Terra Luna Classic Price Rises 7% as Bulls Target $0.000081 Amid Upgrade Momentum

Highlights:

- The LUNC price has surged 7% to trade at $0.000064, as bullish momentum builds in the market.

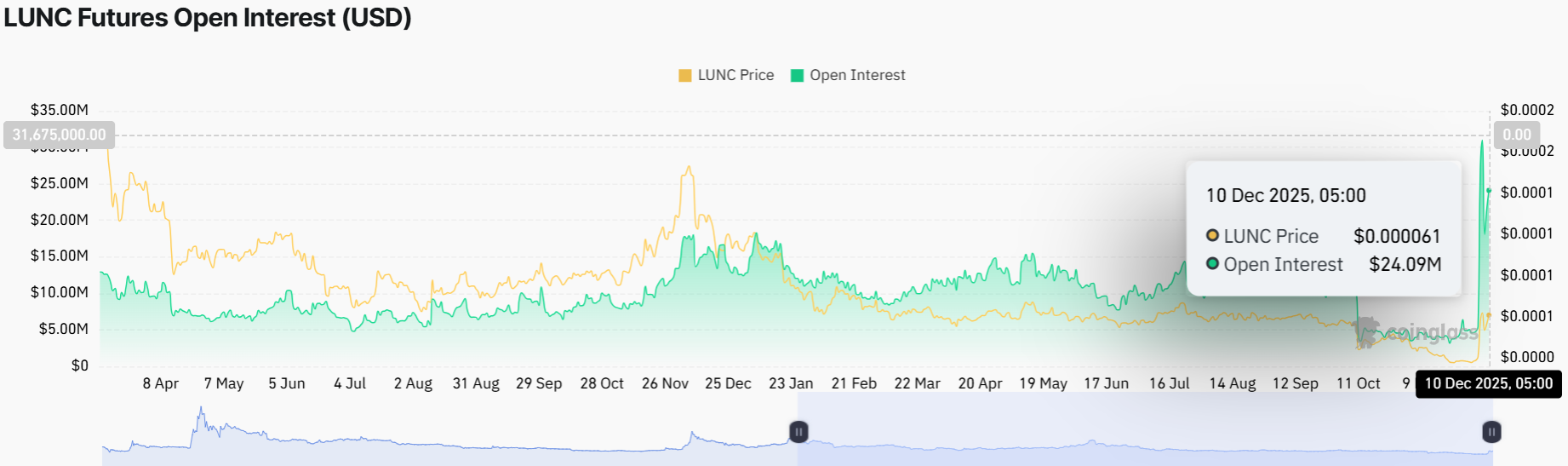

- LUNC futures open interest has continued to rise, signalling growing retail demand.

- The LUNC technical outlook upholds a bullish picture as bulls eye $0.000069-$0.000081 soon.

Terra Luna Classic (LUNC) price is regaining its momentum and is currently trading at $0.000064, marking 7.64% gains over the past 24 hours. The bullish momentum is further supported by the increasing open interest and optimism about the next network upgrade. The LUNC technical outlook upholds a bullish sentiment as bulls target to break above the $0.000081 zone.

Terra Luna Classic price opens the week at a good trend, which continues its upward trend following an upward rally of 129% in the past week. These gains are also supported by the derivatives data showing LUNC futures OI increased to $24.09 million by Wednesday since it stood at $18.15 million on Monday. Increasing OI indicates that new money is flowing into the market, and this may contribute to the present LUNC price boom.

LUNC Futures Open Interest: Coinglass

LUNC Futures Open Interest: Coinglass

Notably, the developers of Terra Classic provided an update of the libraries, Terra Classic v3.6.1, earlier on Sunday, fixing a legacy contract problem and dependency updates. The proposal requests the community and validator consensus to upgrade the chain to v3.6.1 (upgrade name: v13_1). This causes the automatic chain to pause at a height of 26,479,000.

This upgrade should further enhance the security, functionality, and reliability of the Terra Classic blockchain. This should increase the resilience and usefulness of the network in the long term once it becomes active.

Terra Luna Classic Price Outlook

The LUNC/USD chart on a 1-day timeframe shows the price broke out in a parabolic curve, spiking from the $0.000025 support zone to a high of $0.000081. However, due to early profiteering, the token has pulled back to current levels at $0.000064. Still, the price is above the key moving averages at $0.000052(200-day SMA) and $0.000037(50-day SMA), signalling potential upside.

The Relative Strength Index (RSI) sits at 73.55, sitting in the overbought territory, cautioning of potential pullback. Meanwhile, the Moving Average Convergence Divergence (MACD) is flashing a bullish crossover with the MACD line (blue) above the signal line, signaling momentum is on the bulls’ side.

LUNC/USD 1-day chart: TradingView

LUNC/USD 1-day chart: TradingView

Looking at the chart, there are some key support and resistance zones. Terra Luna Classic price is currently sitting at a key support of $0.000052 with resistance capped at $0.000081.

If the LUNC price holds above the key support, there could be a push toward $0.000069, maybe even a test at $0.000081 if the bulls keep pushing. However, if it dips, $0.000052 is the line in the sand. Should the LUNC price fail to hold above that, there might be a slide back to $0.000037, aligning with the 50-day SMA.

In the meantime, the 7% pump indicates that LUNC is gaining momentum and potential, but traders should tread carefully. This comes as the RSI hits 70+, cautioning that it might be time for traders to hit the sidelines and watch for a pullback. In the short term, the LUNC price could push to $0.000069- $0.000081 within the next few days. Long-term, if this trend holds, LUNC could see $0.0001 by the end of the year, but it’s all about those support levels holding strong.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

Ayrıca Şunları da Beğenebilirsiniz

BitGo expands its presence in Europe

Now You Don’t’ New On Streaming This Week, Report Says