ECB Says Cash Will Stay, Even as Digital Payments Grow

As digital transactions continue to rise across Europe, the European Central Bank (ECB) is doubling down on its commitment to preserve physical cash.

In a blog post titled “Making euro cash fit for the future,” ECB Executive Board Member Piero Cipollone outlines why cash remains indispensable—and how the ECB plans to ensure it stays that way.

A Dual Payment Future: Cash and Digital Euro

The ECB explains that while digital payments are growing rapidly, especially following the COVID-19 pandemic, Cipollone made it clear: physical cash isn’t being phased out. Instead, it’s being preserved and modernised to coexist with digital innovations, such as the upcoming digital euro.

To support this dual system, the European Commission’s 2023 Single Currency Package introduced two legislative proposals.

One protects the legal tender status of euro cash, and the other lays the groundwork for a digital euro. Together, these laws aim to ensure that Europeans continue to have a wide range of payment choices—both online and offline.

Cash Still in High Demand Across Europe

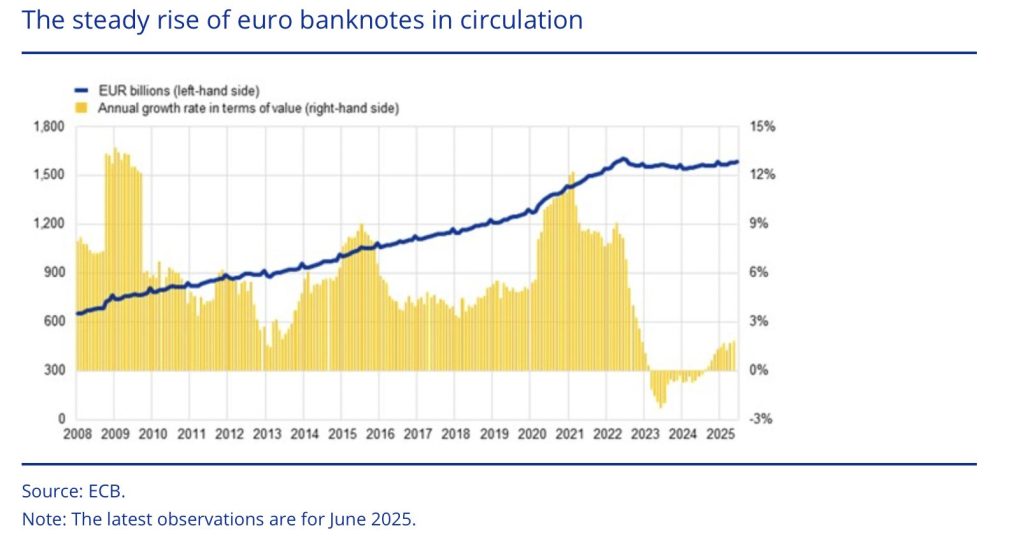

Despite digital trends, the ECB reports that euro banknotes remain a trusted store of value. Over €1.6 trillion worth of euro banknotes—around €5,000 per eurozone citizen—is currently in circulation. While usage dipped slightly during interest rate hikes, cash demand continues to rise at an annual rate of 2.3% in volume.

Cipollone stresses that during past crises—the 2008 financial crash, the sovereign debt crisis, and the pandemic—cash demand surged, reinforcing its role as a stabilising tool in uncertain times. “Cash is always there when you need it,” he notes.

Access to Cash Must Be Protected, Says ECB

One of the ECB’s key concerns is making sure there is equitable access to cash services. As bank branches close and ATMs become less common, rural and underserved regions risk being cut off. To counter this, the proposed Legal Tender of Cash Regulation includes mandatory monitoring and assessment of cash access points across the eurozone.

The ECB says it is working with national central banks to create metrics that account for geographic and population differences. Cipollone stresses that commercial banks have a duty to maintain both withdrawal and deposit services—essential for keeping cash circulating in local economies.

No-Cash Policies Face Legal Pushback

Retailers and public services increasingly refusing to accept cash is another red flag for the ECB. The central bank has criticised “no cash” signs and has called for rules to enforce cash acceptance, particularly in essential services like public transport.

The Court of Justice of the European Union supports this stance, affirming that cash must be accepted unless both parties agree otherwise. The ECB also plans to modernise banknotes—both in design and anti-counterfeit technology—to ensure they remain practical and appealing well into the digital age.

The ECB is clear—cash is not going anywhere. Instead, it’s being future-proofed to stand strong alongside the digital euro, offering Europeans flexibility, security, and inclusivity in how they pay.

ECB Approves Central Bank Money for DLT Transactions

In July, the ECB approved a two-track plan that will utilise central bank money for distributed ledger technology (DLT) transactions.

The first short-term track approach, dubbed “Pontes”, will connect DLT platforms with Eurosystem TARGET services, to be launched by 2026. The track will ensure the free flow of cash, securities and collateral across Europe.

Meanwhile, before the launch of the Pontes pilot in Q3 2026, the ECB will consider DLT-based trial and experiment requests.

You May Also Like

Ether Machine purchased another 10,600 ETH, bringing its total holdings to over 345,000 ETH

$166,000 looks inevitable for Bitcoin, according to CryptoCon’s two-year Fibonacci roadmap