Terraform Labs Founder Do Kwon Sentenced to 15 Years for Orchestrating $40 Billion Crypto Fraud

TLDR:

- Do Kwon misled investors about TerraUSD and LUNA, causing $40B in losses.

- Terraform’s Luna Foundation Guard was controlled secretly by Kwon, not independent.

- Mirror Protocol and Chai blockchain claims were falsified to attract investments.

- Kwon arrested in Montenegro in 2023 and extradited after using a fake passport.

Federal prosecutors confirmed that Terraform Labs founder Do Hyeong Kwon has been sentenced to 15 years in prison for orchestrating a multibillion-dollar fraud that misled global investors.

The ruling followed years of investigations into the collapse of TerraUSD and LUNA, which once formed one of the most widely discussed algorithmic stablecoin ecosystems.

Court records stated that Kwon promoted technologies he claimed were reliable and automated, even as he privately directed interventions to stabilize failing systems.

U.S. District Judge Paul A. Engelmayer ordered the prison term after Kwon’s extradition in 2024 and his guilty plea in mid-2025.

In announcing the outcome, U.S. Attorney Jay Clayton said, “Do Kwon devised elaborate schemes to mislead investors and inflate the value of Terraform’s cryptocurrencies for his own benefit.” Prosecutors also secured more than $19 million in forfeitures tied to the schemes, marking a major enforcement milestone involving digital asset markets.

Misrepresentations Behind Terraform’s Growth

Authorities said Kwon promoted Terraform as a decentralized environment operating through automated financial mechanisms. However, filings showed that several systems did not function as presented.

When UST dropped below its peg in May 2021, the ecosystem did not recover through the Terra Protocol alone. Prosecutors stated that Kwon privately arranged for a trading firm to purchase large amounts of UST to restore the value, contradicting public claims that the algorithm stabilized the market independently.

The Luna Foundation Guard was central to Terraform’s public image in early 2022. Kwon described the LFG as an independent body responsible for handling billions in reserves.

Investigators later stated that he directed both Terraform and the LFG, making major decisions without board approval. The indictment noted that he treated LFG funds as interchangeable with Terraform assets, moving large sums through concealed channels.

Mirror Protocol also received attention from investigators. Kwon asserted that the platform operated without centralized control, yet filings revealed that Terraform managed governance functions and operated automated bots to influence synthetic asset prices.

These findings circulated widely on crypto Twitter, where users shared excerpts from the indictment after prosecutors disclosed new details.

Authorities also reviewed Terraform’s partnership claims involving the Korean payments app Chai. Kwon repeatedly stated that Chai transactions were processed through the Terra blockchain.

Prosecutors reported that traditional payment networks handled transactions and that Terraform copied activity onto the blockchain to create the impression of real-world use. This presentation played an important role in attracting retail and institutional interest.

Collapse, International Arrest, and Sentencing

During its peak in 2022, the combined value of UST and LUNA exceeded $50 billion. Prosecutors said investment accelerated as Terraform promoted rapid adoption and strong ecosystem metrics.

When UST again lost its peg in May 2022, the expanded size of the market prevented the type of coordinated recovery Kwon arranged in 2021, leaving investors with more than $40 billion in losses.

Kwon continued to speak publicly after the collapse. However, investigators later released a recorded conversation from August 2022 in which he said his strategy toward regulators was to “tell them to fuck off.”

He also discussed seeking political protection abroad. These statements appeared frequently on social media as users reacted to the contrast between his private comments and public assurances.

The international pursuit gained momentum when Kwon was arrested in Montenegro in March 2023 for attempting to use a fraudulent passport.

Cooperation among U.S., South Korean, and Montenegrin authorities eventually led to his extradition. Prosecutors credited the FBI’s Virtual Assets Unit and multiple international departments for coordinating the effort.

At sentencing, U.S. Attorney Jay Clayton stated, “Fraud is fraud whether it takes place on our streets, in our securities markets, or in our emerging and important digital asset ecosystem.”

Officials said the ruling reaffirmed ongoing enforcement efforts involving digital assets and demonstrated that misconduct would face the same scrutiny applied to traditional financial structures.

The post Terraform Labs Founder Do Kwon Sentenced to 15 Years for Orchestrating $40 Billion Crypto Fraud appeared first on Blockonomi.

Ayrıca Şunları da Beğenebilirsiniz

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

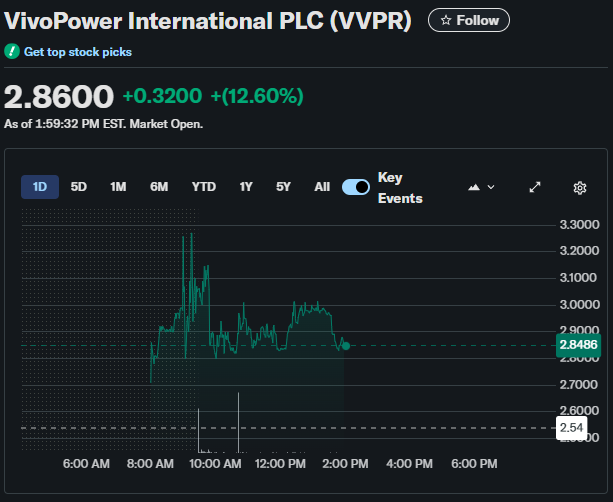

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally