Acurast Airdrop Guide | How to Participate in the Acurast Questing?

The post Acurast Airdrop Guide | How to Participate in the Acurast Questing? appeared first on Coinpedia Fintech News

Key Takeaways

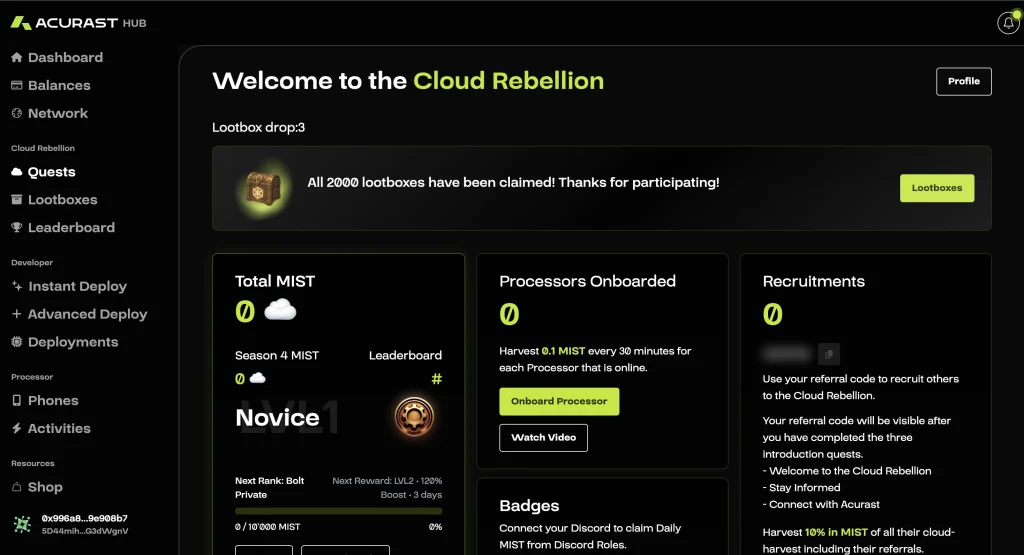

- The Cloud Rebellion is Acurast’s quest hub. Your MIST points (points, NOT tokens) reflect contribution and are a primary input for $ACU airdrop eligibility.

- TGE targeted for late 2025. Stay consistently active — snapshots and allocations won’t be pre-announced.

- Acurast’s network has surpassed 129k+ smartphones and 410M+ on-chain transactions = rapid growth.

What is Acurast?

Acurast is a smartphone-powered decentralized compute network. Phones contribute secure compute via Trusted Execution Environments (TEEs) and hardware-backed attestation, while all jobs are verifiable and settled on-chain. The focus is on rewarding real participation over passive speculation.

The Cloud Rebellion layers a gamified experience on top: complete quests, earn MIST (points), climb the leaderboard, and position yourself for rewards — including the upcoming $ACU airdrop tied to Cloud Rebellion activity.

How to Participate in the Acurast Airdrop

STEP 1: Join the Cloud Rebellion and sign in

STEP 1: Join the Cloud Rebellion and sign in

Head to the Cloud Rebellion portal, sign up with your email, or connect a Web3 wallet like Metamask or WalletConnect. Approve the connect prompt.

STEP 2: Start quests to earn MIST

STEP 2: Start quests to earn MIST

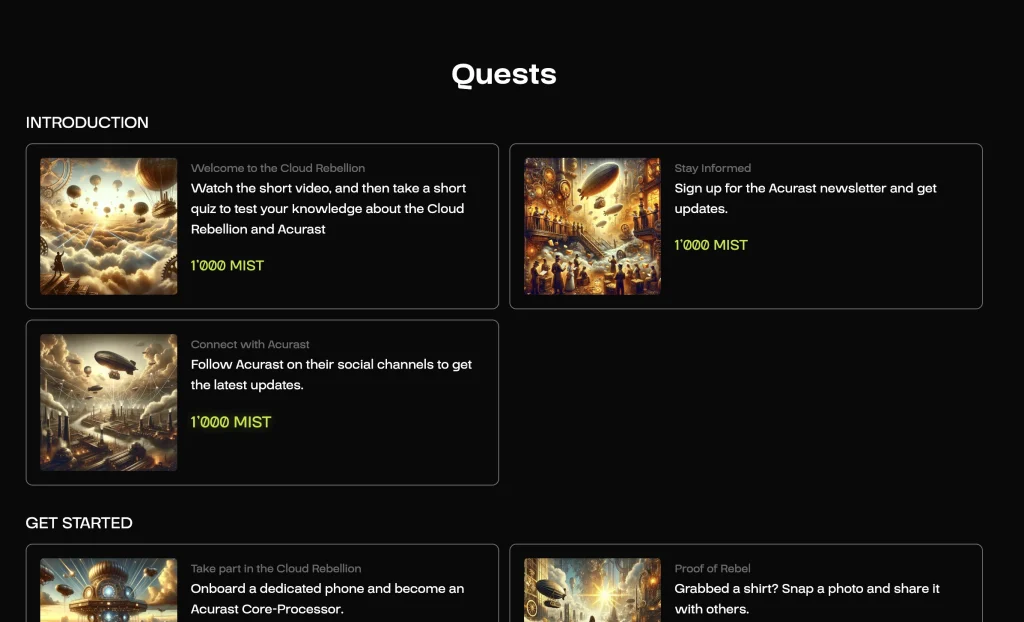

Open the ‘Quests’ tab and clear onboarding/social tasks first, then move to ecosystem or on-chain missions. Watch your MIST total update on your profile.

