Bitcoin Divergence Widens as Mid-Sized Holders Accumulate Into Weakening Demand

According to a report shared by CryptoQuant, Bitcoin’s on-chain structure is entering a phase of growing divergence between holder behavior and broader demand dynamics.

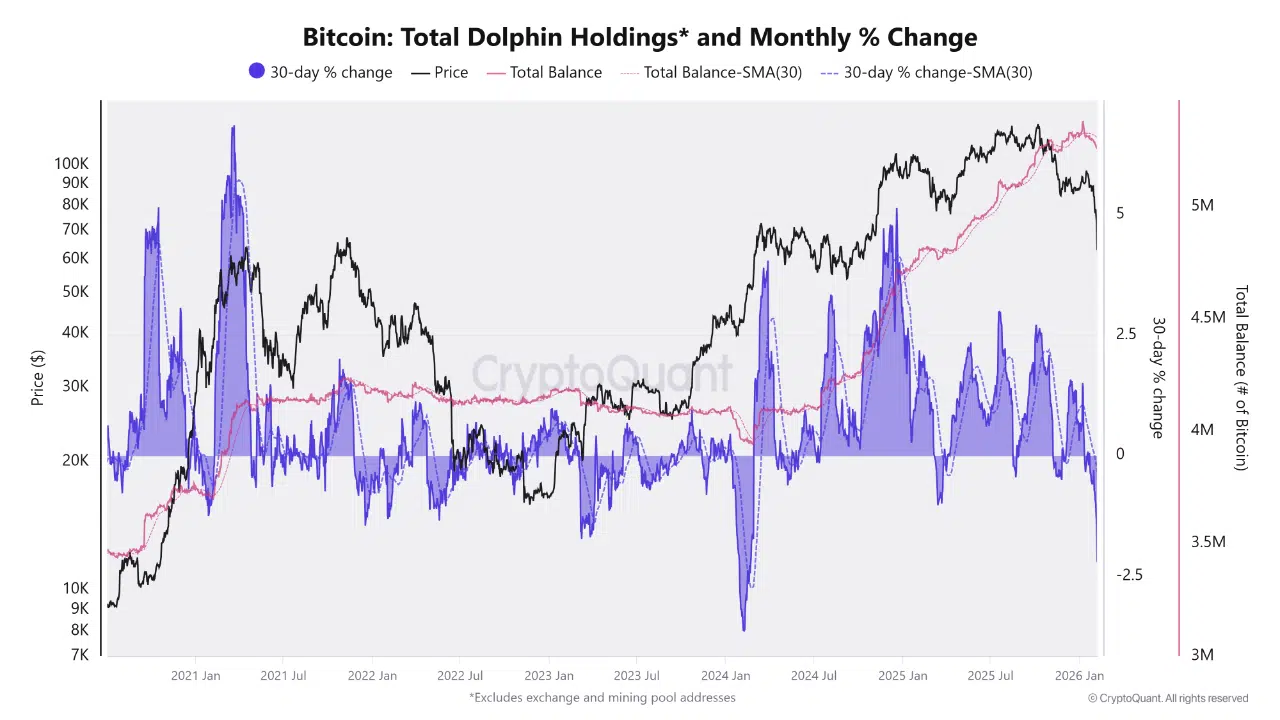

Mid-sized holders, commonly referred to as dolphins, continue to expand their Bitcoin balances even as price momentum and aggregate demand show signs of deterioration.

This divergence suggests that while certain cohorts remain confident enough to absorb supply, the market currently lacks the demand acceleration needed to support sustained upside continuation.

Dolphin Accumulation Remains Structurally Positive

Dolphin cohorts have continued increasing their total Bitcoin holdings, with balances pressing toward new cycle highs despite recent market weakness. The 30-day change in balances remains firmly positive, indicating that this group is still net accumulating rather than distributing into rallies.

At the same time, the pace of accumulation is beginning to moderate. Monthly percentage changes in dolphin balances have started to compress, signaling a shift away from aggressive expansion. This pattern typically emerges during consolidation phases, where accumulation persists but transitions into a slower, more deliberate absorption of supply while market participants wait for clearer catalysts.

At the same time, the pace of accumulation is beginning to moderate. Monthly percentage changes in dolphin balances have started to compress, signaling a shift away from aggressive expansion. This pattern typically emerges during consolidation phases, where accumulation persists but transitions into a slower, more deliberate absorption of supply while market participants wait for clearer catalysts.

Demand Growth Shows Clear Signs of Breakdown

In contrast to holder accumulation, demand-side indicators have weakened significantly. Apparent Demand on a 30-day basis surged during the most recent impulsive rally but has since reversed sharply into negative territory. The depth of this reversal points to a meaningful slowdown in spot absorption, suggesting that recent inflows lacked the persistence required to sustain upward price momentum.

This breakdown becomes more apparent when demand is examined through its structural components. ETF-related inflows, which previously provided a strong marginal bid, have flattened. At the same time, Strategy-related accumulation has stabilized following earlier expansion phases, removing another source of accelerating demand from the market.

Structural Implications for Market Behavior

The current configuration highlights a transitional market structure. Supply continues to be absorbed by mid-sized holders, limiting immediate downside pressure, but the absence of accelerating demand caps upside momentum. Without renewed growth in institutional or spot demand, price action remains constrained despite ongoing accumulation beneath the surface.

This divergence does not signal distribution, but rather a pause in momentum where balance-sheet expansion by specific cohorts contrasts with broader demand exhaustion.

Takeaway

Bitcoin’s on-chain data reflects a market absorbing supply without yet generating the demand needed for continuation. Dolphin accumulation remains intact, but slowing momentum and deteriorating demand suggest that upside resolution likely depends on a renewed expansion in aggregate demand rather than holder positioning alone.

The post Bitcoin Divergence Widens as Mid-Sized Holders Accumulate Into Weakening Demand appeared first on ETHNews.

Ayrıca Şunları da Beğenebilirsiniz

XRP Displays 2021-Style Capitulation – U.Today

Solana Eyes $98 Amid Second-Largest ETF Outflows