What is Aster (ASTER Token)? Complete Guide to the Revolutionary DeFi Crypto

In today's rapidly evolving DeFi landscape, finding a platform that combines advanced trading capabilities with user-friendly design remains challenging. Aster emerges as a next-generation decentralized perpetual exchange that addresses these pain points through innovative technology and comprehensive features. This guide explores everything you need to know about Aster and its native ASTER token, from its unique dual-mode trading system to tokenomics and real-world applications. Whether you're a seasoned DeFi trader or new to decentralized exchanges, understanding Aster's revolutionary approach to perpetual trading could reshape how you think about decentralized finance.

Key Takeaways

- Aster Token (ASTER) powers a next-generation decentralized exchange offering both professional and simplified trading modes across four major blockchains.

- The platform solves capital efficiency problems through its Trade & Earn program, allowing users to earn yields on trading collateral with asBNB and USDF.

- ASTER has a fixed 8 billion token supply with 53.5% allocated to community airdrops and strategic distribution favoring early adopters.

- The dual-mode system provides MEV-resistant trading through 1001x Simple Mode and advanced orderbook trading via Pro Mode with competitive 0.01% maker fees.

- Upcoming developments include Aster Chain L1 blockchain, zero-knowledge proof integration, and intent-based trading systems for automated multi-chain strategies.

What is Aster (ASTER Token)?

Aster is a next-generation decentralized perpetual exchange built for everyone, offering both perpetual and spot trading through a unified, community-first platform. Aster emerged from the strategic merger between Astherus and APX Finance, Aster represents more than just a rebranding—it's a revolutionary vision that simplifies and elevates the entire DeFi experience.

The platform operates across multiple major blockchains including BNB Chain, Ethereum, Solana, and Arbitrum, providing traders with unprecedented flexibility and access to deep liquidity. Aster's core innovation lies in its dual-mode trading system that caters to both professional traders seeking advanced features and newcomers wanting simplified, one-click execution.

ASTER is the native utility token that powers the entire ecosystem, enabling governance participation, fee optimization, and access to advanced platform features. With a maximum supply of 8 billion tokens, ASTER serves as the backbone for value creation, exchange, and community coordination across Aster's comprehensive trading infrastructure.

The platform uniquely combines security, performance, and user-centric design, backed by YZi Labs and supported by a robust development team committed to building the best decentralized perpetual exchange in the space. Aster's approach focuses on delivering seamless, powerful, and truly decentralized on-chain derivatives trading experiences that rival centralized alternatives.

Aster Platform vs ASTER Token: Key Differences

|

Aspect |

Aster (Platform) |

ASTER (Token) |

|

Definition |

Complete DEX ecosystem and trading platform |

Native utility token powering the ecosystem |

|

Function |

Provides trading infrastructure, liquidity, and services |

Enables governance, fee payments, and platform utilities |

|

Components |

Pro Mode, 1001x Simple Mode, Aster Earn, Spot trading |

BEP-20 token with 8 billion max supply |

|

Purpose |

Facilitate decentralized perpetual and spot trading |

Coordinate network participants and value distribution |

|

Usage |

Trade perpetuals, access yield products, manage portfolios |

Stake for governance, pay fees, earn rewards |

|

Scope |

Multi-chain platform across 4 major networks |

Single token standard on Binance Smart Chain |

*BTN- Trade ASTER Now!&BTNURL=https://www.mexc.com/price/aster *

What Problems Does Aster Crypto Solve?

1. Fragmented DeFi Trading Experience

Traditional decentralized exchanges force users to navigate multiple platforms, protocols, and interfaces to access comprehensive trading features. Aster solves this by providing a unified platform where traders can access perpetual contracts, spot trading, yield generation, and advanced trading tools in one seamless interface.

2. Limited Capital Efficiency in DeFi

Most DEXs require users to lock idle capital as collateral without generating additional returns. Aster introduces revolutionary capital efficiency through its Trade & Earn program, allowing users to employ yield-generating assets like asBNB (liquid staking tokens) and USDF (yield-bearing stablecoins) as trading collateral while continuing to earn passive rewards.

