U.S. Lawmakers Push to Let Crypto Into 401(k) Plans, Bitcoin Eye $250,000

The post U.S. Lawmakers Push to Let Crypto Into 401(k) Plans, Bitcoin Eye $250,000 appeared first on Coinpedia Fintech News

U.S. lawmakers have urged the SEC’s Paul Atkins to implement a new executive order that could let Americans invest in Bitcoin and other digital assets inside 401(k) retirement plans.

If approved, this move may unlock trillions in long-term retirement capital for the crypto market, which could push the bitcoin price toward $250K.

Lawmakers Ask SEC to Open the $12.5 Trillion 401(k) Market to Crypto

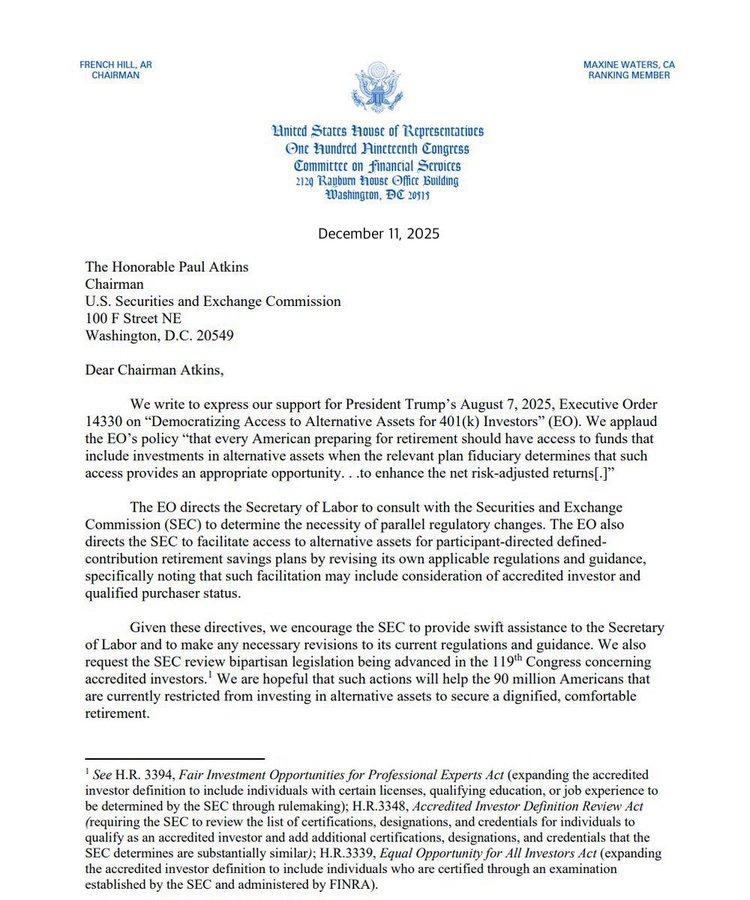

On December 11, U.S. lawmakers sent a formal letter to the SEC Chairman Paul Atkins, showing support for President Trump’s executive order that aims to allow alternative assets like Bitcoin in retirement plans.

The order, signed in August 2025, directs the Department of Labor and the SEC to update rules that currently limit what 401(k) plans can offer.

The goal of this letter is to give everyday workers the same investment choices that large pension funds enjoy. U.S. 401(k) plans hold around $12.5 trillion, and even a small opening for Bitcoin or other crypto assets could bring billions of dollars into the market.

Meanwhile, Lawmakers asked the SEC to speed up these changes so people can invest in more than just stocks and bonds.

Institutional Adoption May Arrive Faster Than Expected

Industry experts believe this policy shift could be a major turning point for crypto in traditional finance. Coinbase’s CEO recently said that Bitcoin and other cryptocurrencies will eventually become a normal part of “everyone’s 401(k).”

Some companies are already preparing for this change. For example, ForUsAll has partnered with Coinbase Institutional to let employees put up to about 5% of their 401(k) savings into crypto.

This shows that the system is already in place and could expand quickly if national rules are updated.

Small 401(k) Allocations Could Push Bitcoin Toward $250,000

The shift complements other industry developments. U.S. spot Bitcoin ETFs from major firms like BlackRock and Fidelity now hold tens of billions of dollars and are widely available in IRAs and brokerage accounts.

Investors and retirement savers alike are already using these products to gain Bitcoin exposure.

If 401(k) plans also start adding Bitcoin, even a small amount like 1–3%, it could bring tens of billions in new buying.

Crypto analyst predict that such steady demand can push BTC price toward $250,000.

Ayrıca Şunları da Beğenebilirsiniz

Here’s How Consumers May Benefit From Lower Interest Rates

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline