Best Crypto Presales to Buy as First XRP and Dogecoin ETFs Are at a Crossroads

ETFs are no longer just for Bitcoin and Ethereum. Last week, three major altcoin exchange-traded funds launched and faced a tough test as the broader crypto market experiences a downturn.

On September 18th, both DOJE ($DOGE) and XRPR ($XRP) spot exchanges launched to strong interest from traders. On its first day, XRPR recorded a trading volume of $37.7M, surpassing every other ETF launch in 2025.

DOJE also performed very well with a volume of $17M, ranking among the top five for 2025 ETF launches. GDLC, a basket ETF offering exposure to a mix of Bitcoin, Ethereum, XRP, Solana, and Cardano, also launched on September 19th with $22M in first-day volume.

Although these ETFs have performed well initially, the larger crypto market is experiencing a period of uncertainty and consolidation. We’ve identified three top crypto presales to consider during the market recovery: Bitcoin Hyper ($HYPER), Snorter Bot ($SNORT), and Remittix ($RTX).

1. Bitcoin Hyper ($HYPER) – Bitcoin Gets a Solana-Based Layer-2 Upgrade for Better Speeds and Lower Fees

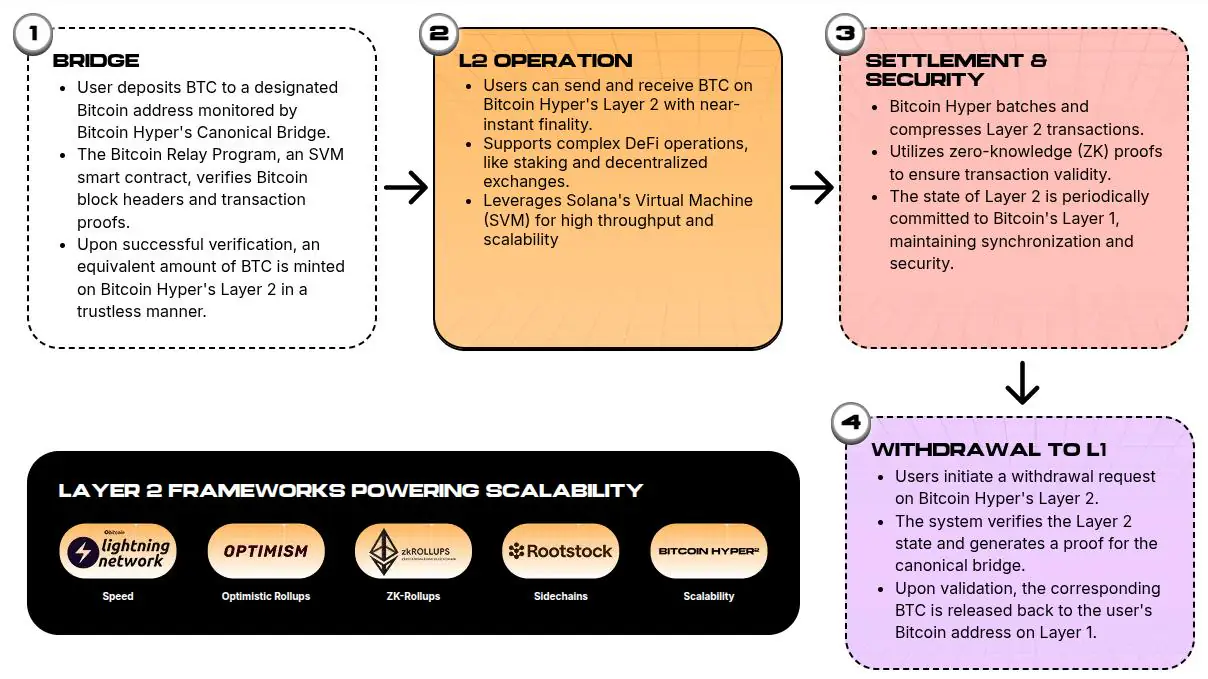

Bitcoin Hyper ($HYPER) is helping Bitcoin compete with modern blockchains like Ethereum and Solana by offering a Layer-2 solution that uses a Solana Virtual Machine (SVM) with zK rollups.

Strong performance from Bitcoin-based ETFs shows that Bitcoin is a viable long-term investment asset. Unfortunately, the same can’t be said for replacing fiat on a daily basis. It’s just too slow – waiting ten minutes for your Bitcoin transfer to clear while trying to buy a coffee isn’t practical.

That’s where Bitcoin Hyper comes into play. Incorporating the scalability of Solana allows Bitcoin transactions to be processed faster on the Layer-2 with minimal fees, while also supporting dApps using smart contracts.

All of the applications you’re used to using on other Web3 blockchains can be supported with Bitcoin Hyper without leaving the Bitcoin ecosystem. You’ll be able to perform crypto swaps, NFT trades, and access DeFi services while holding onto $BTC for long-term gains.

$HYPER is the utility token of the Bitcoin Hyper network. Holding it allows you to vote on the Bitcoin Hyper DAO whenever new proposals are submitted, but that’s not all. Any trades you make on Bitcoin Hyper benefit from lower fees when you use $HYPER, along with smart contract executions.

Utilizing $HYPER also helps unlock the full potential of the Bitcoin Hyper network, as some dApps will keep exclusive features gated to $HYPER holders only. With such a broad range of uses, demand for $HYPER has already skyrocketed – and it’s only in presale.