3. MEV Exploitation and Poor Execution

Maximal Extractable Value (MEV) attacks plague decentralized trading, causing users to receive worse execution prices. Aster's 1001x Simple Mode provides MEV-free, one-click execution that protects traders from front-running and sandwich attacks while maintaining full on-chain transparency.

4. High Trading Costs and Complex Interfaces

Professional trading features typically come with prohibitive fees and steep learning curves. Aster addresses this through Pro Mode's competitive fee structure (0.01% maker, 0.035% taker fees) combined with an intuitive interface that makes advanced trading accessible to users at every skill level.

The Story Behind Aster

Aster emerged from the strategic vision to create the definitive decentralized perpetual exchange following the merger of two pioneering DeFi projects in late 2024. Astherus brought proven expertise in yield-generating products and liquid staking innovations, while APX Finance contributed robust perpetual trading infrastructure and advanced derivatives technology.

The unified platform represents more than consolidation—it embodies a complete reimagining of how decentralized trading should function. Backed by YZi Labs and developed by a team with deep expertise in both traditional finance and blockchain technology, Aster was conceived to potentially capture significant market share in the multi-billion-dollar perpetual trading market.

The project's development timeline reflects rapid innovation, with major milestones including the launch of dual trading modes, implementation of cross-chain functionality, and the introduction of revolutionary features like 24/7 stock perpetuals and yield-bearing collateral systems. The Token Generation Event on September 17, 2025, marked Aster's transition to full community ownership and decentralized governance.

Key Features of Aster and DEX Platform

1. Dual-Mode Trading System

Aster uniquely offers two complementary trading experiences. Pro Mode provides an advanced orderbook interface with deep liquidity, up to 100x leverage, and sophisticated trading tools that rival centralized exchanges while maintaining lower fees. The 1001x Simple Mode delivers on-chain, MEV-resistant perpetual trading with up to 1001x leverage through one-click execution, perfect for users seeking simplicity without sacrificing power.

2. Revolutionary Capital Efficiency

The Trade & Earn program transforms how traders utilize collateral by enabling yield-generating assets as margin. Users can employ asBNB (earning BNB staking rewards plus Launchpool benefits) or USDF (generating stablecoin yields through delta-neutral strategies) as trading collateral, creating unprecedented capital efficiency where every trade generates both trading profits and passive income.

3. Multi-Chain Accessibility

Operating across BNB Chain, Ethereum, Solana, and Arbitrum, Aster provides seamless cross-chain trading without requiring users to manage multiple wallets or bridge assets manually. This multi-chain approach ensures optimal execution regardless of where users hold their assets while maintaining unified liquidity pools.

