Can Africans move from sports betting to the $12bn global Decentralised Prediction Market?

On January 31, 2026, the global Decentralised Prediction Market (DPM) sector hit a fever pitch. Total trading volume reached a staggering $12 billion, marking a 240% surge in just a few months, according to data from Dune Analytics. From global elections to volatile tech stocks, the world is increasingly using the blockchain to “price” the future.

Yet, in Africa, a region that consistently leads the world in retail crypto adoption, a curious silence lingers. Despite the continent’s massive appetite for digital assets and its deeply rooted betting culture, a dominant, African-focused DPM remains elusive.

To unpack this, I had a chat with ecosystem observer Olayinka Omoniyi about why the “betting capital of the world” is still playing on borrowed digital ground and what it will take to localise the $12 billion revolution.

To understand the stakes, one must first understand the tech. A Decentralised Prediction Market (DPM) is a blockchain-based exchange where users trade shares in the outcome of future events. Unlike traditional bookmakers, there is no house to skew the odds or limit winners.

Prices are set by the crowd, and outcomes are settled by smart contracts using decentralised data feeds (oracles).

If a “Yes” share for a local election costs $0.70, the market is effectively saying there is a 70% probability of that outcome. It is, in essence, the wisdom of the crowd turned into a financial instrument.

Sports betting platform

Sports betting platform

Africa is not sitting entirely on the sidelines; Omoniyi points to emerging pioneers like Bayse (formerly GoWagr) and UltraMarket by Njoku as players attempting to unlock local liquidity.

The hurdle isn’t just about code: it is also about discovery

“Like any global industry, African founders tend to have a slow adoption, and discovery is hard due to expensive distribution channels (i.e., legacy media, digital ads, UGC creators),” Omoniyi explains.

In an ecosystem where digital ads and creator campaigns carry heavy price tags, Omoniyi suggests a shift in strategy: Brand Equity Hijacking. For local DPMs to scale, they must find “cheap discovery” options, such as co-marketing with established African brands to leverage existing trust.

The most significant barrier to DPM adoption in Africa is the shadow cast by the sports betting industry. In markets like Nigeria, South Africa and Kenya, betting is a daily ritual worth billions of dollars. If the habit of predicting is already there, why hasn’t it migrated to the blockchain?

According to Omoniyi, it boils down to a fundamental failure in User Experience (UX).

“With the popularity of betting platforms in the African market, the habit of transitioning into a prediction market is already laid out. The major hurdle is tied to the User Experience (UX) of how the platform is presented. Any prediction market platform that doesn’t optimise for the pattern of how users already interact with sports betting platforms will see slow adoption and higher learning friction,” Omoniyi warns.

