3 Best Crypto Presales With Live Products: Why $TAP’s Visa Card is #1

Whenever people have looked for an outlining crypto project, usually, the project with the best use case has been the ultimate winner. That’s because, as most projects come and go, a functioning project generates real revenue that is also sustainable.

And in the current market, there’s one crypto presale called Digitap ($TAP) that’s gaining the most headway, even with competitors like BlockDAG ($BDAG) and Bitcoin Hyper ($HYPER).

- Digitap ($TAP): The world’s first omnibank and best crypto to buy now.

- BlockDAG ($DAG): A DAG protocol with an active tesenet.

- Bitcoin Hyper ($HYPER): A Bitcoin Layer-2 project that uses the Solana Virtual Machine.

Digitap: Why This Crypto Presale Stands Out

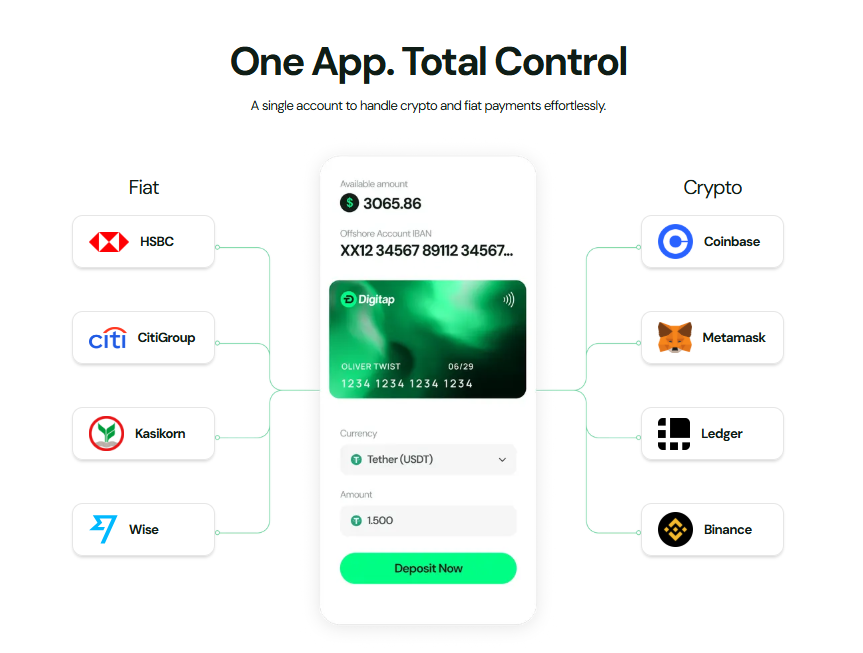

Digitap is one of the most talked-about crypto presales right now, especially among smart money investors. That’s because it offers something that other crypto presales or even established projects don’t have: a way to finally merge crypto and fiat.

By being an omnibank, Digitap allows users to store, hold, and spend both fiat and crypto in one place, giving both crypto and non-crypto users a service that could be massively beneficial to them. Because of this, experts see it as the best crypto to buy now. But, there’s more.

Digitap also has fully-functioning crypto cards backed by Visa, allowing users to spend their fiat and/or crypto anywhere Visa is accepted. They’ll get instant conversions and settlements, and will finally be able to use crypto for everyday purchases. Also, the Digitap app is already live and available via the Google Play Store and Apple App Store.

It’s incredibly intuitive and easy to access by non-crypto users, which has opened a huge door for Digitap in terms of potential adoption. Thousands of people are already using it, and experts believe that there will be millions more to come.

| Metric | Details |

| Stage Price | $0.0268 |

| Next Stage Price | $0.0297 |

| Tokens Sold | Over 90 million |

| Capital Raised | Over $1.4 million |

| Fundraising Goal | $10 million |

BlockDAG: An Ambitious New Player

As far as choosing the most promising crypto to buy now, BlockDAG is also a sound contender. That’s because it is developing a Layer-1 protocol that uses a Directed Acyclic Graph (DAG) structure instead of a traditional blockchain. This means that, with this structure, BlockDAG aims to provide much faster processing and transaction speeds than there are now.

With this in mind, experts see it as a very promising crypto to buy now, but one aimed at a more niche part of the crypto market. So, they don’t see BDAG experiencing the same level of adoption that Digitap could, which is why $TAP is their #1 crypto presale choice.