4. Advanced Trading Infrastructure

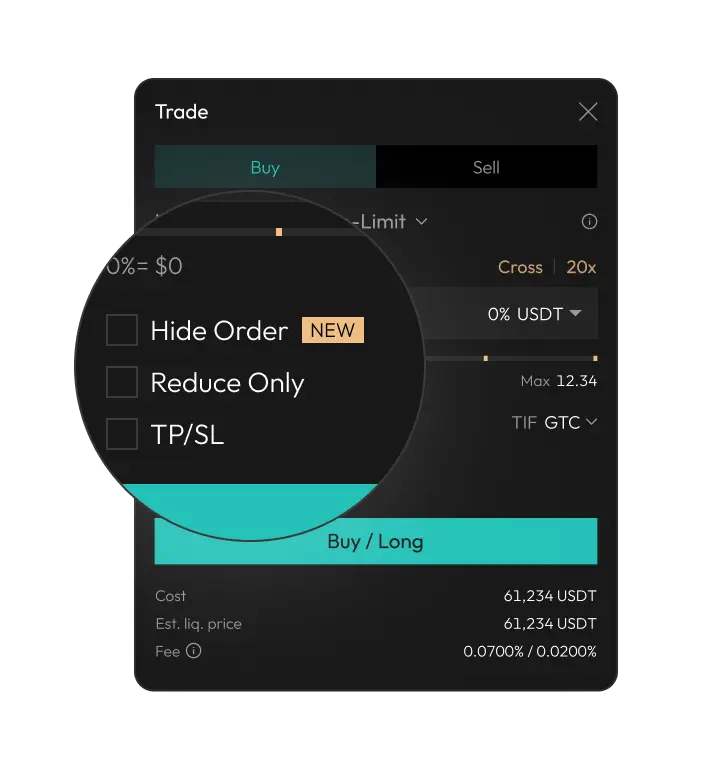

Professional traders benefit from hidden orders, grid trading automation, hedge mode for simultaneous long/short positions, and comprehensive risk management tools. The platform supports both isolated and cross-margin modes, real-time analytics, and customizable trading interfaces that adapt to individual trading styles and preferences.

*BTN- Trade ASTER Now!&BTNURL=https://www.mexc.com/price/aster *

Aster Real-World Use Cases

1. Professional Derivatives Trading

Institutional traders and professional DeFi users leverage Aster's Pro Mode for sophisticated derivatives strategies, including delta-neutral hedging, arbitrage opportunities, and complex multi-asset positions. The platform's deep liquidity and advanced order types enable execution of strategies previously only possible on centralized exchanges.

2. Yield-Optimized Trading

Individual traders maximize capital efficiency by using yield-bearing collateral for perpetual trading. For example, users can stake BNB to receive asBNB, use it as trading margin for leveraged positions, and simultaneously earn BNB staking rewards, Launchpool allocations, and potential trading profits—creating multiple income streams from a single capital deployment.

3. Automated Trading Strategies

Grid trading functionality enables users to implement algorithmic strategies that automatically buy low and sell high within defined price ranges. This automation is particularly valuable in volatile markets where manual execution would be impractical, allowing traders to capture profits from price oscillations without constant monitoring.

4. Cross-Chain Portfolio Management

Users manage diversified portfolios across multiple blockchain ecosystems through Aster's unified interface. This includes trading SOL-based perpetuals while using BNB Chain yield products as collateral, or accessing Ethereum DeFi yields while trading Arbitrum-based derivatives, all within a single platform.