To date, $HYPER has raised an impressive $17.7M. As a result, the token’s price has increased to $0.012965, but you can still purchase yours now and secure up to 65% in staking rewards.

Get your $HYPER tokens today.

2. Snorter ($SNORT) – Make Unlimited Trades with this Telegram-Based Trading Bot

Snorter Token ($SNORT) is the official token of Snorter Bot, a trading bot that makes finding and swapping new altcoins simple with a Telegram-based interface.

Check out any DeX, and you’ll see a flood of new tokens appearing every moment. Finding the right one to trade can be like searching for a needle in a haystack, especially with the constant risk of scams, making it crucial to do your due diligence on each one.

That’s why Snorter is an essential tool for trading altcoins. It runs continuously in the background, identifying new coins that are performing well for you to review at your convenience.

Once you’ve found a coin you want to trade, just use Snorter’s automatic buy and sell orders to execute trades at your preferred price. Snorter also reduces the work by scanning each coin with a honeypot detection engine to spot rugpull signals early.

Once Snorter Bot drops, it will work with Solana. Support is also in development for Ethereum, BNB, Polygon, and Base, with these modules planned for release after the initial launch.

When Snorter launches, it will support the Solana blockchain from day one. Post-release support for Ethereum, BNB, Polygon, and Base is also planned.

Snorter is impressive enough on its own, but it’s $SNORT$ that truly makes the difference. It’s a utility token for Snorter that unlocks several exclusive features inside Snorter Bot. With it, you can:

- Reduce your transaction fees to 0.85%

- Trade an unlimited number of times per day

- Copy other wallets and follow their trades exactly

- Execute trades through a high-speed RPC node for sub-section executions

It’s clear that Snorter becomes a top-tier trading bot once you hold $SNORT, which is why the presale has already raised over $4M. It’s not too late to buy in, as you can still get $SNORT for only $0.1053. Any $SNORT you purchase can be staked for up to 116% annual rewards.

Join the Snorter Token presale before Snorter launches.

3. Remittix ($XRP) – Cross-Border Payments and Settlements Using One Crypto

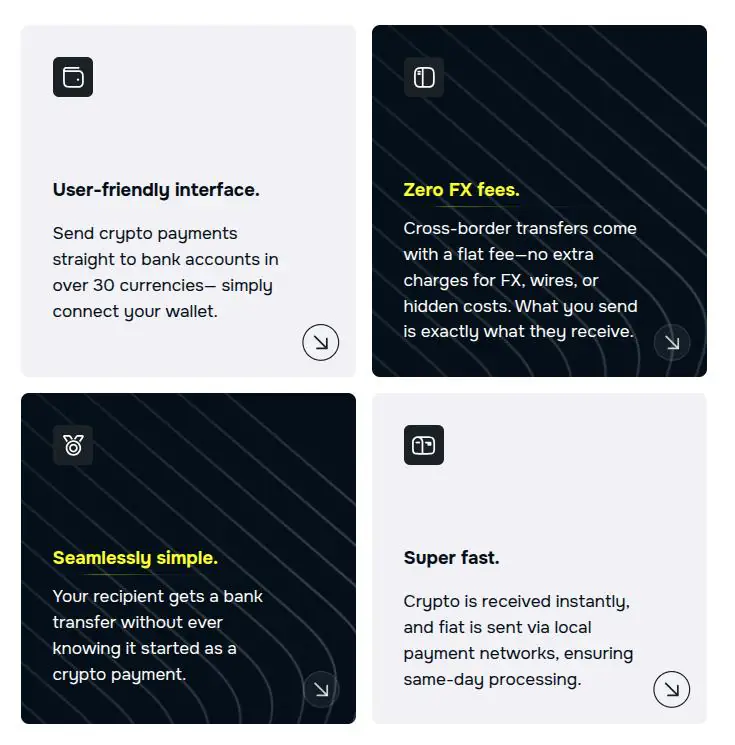

Remittix ($RTX) is bridging the gap between cryptocurrency and traditional finance systems. The platform aims to support transfers across more than 40 cryptocurrencies and over 30 fiat currencies through a seamless interface that removes the underlying complexities of crypto.

With Remittix, transfers settle nearly instantly. Crypto is sent as soon as it processes on the blockchain, while money orders settle within the same day. To a cash recipient, it may look like crypto hasn’t been used at all.

For businesses, Remittix provides merchant solutions that allow online services to accept cryptocurrency payments through a seamless checkout process. Essentially, it enables existing web platforms to create a unified Web3 payment experience without concerns about offramping crypto.

So far, the Remittix presale has raised over $26.3M in token sales. Currently, you can buy $RTX for $0.1130, but the price will soon increase to $0.1166. Unlike $HYPER and $SNORT, Remittix does not have a presale staking program.

You can purchase $RTX through the official Remittix presale.

All crypto products are volatile. Be sure to always do your own research before investing – and only invest what you’re prepared to lose. This article is not financial advice.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Best Crypto Presales to Buy as First XRP and Dogecoin ETFs Are at a Crossroads appeared first on Coindoo.

Vous aimerez peut-être aussi

Fed spokesperson: The Fed has started a moderate rate cut cycle, and there are huge differences in future decisions

Ohio Man Falls for ‘Too Good To Be True’ TikTok Romance Scam, Loses Up To $55,000 While in Nursing Home: Report