2026-02-07 Saturday

Actualités crypto

Suivez les actualités crypto les plus tendances du marché

L'offre de bonus de 30%-300% de DeepSnitch AI et sa projection 100X déclenchent une frénésie d'achat parmi les investisseurs, les données de Santiment montrent que les traders de XRP sont optimistes tandis que BTC, ETH s'effondrent

Profitez des vidéos et de la musique que vous aimez, téléchargez du contenu original et partagez-le avec vos amis, votre famille et le monde entier sur YouTube.

Partager

Auteur : Blockchainreporter2026/02/07 21:40

Samsung présente un portefeuille complet de solutions CVC intelligentes

LAS VEGAS, 7 février 2026 /PRNewswire/ — Basée sur une technologie d'onduleur avancée et une conception intelligente, la gamme HVAC de Samsung reflète un mécanisme d'engagement envers la performance

Partager

Auteur : AI Journal2026/02/07 21:30

La crypto n'est plus un mot « vulgaire » pour les entreprises aux EAU | Opinion

L'adoption stratégique de la crypto par les EAU montre que le pays est prêt à façonner l'avenir de la finance mondiale

Partager

Auteur : Crypto.news2026/02/07 21:20

Les futurs avocats se moquent des questionnaires « politisés » alors que le DOJ s'effondre

Si les dirigeants du ministère de la Justice se demandent pourquoi leurs bureaux se vident de l'intérieur, le New York Times suggère qu'ils n'ont pas besoin de chercher plus loin que leur

Partager

Auteur : Alternet2026/02/07 21:19

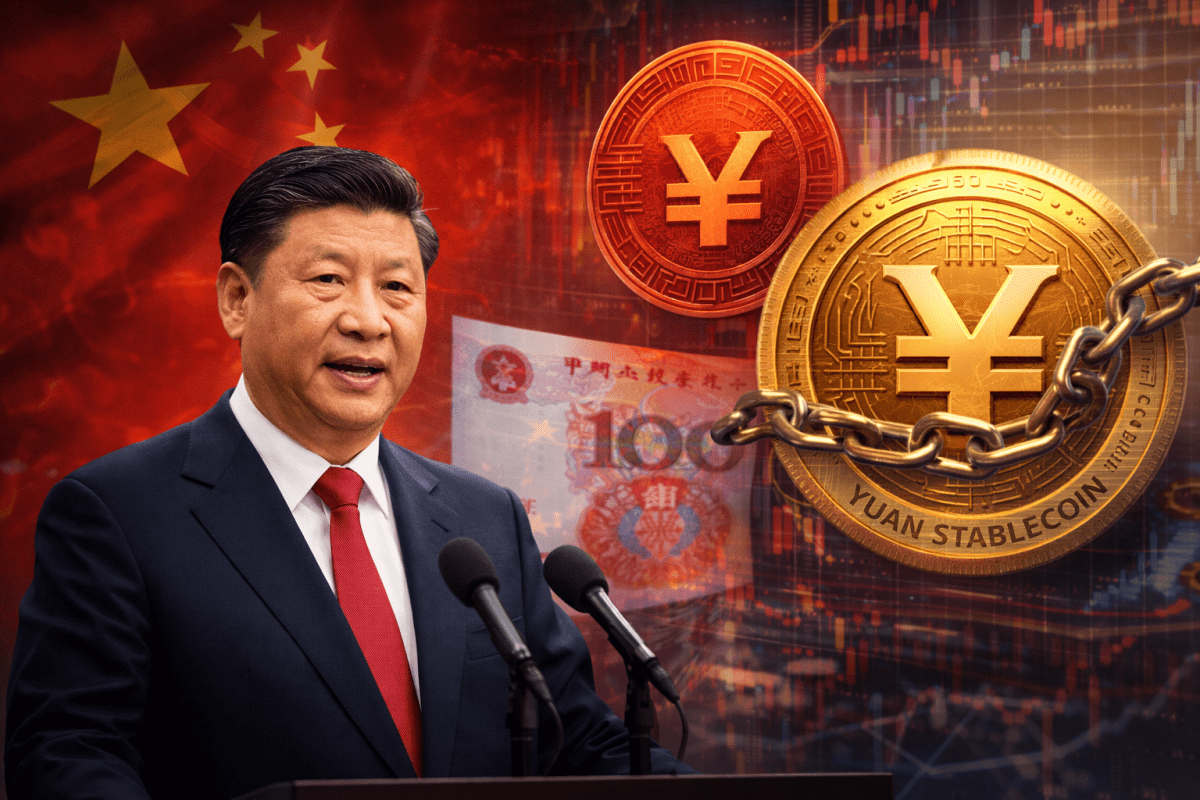

La Chine sévit contre les stablecoins en yuan à l'étranger dans le cadre de la promotion de l'adoption du yuan numérique

La banque centrale de Chine a interdit à toute entité étrangère d'émettre des stablecoins liés à son yuan sans autorisation expresse des autorités chinoises. Le gouvernement

Partager

Auteur : Crypto News Flash2026/02/07 21:10

Après DOGE, SHIB et PEPE, Pepeto pourrait être la prochaine grande Meme Coin

Lorsque vous pensez aux derniers cycles de meme coins, trois noms reviennent toujours en premier : Dogecoin, Shiba Inu et Pepe Coin. Ils ont prouvé une chose mieux que n'importe quel graphique : être

Partager

Auteur : Techbullion2026/02/07 21:09

Un défenseur du XRP partage une explication du récent flash crash

Les effondrements soudains des prix sur les marchés des cryptomonnaies se produisent rarement sans laisser de confusion dans leur sillage. Les traders sont souvent confrontés à un tourbillon de théories avant de pouvoir vérifier

Partager

Auteur : Timestabloid2026/02/07 21:05

Republic Europe proposerait des actions indirectes de Kraken avant l'introduction en bourse

Republic Europe pourrait offrir aux investisseurs de détail européens des actions indirectes de Kraken avant l'IPO prévue.

Partager

Auteur : bitcoininfonews2026/02/07 21:01

Le comportement erratique de Trump révèle une chose

J'essaie d'ignorer les publications de Trump parce que chacune d'entre elles est remplie de ses discours nocifs et pompeux. Mais parfois ses publications sont si révoltantes que je ne peux pas simplement les laisser

Partager

Auteur : Alternet2026/02/07 20:52