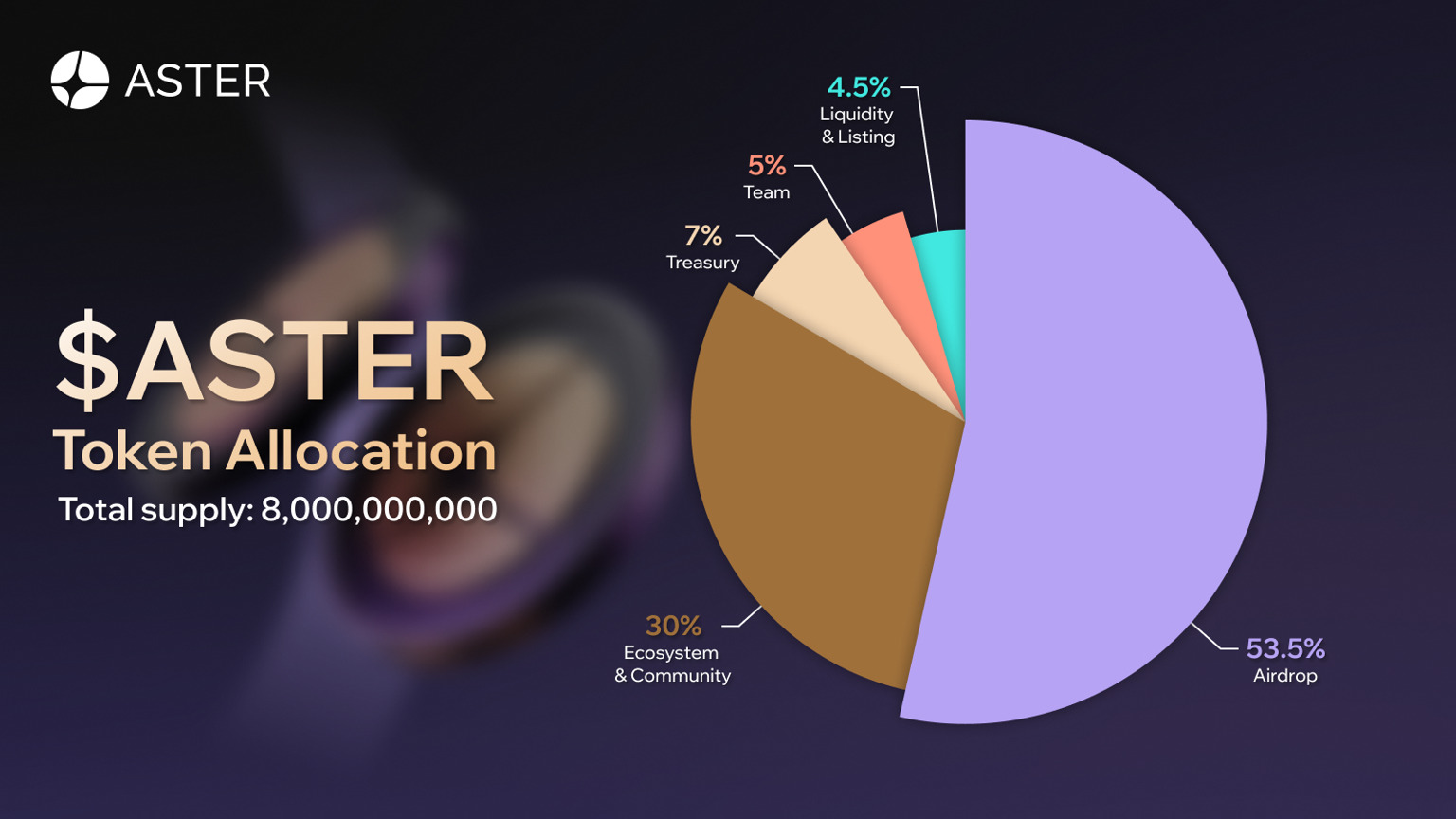

ASTER Tokenomics and Supply

ASTER maintains a fixed maximum supply of 8 billion tokens distributed strategically to ensure long-term sustainability and community alignment. The allocation prioritizes community rewards and ecosystem development while maintaining proper incentives for core contributors and liquidity provision.

Token Distribution Breakdown:

- Airdrop: 53.5% (4,280,000,000 ASTER) - Largest allocation rewards loyal users who participated in Aster Spectra programs, earned loyalty points through trading, and contributed to ecosystem growth. Initial unlock of 704 million tokens (8.8% of total) occurred at TGE for eligible participants.

- Ecosystem & Community: 30% (2,400,000,000 ASTER) - Supports APX holder migration, liquidity bootstrapping, strategic partnerships, marketing initiatives, and development grants. Includes APX-to-ASTER conversion mechanism with decreasing exchange rates over time.

- Treasury: 7% (560,000,000 ASTER) - Reserved for future strategic initiatives, operational reserves, and governance-approved programs. Remains locked until utilized through community governance decisions.

- Team: 5% (400,000,000 ASTER) - Allocated to core contributors and advisors with 1-year cliff and 40-month linear vesting to ensure long-term commitment and alignment with project success.

- Liquidity & Listing: 4.5% (360,000,000 ASTER) - Dedicated to exchange listings and liquidity bootstrapping, fully unlocked at TGE to ensure immediate trading availability and market stability.

The tokenomics design includes protocol revenue buyback mechanisms and governance-based reward distribution to maintain token value and encourage active community participation in platform development decisions.

How ASTER Token Works?

1. Governance and Protocol Development

ASTER holders participate in decentralized governance decisions affecting platform development, fee structures, and strategic initiatives. Token holders vote on protocol upgrades, treasury allocations, and ecosystem partnerships, ensuring community-driven evolution that aligns with user interests rather than centralized control.