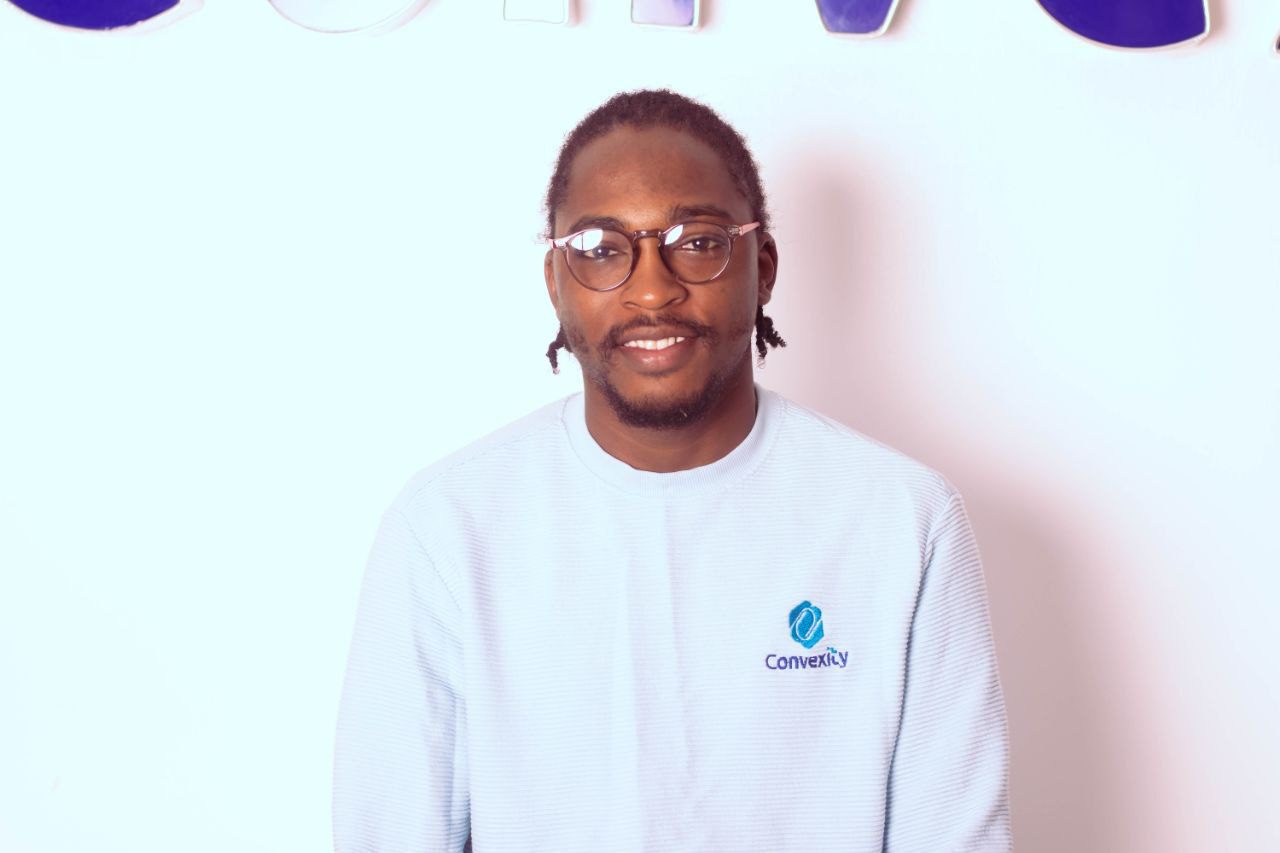

Olayinka Omoniyi

Olayinka Omoniyi

DPMs require high-fidelity data to resolve markets. According to him, “The major hurdle for local prediction markets is the cost of access to the data of events happening across Africa; the next hurdle is liquidity for seamless participation, which isn’t cheap, as we all know, for an African-focused prediction appetite.”

Decentralised Prediction Market (DPM): The high price of borrowed platforms

Why should it matter if Africans use global platforms like Polymarket? For Omoniyi, the cost of relying on offshore infrastructure is a matter of economic sovereignty.

When we use offshore DPMs, we are participating in a “borrowed” ecosystem where access can be denied, and liquidity, the lifeblood of any market, constantly leaves the continent.

“The key benefit [of local DPMs] would be that we will own our narrative, lock in the financial benefit, and circulate shared value on the continent,” says Omoniyi.

On why many Africans and, indeed, Nigerians still prefer sports betting over crypto prediction markets, Omoniyi says, “Familiarity and habit are the easiest picks, but ‘access’ and the cost of such ‘access and exit’ are factors that I see that make it easier to settle with a familiar sports betting platform.”

A man and a woman are predicting the DPM

A man and a woman are predicting the DPM

Also, being a strong sports fanbase plays a bias factor in why they opt for the familiar,” he added.

To bridge this gap, DPMs must stop being “crypto products” and start being “people products”. They will have to invest heavily in “habit”-changing marketing tactics to get to the point where they are so top of mind that they can’t be ignored.

The global prediction market is a $12 billion train that has already left the station. For Africa to do more than watch from the platform, the African-focused DPMs must look less like crypto exchanges and more like the local betting platforms our users are already familiar with.

The post Can Africans move from sports betting to the $12bn global Decentralised Prediction Market? first appeared on Technext.

Ayrıca Şunları da Beğenebilirsiniz

Young Republicans were more proud to be American under Obama than under Trump: data analyst

Vitalik Buterin Outlines Ethereum’s AI Framework, Pushes Back Against Solana’s Acceleration Thesis