Michael Saylor’s Bitcoin Treasury Strategy Now Accounts for 3.2% of BTC Supply

Bitcoin Magazine

Michael Saylor’s Bitcoin Treasury Strategy Now Accounts for 3.2% of BTC Supply

Over the last two months, the broader bitcoin market has bled to semi-surprising lows and it seems like fear has crept into the forefront of market sentiment. But Strategy’s Michael Saylor, in true Saylor fashion, just put his head down and bought more bitcoin.

Over the past two weeks, Strategy has spent nearly $2 billion just on Bitcoin.

Strategy has steadily expanded their Bitcoin treasury over the years, now holding 671,268 BTC — equivalent to 3.2% of all Bitcoin ever expected to exist, the company says.

The firm’s average purchase price for its holdings sits at roughly $75,000 per BTC, with a total acquisition cost of $50 billion and a current Bitcoin net asset value of $60 billion.

Strategy has added Bitcoin in every quarter since Q3 2020, totaling 90 separate acquisitions.

Per Bitcointreasuries.net, Strategy’s Bitcoin holdings tower over every other publicly traded treasury, owning 12 times the next largest holder, MARA Holdings.

While most companies in the top 10 hold between 13,000 and 53,000 BTC, Strategy’s accumulation dwarfs them, underscoring its unprecedented scale of BTC holdings.

Earlier this month, Strategy created a $1.44 billion cash reserve to safeguard future dividends and interest payments, in an effort to reassure investors it would not need to sell any of its roughly $56 billion in Bitcoin amid broader Bitcoin market weakness.

Funded by recent Class A stock sales, the reserve initially covered 21 months of obligations, with plans to extend to 24 months. CEO Phong Le said the move sharply reduced the likelihood of BTC liquidation, addressing fears from prior comments.

Strategy wants more bitcoin: ‘We are going to buy all of it’

At the Bitcoin MENA conference, Saylor discussed his bitcoin beliefs more, saying that Bitcoin was the foundation of a new digital capital and credit era. Addressing sovereign wealth funds, banks, and investors, Saylor framed Bitcoin as “digital capital,” contrasting it with traditional assets like gold, real estate, and equities, and emphasizing its potential as a core store of value in the digital economy.

Saylor emphasized the growing institutional adoption of Bitcoin, with major U.S. banks—including Bank of America, Wells Fargo, JP Morgan, and Citi—now offering custody solutions and credit against Bitcoin.

He also cited bipartisan government support from agencies like the Treasury, SEC, and CFTC.

Central to Strategy’s vision is converting volatile Bitcoin into predictable, yield-generating credit. Through over-collateralized instruments like STRK (8% dividend) and STRF (10% perpetual bond), Strategy delivers steady cash flows while enhancing long-term Bitcoin exposure.

Saylor claimed these mechanisms allow the company to double Bitcoin per share every seven years, creating liquidity and aligning corporate growth with investor returns. He likened Bitcoin-backed credit to gold-backed financial systems, envisioning a global shift toward digital gold-supported credit integrated into traditional banking.

Earlier this week, news came out that Strategy will retain its spot in the Nasdaq 100 index despite an annual reshuffle that removed six companies and added three.

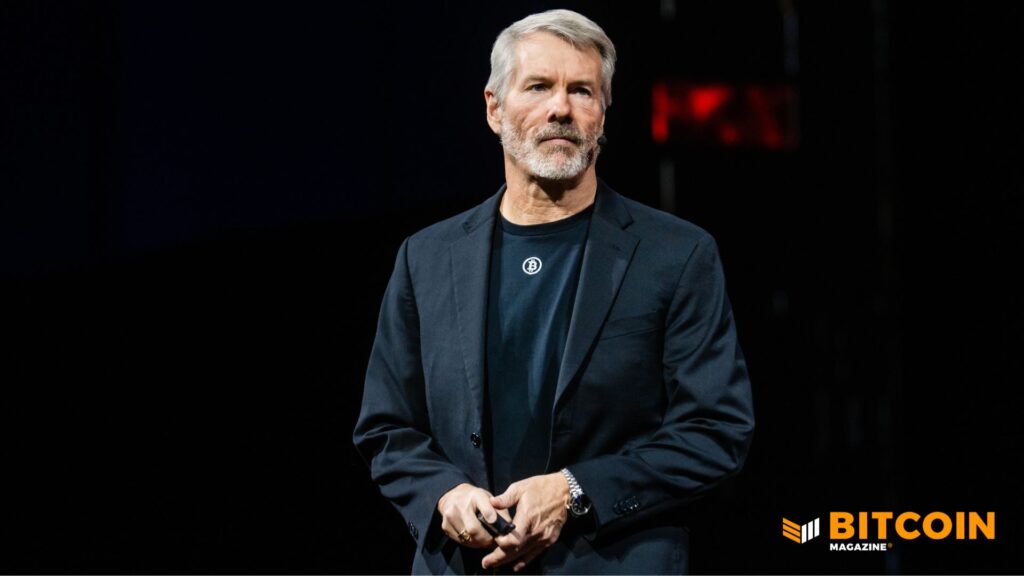

Strategy’s Michael Saylor speaking at Bitcoin Amsterdam

Strategy’s Michael Saylor speaking at Bitcoin Amsterdam

This post Michael Saylor’s Bitcoin Treasury Strategy Now Accounts for 3.2% of BTC Supply first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Ayrıca Şunları da Beğenebilirsiniz

Shiba Inu (SHIB) vs Little Pepe (LILPEPE): Which Meme Coin Will Take the Crown from Dogecoin (DOGE)?

Kodiak Sciences Announces Pricing of Upsized Public Offering of Common Stock