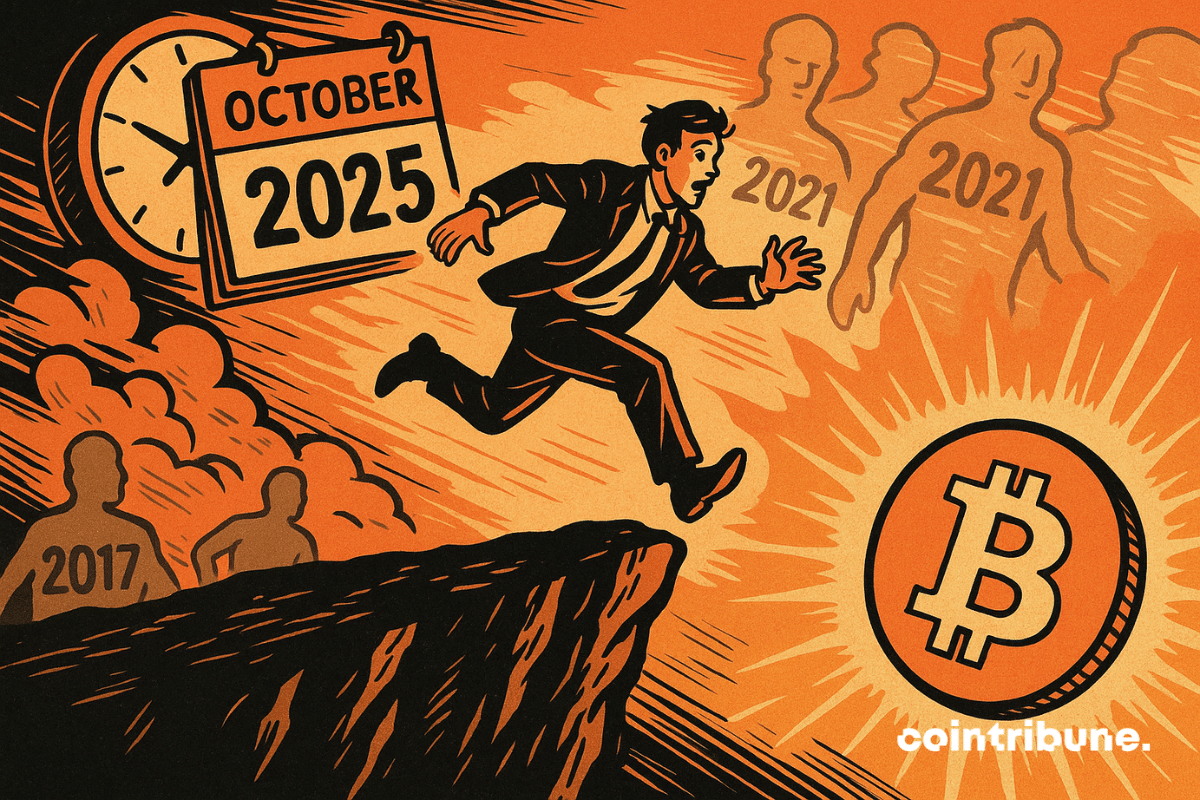

Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally. L’article Bitcoin Enters “Uptober” 2025: Can History’s Seasonal Rally Repeat? est apparu en premier sur Cointribune. Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally. L’article Bitcoin Enters “Uptober” 2025: Can History’s Seasonal Rally Repeat? est apparu en premier sur Cointribune.

Bitcoin Enters “Uptober” 2025: Can History’s Seasonal Rally Repeat?

2025/09/29 02:05

Bitcoin is heading into October with traders eyeing its seasonal track record for momentum. Market participants coined the phrase “Uptober” to describe the month’s history of outsized gains, and attention now turns to whether 2025 will continue that trend. After a modest September, investors are weighing past performance against current conditions to judge whether the final quarter could spark another rally.

L’article Bitcoin Enters “Uptober” 2025: Can History’s Seasonal Rally Repeat? est apparu en premier sur Cointribune.

Clause de non-responsabilité : les articles republiés sur ce site proviennent de plateformes publiques et sont fournis à titre informatif uniquement. Ils ne reflètent pas nécessairement les opinions de MEXC. Tous les droits restent la propriété des auteurs d'origine. Si vous estimez qu'un contenu porte atteinte aux droits d'un tiers, veuillez contacter service@support.mexc.com pour demander sa suppression. MEXC ne garantit ni l'exactitude, ni l'exhaustivité, ni l'actualité des contenus, et décline toute responsabilité quant aux actions entreprises sur la base des informations fournies. Ces contenus ne constituent pas des conseils financiers, juridiques ou professionnels, et ne doivent pas être interprétés comme une recommandation ou une approbation de la part de MEXC.

