CleanSpark Shares Surge 6% After Landing $100M Bitcoin-Backed Loan Deal From Coinbase

TLDR

- CleanSpark secured $100 million Bitcoin-backed credit facility from Coinbase Prime using its Bitcoin holdings as collateral

- Company shares rose 5-6% in after-hours trading following the Monday announcement

- Funds will expand CleanSpark’s energy portfolio, Bitcoin mining operations, and high-performance computing capabilities

- This brings CleanSpark’s total Bitcoin-backed financing from Coinbase Prime to $300 million

- The strategy allows growth without selling Bitcoin holdings or diluting shareholders through equity raises

Bitcoin mining company CleanSpark has secured a new $100 million credit facility from Coinbase Prime, using its Bitcoin holdings as collateral. The company announced the deal on Monday, sending shares up nearly 6% in post-market trading.

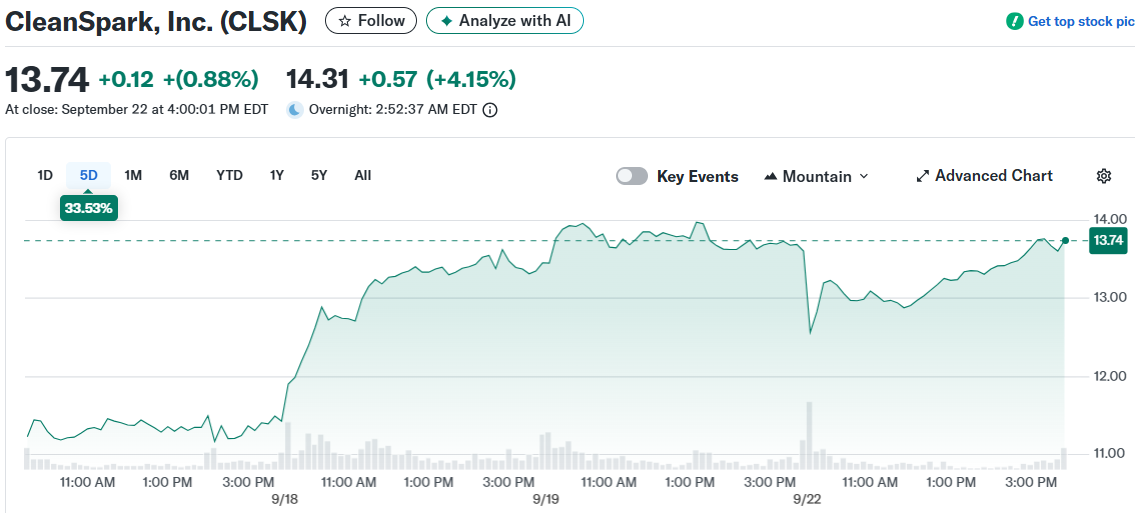

CleanSpark closed at $13.74 on September 22 and gained to $14.44 in after-hours trading following the news. The mining company will use the proceeds for strategic capital expenditures across multiple business areas.

CleanSpark, Inc. (CLSK)

CleanSpark, Inc. (CLSK)

The funds will help expand CleanSpark’s energy portfolio while scaling its Bitcoin mining operations. The company also plans to invest in high-performance computing capabilities as part of its growth strategy.

CleanSpark holds approximately 13,000 Bitcoin in total, using a portion of these holdings to secure the credit facility. This approach allows the company to access capital without selling its Bitcoin or issuing new shares.

Expanding Beyond Bitcoin Mining

Chief Business Officer Harry Sudock explained that CleanSpark takes a comprehensive approach to asset utilization. The company conducts thorough reviews of every power contract, plot of land, and energy relationship in its portfolio.

Some portions of CleanSpark’s power pipeline may not suit Bitcoin mining but could work well for high-performance computing. The company believes this versatility creates larger growth opportunities than focusing on a single capability.

Growing Partnership with Coinbase Prime

This latest deal brings CleanSpark’s total Bitcoin-backed financing from Coinbase Prime to approximately $300 million. The strategic partnership has provided the company with multiple credit facilities over time.

Building HPC Capabilities

Many Bitcoin mining companies have pivoted toward artificial intelligence and high-performance computing in recent years. These operations require tremendous amounts of energy, making mining facilities suitable for hosting HPC machines.

CleanSpark’s leadership changes have hinted at diversification beyond Bitcoin mining. The company seeks to develop multiple revenue streams through its existing infrastructure.

The credit facility represents a non-dilutive financing approach that preserves shareholder value. Rather than selling Bitcoin or issuing new shares, CleanSpark leverages its cryptocurrency holdings to fund expansion.

Sudock emphasized that the company focuses on extracting maximum value from its Bitcoin holdings. This strategy provides investor value while enabling operational scaling across multiple business lines.

The September 22 announcement follows CleanSpark’s best quarter to date. The company continues scaling operations through strategic financing arrangements with institutional partners like Coinbase Prime.

The post CleanSpark Shares Surge 6% After Landing $100M Bitcoin-Backed Loan Deal From Coinbase appeared first on CoinCentral.

Vous aimerez peut-être aussi

Bitwise CEO: In the next 6 to 12 months, the focus of the crypto field will be on the credit and lending market

Ripple Cryptocurrency News: XRP Tundra Presale Launches with Dual-Token Model