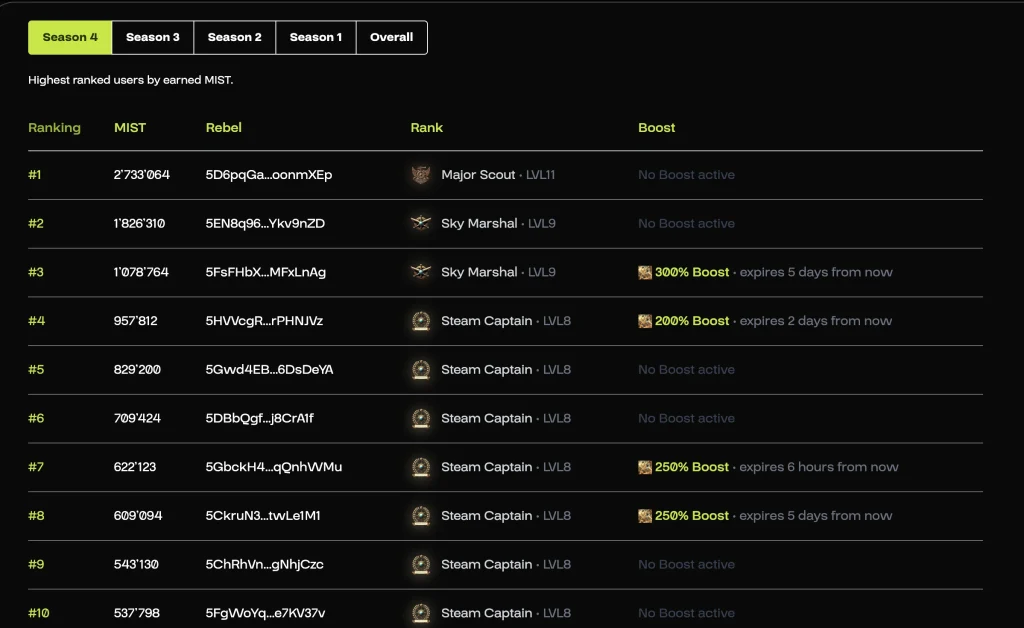

STEP 3: Check daily/weekly tasks and the leaderboard

STEP 3: Check daily/weekly tasks and the leaderboard

STEP 3: Claim Community Badges for Extra Rewards

Acurast also offers “Badges” that grant special Discord roles and additional MIST rewards.

Join the Acurast Discord

- Verify your community membership, either by verifying an NFT or redeeming a voucher code.

- Sign up/in to the Cloud Rebellion – claim your extra MIST reward every 24 hours

- See this thread for examples of how the badges look and which roles are available.

Return regularly for short-window quests and multipliers. Track your rank to gauge progress.

STEP 4: Stay engaged on official channels

STEP 4: Stay engaged on official channels

Follow Acurast on X and join Discord for surprise quests, AMAs, and announcements. Enable notifications so you don’t miss limited-time events.

STEP 5: Prepare your wallet for claim instructions

STEP 5: Prepare your wallet for claim instructions

Use a self-custodial wallet (not an exchange account) and keep a small amount of gas on hand. Around TGE, Acurast will publish official claim/migration instructions. Then just connect your wallet, verify eligibility, and follow the guide.

Final Thoughts

That’s the rundown for joining Cloud Rebellion, earning MIST consistently, and keeping an eye out for official updates. The snapshot will not — I repeat — will NOT be announced, so steady participation is undoubtedly your edge.

Follow Acurast on X and join the Discord for new quests, surprise events, and updates.

FAQs

1. How do I know if I’m eligible for the airdrop?

If you have MIST points on Cloud Rebellion, you’re in the pool. The more MISTyou earn, the higher your eligibility weight.

2. When will the airdrop be distributed?

The exact date is undisclosed, but it is expected to occur after the mainnet launch, which is targeted for late 2025. Follow official channels for updates.

3. Do I need to hold tokens to qualify?

No, this is an airdrop that rewards activity — not token holdings. Focus on completing quests and earning MIST points.

Disclaimer: Crypto airdrops are promotional and carry risk. Token distributions and dates can change. Always verify links and never share private keys or seed phrases.

Vous aimerez peut-être aussi

‘Good Time to Buy’ Crypto as 96% Expect US Govt to Reopen This Week

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more