Partager des idées

Vous aimerez peut-être aussi

Analyst Predicts ‘Uptober’ Rally for BTC Regardless of FOMC Decision

The post Analyst Predicts ‘Uptober’ Rally for BTC Regardless of FOMC Decision appeared on BitcoinEthereumNews.com. Bitcoin traded at $116,236 as of 14:04 UTC on Sept. 17, up about 1% in the past 24 hours, holding above a key level as markets await the Federal Reserve’s policy announcement. Analysts’ comments Dean Crypto Trades noted on X that bitcoin is only about 7% above its post-election local peak, while the S&P 500 has risen 9% and gold has surged 36% during the same period. He said bitcoin has compressed more than those assets, making it likely to lead the next larger move, though it could form a “lower high” before extending further. He added that ether could join in once it breaks $5,000 and enters price discovery. Lark Davis pointed to bitcoin’s history around September FOMC meetings, saying every September decision since 2020 — except during the 2022 bear market — has preceded a strong rally. He stressed that the pattern is less about the Fed’s rate choice itself and more about seasonal dynamics, arguing that bitcoin tends to thrive in this period heading into “Uptober.” CoinDesk Research’s technical analysis According to CoinDesk Research’s technical analysis data model, bitcoin rose about 0.9% during the Sept. 16–17 analysis window, climbing from $115,461 to $116,520. BTC reached a session high of $117,317 at 07:00 UTC on Sept. 17 before consolidating. Following that peak, bitcoin tested the $116,400–$116,600 range multiple times, confirming it as a short-term support zone. In the final hour of the session, between 11:39 and 12:38 UTC, BTC attempted a breakout: prices moved narrowly between $116,351 and $116,376 before spiking to $116,551 at 12:34 on higher volume. This confirmed a consolidation-breakout pattern, though the gains were modest. Overall, bitcoin remains firm above $116,000, with support around $116,400 and resistance near $117,300. Latest 24-hour and one-month chart analysis The latest 24-hour CoinDesk Data chart, ending 14:04 UTC on…

Partager

BitcoinEthereumNews2025/09/18 12:42

Partager

Dogecoin (DOGE) $1 Target Faces Skepticism as Little Pepe (LILPEPE) Gains Attention With 45x Potential

Dogecoin is still the most well-known meme coin in the crypto world, but many experts doubt it will reach $1 this cycle. Newer tokens like Little Pepe (LILPEPE) are getting more attention from investors because they are struggling in the market. Dogecoin’s $1 Ambition Under Scrutiny The price of Dogecoin is about $0.27 right now,

Partager

Coinstats2025/09/29 04:45

Partager

Singapore and UAE Lead the World in Crypto Adoption, According to Latest Report

Singapore and UAE lead global crypto adoption, with impressive growth. US ranks third globally, driving crypto infrastructure with 30,000 ATMs. Canada sees remarkable 225% rise in crypto ownership and adoption. Singapore and the United Arab Emirates (UAE) have emerged as the world’s leading nations in terms of crypto engagement, according to a recent study by ApeX Protocol. Singapore took the top spot with a perfect composite score of 100. This achievement was largely driven by the impressive 24.4% of its population holding digital assets and a dominant position in global crypto-related search activity. In fact, Singapore led the world in search volume with an astounding 2,000 crypto-related queries per 100,000 residents. This surge in adoption is significant, as just a year ago, only 11% of Singaporeans owned cryptocurrency. Also Read: Mike Novogratz Reflects on XRP’s Resilience Amid SEC Battle The UAE came in a close second with a score of 99.7, primarily fueled by the 25.3% of its population that owns crypto. Over the past few years, the Gulf nation has witnessed a massive 210% increase in crypto adoption. The country experienced a remarkable surge in 2022, when over 34% of residents reported holding crypto assets. Factors Driving Crypto Adoption Across Nations The ApeX Protocol report assessed each country’s crypto involvement based on four key indicators: ownership rate, adoption growth, search activity, and the availability of ATMs. The United States followed in third place, scoring 98.5. The US stands out due to its robust infrastructure, including more than 30,000 crypto ATMs, the highest number in the world. Additionally, the country has seen a 220% rise in crypto adoption since 2019. Canada, which ranks fourth with a score of 64.7, recorded the highest adoption growth rate among the nations studied, with a 225% increase in crypto ownership. Approximately 10.1% of Canada’s population holds crypto, and the country boasts over 3,500 crypto ATMs. Turkey rounded out the top five with a score of 57.6. Nearly 19.3% of Turkey’s population owns crypto, and the country continues to show strong interest in the digital asset space, ranking third globally in terms of ownership. Other countries in the top 10 include Germany, Switzerland, Australia, Argentina, and Indonesia. These nations are also witnessing significant increases in adoption, coupled with strong infrastructure and growing public interest in digital currencies. This surge in global crypto adoption reflects a broader shift toward digital assets, signaling a change in how people around the world are interacting with technology, finance, and trust in the digital age. Crypto is no longer a niche investment; it has become an integral part of the financial ecosystem for many nations. Also Read: XRP’s October Performance: Why ‘Uptober’ Is More Myth Than Reality The post Singapore and UAE Lead the World in Crypto Adoption, According to Latest Report appeared first on 36Crypto.

Partager

Coinstats2025/09/29 04:20

Partager