Why is Bitcoin Cash (BCH) Price Rising Today? Is a 25% Upside Move Taking Shape?

The post Why is Bitcoin Cash (BCH) Price Rising Today? Is a 25% Upside Move Taking Shape? appeared first on Coinpedia Fintech News

Bitcoin Cash (BCH) price is starting to move higher again after spending time trading sideways, catching the attention of the broader crypto market. The recent bounce suggests that buyers are slowly stepping back in, helping the price recover from its recent dip.

While it’s still too early to call a full breakout, the improving price action has sparked discussion about whether BCH could be setting up for a larger move. If buying momentum continues and key levels hold, a potential 25% upside may come into view — though the market will need further confirmation before that scenario plays out.

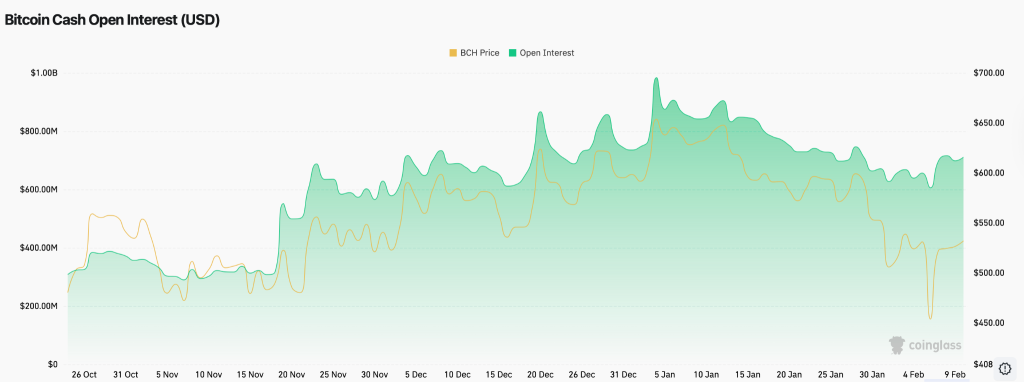

Open Interest Turns Higher After Prolonged Decline

The chart shows Bitcoin Cash open interest starting to climb again after a prolonged decline, even as the price has settled into a period of consolidation. Since late November, open interest has risen from around $300–$350 million to roughly $650–$700 million, suggesting that traders are increasingly positioning through derivatives.

What stands out is that this rise in open interest hasn’t been matched by a strong price breakout. Instead, BCH has moved sideways following its recent rally, pointing to a market that is waiting for direction rather than committing fully.

At the same time, active address counts have fallen, signaling a slowdown in on-chain activity and fewer users transacting on the network. Together, this suggests that current price stability is being supported more by leveraged positioning than fresh spot demand. While this can set the stage for a larger move, it also leaves the price more sensitive to sudden shifts in sentiment.

BCH Price Holds Key Support as Structure Remains Intact

From a price-structure perspective, Bitcoin Cash continues to hold an important technical footing. Price is respecting a multi-year ascending trendline, which has acted as reliable support through previous pullbacks and remains intact despite recent volatility. This suggests that the broader uptrend has not yet broken down.

In the near term, BCH is also defending a key support zone between $508.9 and $527.3, where buyers have repeatedly stepped in. This area aligns closely with the weekly 50-period moving average, reinforcing it as a strong demand zone rather than a short-term bounce level.

Momentum indicators are beginning to stabilize as well. The weekly RSI, after plunging toward oversold levels, is now flattening and attempting to turn higher. While confirmation is still needed, this behavior opens the door for a potential bullish divergence if the price continues to hold support.

If BCH maintains this structure, a move toward $650–$700 comes into focus, representing the next major resistance zone. A sustained breakout above that area could open room for a broader move toward $780–$800, roughly aligning with a potential 25% upside from current levels.

Ayrıca Şunları da Beğenebilirsiniz

Where Next for Bitcoin? The Bull and Bear Case

The million-dollar winner of the X Creators Contest has been exposed for involvement in a Memecoin scam.