The Fed Cut Interest Rates by 0.25%

- on December 10, the FOMC meeting was held.

- The regulator reduced the interest rate by 25 basis points.

- Crypto assets reacted ambiguously, as such a probability was already laid down and taken into account by the market.

- Further rate cuts in January are projected to be unlikely.

On December 10, 2025, a meeting of the Federal Open Market Committee of the US Federal Reserve (FOMC) was held. According to its results, the regulator decided to reduce the interest rate by 0.25% — to 3.5%-3.75%.

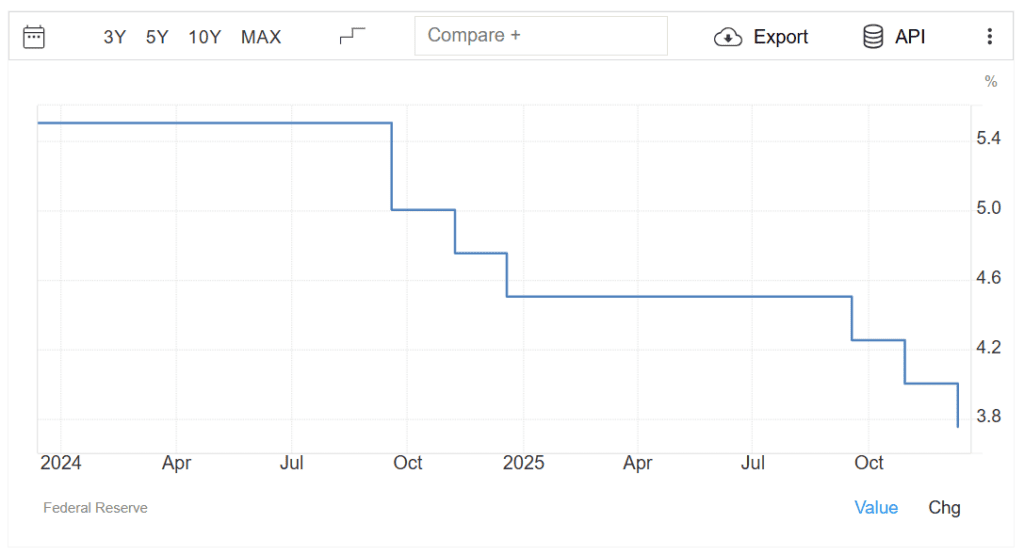

This is the third consecutive reduction of the interest rate. The regulator started to soften the policy in September 2025:

Interest rate change by month. Source: Trading Economics.

Interest rate change by month. Source: Trading Economics.

Note that there was no significant reaction from crypto assets, as, in fact, experts expected. The bitcoin rate jumped to $94,476 at one point, after which it collapsed.

BTC/USDT rate on the Binance exchange. Source: TradingView.

BTC/USDT rate on the Binance exchange. Source: TradingView.

Earlier, we covered market participants’ expectations regarding policy easing. According to experts, the rate cut was already partially embedded in the pricing of high-risk assets, so its effect was not too significant.

For more details on how the Fed Funds rate in general affects the cryptocurrency market, watch a video on our YouTube channel.

This is the last Fed meeting in 2025. The next one is scheduled for the end of January 2026. According to the forecast of the CME exchange, the probability of further interest rate cuts is less than 20%.

After the meeting, Fed Chairman Jerome Powell gave a press conference. The full transcript of his speech can be found below:

At the beginning of the speech, Powell emphasized that the regulator made the decision under the conditions of data scarcity. They were not prepared and published due to the US government shutdown. At the same time, according to him, the situation has not changed too much in relation to the one observed in October 2025.

In addition, the Fed Chairman noted the following:

- available indicators point to moderate growth in economic activity.

- consumer spending is stable, business fixed investment is rising, but activity in the residential sector remains weak.

- the shutdown had a negative impact on economic activity in the fourth quarter, but this drawdown is likely to be offset in the next period.

- GDP growth is projected at 1.7% in 2025 and 2.3% in 2026, up from September.

- layoff and hiring rates remain low.

- the most recently released report, for September 2025, showed that the unemployment rate continues to rise.

- employment growth rate has slowed, likely due to reduced immigration.

- inflation remains above target, but it is difficult to assess its change due to the lack of data.

- there are upside risks to inflation in the short term and downside risks to employment.

- the interest rate has reached the “neutral level” after being lowered since September 2025, inflation is expected to continue to fall and employment is expected to rise.

- the meeting decided to start buying short-term Treasury bonds, mainly Treasury bills, solely for the purpose of maintaining sufficient reserves in the long term.

Responding to questions from the press, Powell said that the Fed has suspended its policy adjustments pending the release of new employment and consumer price index (CPI) data.

He also noted that the growth in economic development with relatively stable high unemployment is at least partly due to the popularity of AI.

It should be noted that Powell was repeatedly asked questions with political overtones, in particular, how he feels about the course of interviews for the position of the next Fed chairman, as well as whether it does not complicate the work of the regulator. The Chairman carefully avoided such discussions and refused to comment on them.

Ayrıca Şunları da Beğenebilirsiniz

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Dogecoin Rally Sparks Meme Coin Frenzy