Glassnode: XRP Is Back In Its 2021-2022 Playbook As SOPR Drops Sub 1

XRP is flashing a familiar on-chain stress pattern after slipping below its aggregate holder cost basis, a move Glassnode says has historically coincided with capitulation, loss realization, and a slow grind toward stabilization rather than an immediate rebound.

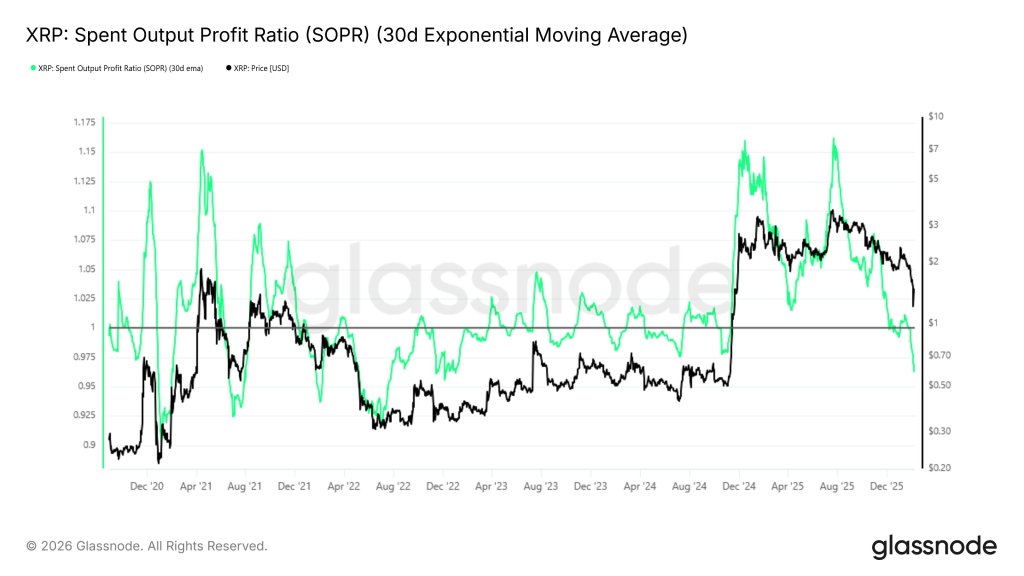

In a Feb. 9 post on X, the on-chain analytics firm said XRP “lost its aggregate holder cost basis, triggering panic selling,” pointing to a sharp deterioration in spent output profitability. Glassnode flagged its Spent Output Profit Ratio (SOPR) on a 7-day EMA basis falling from 1.16 in July 2025 to 0.96 “now,” adding that “holders are realizing significant losses” and that “on-chain profitability flipped negative.”

SOPR prints below 1 are typically read as the market spending coins at a loss on aggregate, a regime that can persist when sellers are forced to exit and bids are primarily coming from buyers with longer horizons. In Glassnode’s framing, that’s what makes the current setup rhyme with a prior XRP cycle: “This setup closely resembles the Sep 2021–May 2022 phase, where SOPR plunged to a <1 range for prolonged consolidation before stabilization.”

The Feb. 9 warning isn’t an isolated call. On Feb. 1, Glassnode wrote that “The XRP Realized Price is trading at $1.48,” adding that “The current market structure is very similar to that of April 2022.” Weeks earlier, on Jan. 19, the firm again pointed to a 2022 echo, saying XRP’s structure “closely resembles that of February 2022,” and describing a cohort tension where newer buyers are accumulating below the cost basis of longer-held supply. Glassnode’s Jan. 19 post also emphasized the behavioral side of that structure: as the pattern persists, “psychological pressure on top buyers continues to build over time.”

XRP Capitulation Or Breakdown Next?

Some market participants treated the sub-1 SOPR regime less as a red flag and more as a process of transferring supply from weaker hands to stronger ones. One reply, from the account @investorie, framed it explicitly as a bottom-building signal:

“This is a classic capitulation signal, not a structural failure. SOPR below 1 means weak hands are exiting at a loss. That pressure gets absorbed, and historically it’s how durable bases form, not how long-term trends end.”

Another respondent, 0xsimba, drew a parallel to Bitcoin’s forced-selling episodes while echoing Glassnode’s historical comparison: “When SOPR drops below 1 for extended period, pain transferring from weak to strong hands. Sep 2021–May 2022 precedent, Prolonged consolidation then recovery. Setup is forming. Signal needs confirmation.”

If Glassnode’s comparison holds, the near-term takeaway is less about a single inflection point and more about whether XRP remains trapped in a loss-realization regime long enough to exhaust marginal sellers, setting the stage for stabilization only after profitability metrics stop deteriorating and SOPR can reclaim, and hold, the break-even line.

At press time, XRP traded at $1.4225.

Ayrıca Şunları da Beğenebilirsiniz

Ukraine Gains Leverage With Strikes On Russian Refineries

Zhongchi Chefu acquired $1.87 billion worth of digital assets from a crypto giant for $1.1 billion.