2. Trading Optimization and Fee Benefits

The platform implements fee optimization mechanisms for ASTER holders, though specific discount structures continue evolving through governance decisions. Additionally, ASTER serves as the foundation for protocol revenue sharing, where trading fees and platform revenues flow back to active token holders and governance participants.

3. Ecosystem Access and Premium Features

ASTER unlocks access to advanced platform features, priority access to new trading pairs, and exclusive participation in ecosystem programs. This includes early access to yield farming opportunities, priority allocation in token launches, and enhanced position limits for professional trading strategies.

4. APX Migration and Legacy Support

ASTER serves as the upgrade path for legacy APX token holders through a structured conversion mechanism with time-sensitive exchange rates. This migration process ensures seamless transition from the previous ecosystem while rewarding early adopters who participate promptly in the upgrade process.

*BTN- Trade ASTER Now!&BTNURL=https://www.mexc.com/price/aster *

Aster Future Roadmap

Aster's roadmap centers on three transformative developments that will establish it as the leading decentralized derivatives platform. The upcoming Aster Chain represents a purpose-built Layer 1 blockchain optimized specifically for high-frequency trading and complex DeFi operations, offering sub-second transaction finality and significantly reduced gas costs for all trading activities.

Zero-knowledge proof integration will enhance privacy and scalability while enabling new categories of sophisticated trading strategies previously impossible in transparent blockchain environments. This technology will allow institutional traders to execute large positions without revealing their strategies while maintaining full decentralization and security guarantees.

The intent-based trading system represents perhaps the most ambitious innovation, automating complex multi-chain strategies by interpreting user intentions and executing optimal pathways across different liquidity sources and blockchain networks. This system will enable traders to express desired outcomes rather than manually managing complex execution details.

These developments position Aster to capture substantial market share in the rapidly growing perpetual derivatives sector, which has demonstrated hundreds of billions in monthly trading volume across decentralized platforms.

Is Aster Token Better Than Competitors?

Aster competes primarily against established perpetual DEXs including GMX, dYdX, and Gains Network, but differentiates itself through unique innovations that address common DeFi trading limitations.

Aster's Competitive Advantages:

Unlike GMX's single-pool model that creates potential conflicts between traders and liquidity providers, Aster employs traditional orderbook mechanisms in Pro Mode that eliminate these structural issues while maintaining decentralization. The dual-mode approach offers both professional orderbook trading and simplified one-click execution, providing flexibility that competitors cannot match.

The revolutionary Trade & Earn program creates capital efficiency impossible with traditional perpetual DEXs. While competitors require idle collateral, Aster enables users to earn yields on margin through asBNB staking rewards and USDF delta-neutral strategies, effectively providing "free" leverage for active traders.

Aster's multi-chain native architecture surpasses competitors who typically operate on single networks or require complex bridging mechanisms. This approach provides seamless access to liquidity and assets across major blockchain ecosystems without additional complexity or security risks.

The MEV-resistant 1001x mode directly addresses execution quality issues that plague other decentralized perpetual platforms, ensuring users receive fair pricing without front-running or sandwich attacks that commonly affect AMM-based competitors.

Where to Buy ASTER Token

ASTER is available for trading on MEXC, a leading cryptocurrency exchange known for its comprehensive security measures, competitive trading fees, and user-friendly interface. MEXC provides multiple trading pairs for ASTER, ensuring adequate liquidity and price discovery for both retail and institutional traders.

The exchange offers both spot trading for direct ASTER purchases and advanced features including futures trading, staking options, and portfolio management tools. MEXC's robust infrastructure supports high-frequency trading while maintaining industry-standard security protocols to protect user assets.

How to Buy ASTER Token on MEXC

Step-by-Step MEXC Purchase Guide:

- Create MEXC Account - Visit MEXC website and complete registration with email verification and KYC requirements.

- Secure Your Account - Enable two-factor authentication and complete identity verification for full trading access.

- Deposit Funds - Transfer USDT or other supported cryptocurrencies to your MEXC wallet via supported networks.

- Navigate to ASTER Markets - Search for "ASTER" in the trading section and select your preferred trading pair.

- Place Your Order - Choose between market orders for immediate execution or limit orders for specific price targets.