As for the $BDAG presale, it’s nearing its end, with over $434 million raised so far. $BDAG is selling at a price of $0.005, and the launch on exchanges should be imminent.

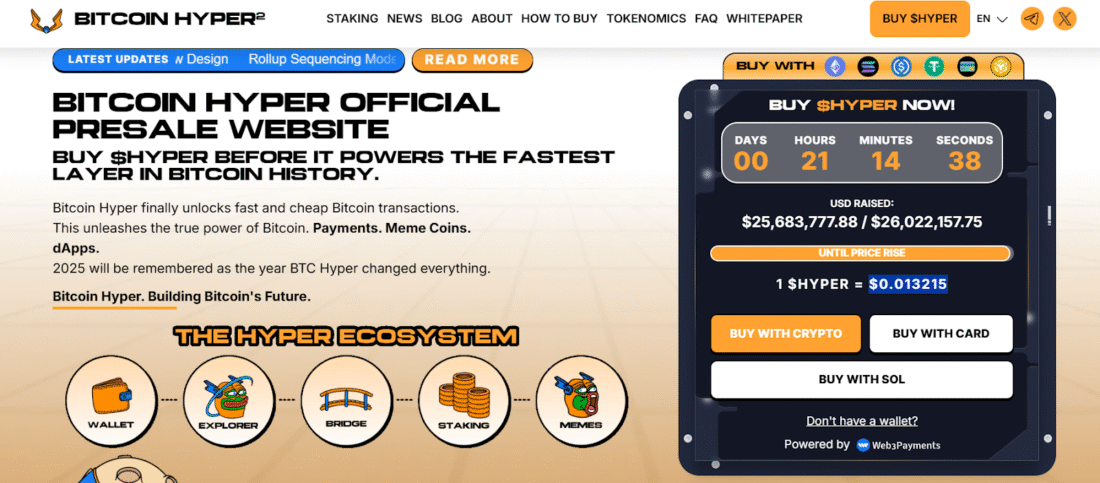

Bitcoin Hyper: The New Bitcoin L2

Bitcoin Hyper is another promising crypto to buy now, as it aims to address Bitcoin’s scalability challenges. To do that, Bitcoin Hyper is set up as a Layer-2 solution that uses the Solana Virtual Machine (SVM) to function. This is meant to provide fast, low-cost transactions and smart contract functionality for the Bitcoin network.

With this in mind, the $HYPER crypto presale has attracted significant interest, raising over $25 million so far. At the moment, one $HYPER token is available for $0.013215, while the launch price is currently unknown.

Also, the $HYPER presale gives investors access to a dynamic APY of around 46%. Even though this is promising, it’s still only touching on a very niche part of the crypto market, or even more specifically, the part of the market that uses the Bitcoin network. So, while it’s promising for them, it, too, falls short of the use cases that Digitap offers.

Digitap Securely Holds the #1 Presale Among the Pack of Crypto Presales

One of the reasons why Digitap is leading among the other presales mentioned here is its maturity and use cases. Namely, out of the 3, Digitap is the newest presale, giving investors lower entry points. But, more importantly, Digitap offers services that can be beneficial for millions of people, not just crypto users.

Also, since the world has been leaning toward digitalization for years now, experts believe that Digitap could usher in a new era in finance, affecting not just crypto but traditional markets, too.

Furthermore, Digital has a powerful AI-routing system that slashes the industry average cross-border payment fees of 6.2% to under 1%, meaning it can be extremely cost-effective for anyone who wants to do global transactions.

Digitap already has a live app available, one that has garnered the attention of thousands of users even now. And with its Visa-backed crypto card, Digitap is already showing that it has finally managed to merge crypto and fiat once and for all.

USE THE CODE “MILLION30” FOR 30% OFF FIRST-TIME PURCHASES

A New Standard for Presale Investments

Not many presales offer a tangible product before launch, but Digitap is one of them. This has only strengthened its case as the best crypto to buy now, as it shows real utility and helps investors see how they can benefit from it from the start.

With this in mind, experts view $TAP as the leader of all presales in 2025 and believe it could potentially usher in a new era in finance and global markets soon.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app Social: https://linktr.ee/digitap.app

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post 3 Best Crypto Presales With Live Products: Why $TAP’s Visa Card is #1 appeared first on Live Bitcoin News.

Vous aimerez peut-être aussi

Wintermute Analysis: Stablecoins Grow While ETFs and DATs Stall in Crypto Markets

China Launches Cross-Border QR Code Payment Trial