles delivers more timely buy/sell signals.

Cyber Monday Sale: 40% Off Annual Plans!

The BEST saving of the year is here. Get 40% off all our annual plans.

- Unlock +150 Bitcoin charts.

- Access Indicator alerts – so you never miss a thing.

- Private TradingView indicators of your favorite Bitcoin charts.

- Members-only Reports and Insights.

- API access & more all for a FRACTION of standard industry prices.

All for just $17/month with the Black Friday deal. This is our biggest sale all year!

Bitcoin Price: Faster-Reaction Metrics for Today’s Cycle

Beyond valuation tools, activity-based indicators like Coin Days Destroyed can be made more useful by shortening their lookback periods. A 90-day moving average of Coin Days Destroyed has historically tracked large waves of long-term holder distribution, but the more muted and choppy nature of the current cycle means that a 30-day moving average is often more informative. With Bitcoin no longer delivering the same parabolic moves, metrics need to react faster to reflect today’s shallower yet still important waves of profit-taking and investor rotation.

Figure 4: The 30DMA Coins Days Destroyed has proven to react faster to on-chain dynamics. View Live Chart

Figure 4: The 30DMA Coins Days Destroyed has proven to react faster to on-chain dynamics. View Live Chart

Excluding the latest readings and focusing on the advance up to the all-time high of this cycle, the 30-day Coin Days Destroyed metric flashed almost exactly at the cycle peak. It also triggered earlier as Bitcoin first crossed roughly $73,000–$74,000, and again when price moved through $100,000, effectively flagging all key distribution waves. While this is easy to observe in hindsight, it reinforces that on-chain supply and demand signals remain relevant; the task is to calibrate them to current volatility regimes and market depth.

Bitcoin Price Spent Output Profit Ratio (SOPR)

The Spent Output Profit Ratio (SOPR) provides another lens on realised profit-taking, but the raw series can be noisy, with sharp spikes, frequent mean reversion, and large moves both during rallies and during intra-bull capitulations. To extract more actionable information, a 28-day (monthly) change in SOPR can be used instead. This smoothed alternative highlights when the pace of profit realisation is accelerating to extreme levels over a short window, cutting through the noise of intra-cycle volatility.

Figure 5: Applying a 28DMA to the SOPR metric smooths the data, reduces unnecessary ‘noise’, and accurately identifies local tops.

Figure 5: Applying a 28DMA to the SOPR metric smooths the data, reduces unnecessary ‘noise’, and accurately identifies local tops.

Applied to the latest cycle, the monthly SOPR change produced distinct peaks as Bitcoin first moved through the $73,000–$74,000 zone, again above $100,000, and once more around the $120,000 region. While none of these perfectly captured the final wick high, they each marked phases of intense profit-taking pressure consistent with cycle exhaustion. Using monthly changes rather than the raw metric makes the signal clearer, especially when combined with cross-asset views of Bitcoin’s purchasing power versus equities and Gold.

Bitcoin Price Cycle Conclusion: Adapt or Fall Behind

In hindsight, many popular top-calling indicators did work throughout this bull market when measured through the right lens and on appropriate timeframes. The key principle remains: react to the data, do not attempt to predict. Rather than waiting for any single metric to perfectly call the top, a basket of adapted indicators, interpreted through the lens of purchasing power and changing market dynamics, can increase the probability of identifying when Bitcoin is overheating and when it is transitioning into a more favorable accumulation phase. The coming months will focus on refining these models to ensure they remain viable not just historically, but robustly accurate going forward.

For a more in-depth look into this topic, watch our most recent YouTube video here: Why Didn’t The Bitcoin Top Calling Metrics Work?

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Why Bitcoin Price Top Indicators Failed This Cycle first appeared on Bitcoin Magazine and is written by Matt Crosby.

Ayrıca Şunları da Beğenebilirsiniz

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase

UK crypto holders brace for FCA’s expanded regulatory reach