- Confirm Purchase - Review transaction details and confirm your ASTER token purchase.

- Manage Holdings - Monitor your ASTER balance in your MEXC portfolio or withdraw to external wallets if desired.

*BTN- Trade ASTER Now!&BTNURL=https://www.mexc.com/price/aster *

Conclusion

Aster represents a paradigm shift in decentralized perpetual trading by combining advanced professional features with user-friendly design and revolutionary capital efficiency innovations. Through its dual-mode trading system, yield-bearing collateral options, and multi-chain architecture, Aster addresses fundamental limitations that have prevented DEXs from competing effectively with centralized alternatives.

The ASTER token ecosystem creates sustainable value through community governance, protocol revenue sharing, and ecosystem utility functions that align stakeholder interests with platform success. As the DeFi derivatives market continues expanding, Aster's comprehensive approach positions it to capture significant market share while delivering superior user experiences.

With upcoming innovations including Aster Chain, zero-knowledge integration, and intent-based trading systems, Aster is building infrastructure that will define the next generation of decentralized finance. For traders seeking advanced capabilities, superior capital efficiency, and participation in a community-driven ecosystem, Aster offers compelling advantages over existing alternatives.

Maximize Your Crypto Journey with MEXC's Referral Program

Looking to enhance your trading rewards while exploring ASTER token opportunities? MEXC's Referral Program offers up to 40% commission when you invite friends to join the platform. Simply share your referral code, have friends sign up through your link, and automatically earn commissions on their trading activities. With daily commission distribution and 1,095 days validity from signup, this program provides an excellent way to build passive income while introducing others to MEXC's comprehensive trading services and exclusive ASTER token features.

ASTER token airdrop now live! Exclusive MEXC campaign brings revolutionary DEX trading to your portfolio!

Excited about Aster's dual-mode trading system and yield-bearing collateral innovations? MEXC is now hosting an exclusive ASTER token airdrop campaign with generous rewards! Complete simple trading tasks to participate in this groundbreaking DEX ecosystem that's transforming perpetual trading through MEV-resistant execution and multi-chain accessibility. Don't miss this opportunity to become an early adopter in next-generation DeFi trading — visit MEXC's Airdrop+ page now and join the Aster revolution.

Popular Articles

MEXC Futures Now Support Order History and Capital Flow Exports to PDF

In cryptocurrency trading, Futures Order History serves as key evidence of a user's trading activity. They are particularly important for strategy review and performance analysis. Exporting these reco

What is Dill (DL Token)? Complete Guide to the Revolutionary Modular Blockchain

In today's rapidly evolving blockchain landscape, scalability remains the industry's most pressing challenge. While most Layer 1 blockchains force applications into rigid frameworks that compromise pe

Common Technical Analysis Theories

Technical analysis is a widely used tool in financial investing, aimed at predicting future market trends by studying historical price movements and trading data. This article will break down the core

How to Quickly Draw Price Lines and High/Low Price Lines

In cryptocurrency trading, candlestick charts are an essential tool for traders' daily market analysis. Among them, the price line and high-low price lines are fundamental yet critical components of t

Related Articles

What is Aster (ASTER Token)? Complete Guide to the Revolutionary DeFi Crypto

In today's rapidly evolving DeFi landscape, finding a platform that combines advanced trading capabilities with user-friendly design remains challenging. Aster emerges as a next-generation decentraliz

MEXC Futures Now Support Order History and Capital Flow Exports to PDF

In cryptocurrency trading, Futures Order History serves as key evidence of a user's trading activity. They are particularly important for strategy review and performance analysis. Exporting these reco

What is Dill (DL Token)? Complete Guide to the Revolutionary Modular Blockchain

In today's rapidly evolving blockchain landscape, scalability remains the industry's most pressing challenge. While most Layer 1 blockchains force applications into rigid frameworks that compromise pe

Common Technical Analysis Theories

Technical analysis is a widely used tool in financial investing, aimed at predicting future market trends by studying historical price movements and trading data. This article will break down the core