Crucial SEC Meeting Unveils Future of Crypto Regulation with Sui Developer

BitcoinWorld

Crucial SEC Meeting Unveils Future of Crypto Regulation with Sui Developer

The landscape of digital assets is constantly evolving, and at its core lies the urgent need for clear and effective crypto regulation. A recent, pivotal meeting between the U.S. Securities and Exchange Commission’s (SEC) crypto task force and Mysten Labs, the developer behind the Sui blockchain, highlights this ongoing effort. This engagement signifies a crucial step towards defining the future framework for the cryptocurrency market.

Why is SEC Engagement on Crypto Regulation So Important?

On September 9, the SEC’s specialized crypto task force convened with Mysten Labs to delve into approaches for cryptocurrency market oversight. This discussion, as reported by Cointelegraph, underscores the SEC’s proactive stance in understanding and potentially regulating the rapidly expanding digital asset sector. The SEC’s role is to protect investors and maintain fair, orderly, and efficient markets, a mandate it now extends to the crypto space.

The agency’s engagement with industry players like Mysten Labs is vital. It allows regulators to gain direct insights into the technology and operational models of new blockchain projects. Conversely, it offers developers a platform to articulate their innovations and concerns regarding potential regulatory frameworks. This dialogue is essential for fostering an environment where innovation can thrive alongside robust investor protection through sound crypto regulation.

Understanding Sui and Mysten Labs’ Role in Crypto Regulation Discussions

Mysten Labs is a prominent name in the blockchain world, known for developing Sui, a Layer 1 blockchain designed for high performance and scalability. Sui aims to support a wide range of decentralized applications, from gaming to DeFi, by offering low-latency transactions and high throughput. Their involvement in discussions about crypto regulation is significant because their technology represents the cutting edge of blockchain development.

Here are some key aspects of Sui’s platform that make these discussions particularly relevant:

- Scalability: Sui’s architecture is built to handle a massive volume of transactions, which could attract mainstream adoption.

- Developer-Friendly: It offers a programming model that simplifies the creation of complex dApps.

- Security: Emphasizes robust security features, crucial for investor confidence.

As platforms like Sui push the boundaries of what blockchain technology can achieve, regulators face the challenge of understanding these complex systems to create appropriate rules. Mysten Labs’ participation provides valuable technical context to the SEC’s policy-making efforts, influencing the trajectory of future crypto regulation.

What Challenges Does Crypto Regulation Face Today?

Regulating cryptocurrencies presents a unique set of challenges. Unlike traditional financial instruments, digital assets often operate across borders, utilize novel technologies, and can be highly volatile. Regulators must balance the need for investor protection with the desire to foster innovation. Overly restrictive rules could stifle growth, while insufficient oversight could expose investors to significant risks.

Key challenges include:

- Defining Digital Assets: Classifying cryptocurrencies as securities, commodities, or a new asset class remains a contentious issue.

- Jurisdictional Complexity: The global nature of crypto makes consistent international crypto regulation difficult.

- Technological Understanding: Regulators need to keep pace with rapid technological advancements to craft effective policies.

- Market Manipulation: Ensuring fair trading practices and preventing illicit activities.

These complexities underscore why direct engagement between regulators and innovators is not just beneficial, but absolutely necessary. It helps bridge the knowledge gap and ensures that future crypto regulation is informed and practical.

Charting a Path Forward: The Impact of Regulatory Dialogues

The meeting between the SEC and Mysten Labs is more than just a single discussion; it’s part of an ongoing global effort to establish a clear framework for digital assets. Such dialogues can lead to more predictable and transparent regulatory environments, which ultimately benefits both investors and developers. When rules are clear, businesses can innovate with greater certainty, and investors can participate with more confidence.

The outcomes of these discussions could:

- Enhance Market Stability: Clear rules can reduce volatility and speculative behavior.

- Boost Institutional Adoption: More institutions may enter the crypto space with defined guidelines.

- Promote Innovation: A well-understood regulatory landscape can encourage responsible development.

Ultimately, the goal of effective crypto regulation is to create a secure and thriving digital economy. The collaborative spirit shown in these meetings suggests a path towards balanced and forward-thinking policies that could shape the future of finance.

The recent engagement between the SEC’s crypto task force and Mysten Labs represents a critical dialogue in the ongoing quest for robust crypto regulation. By fostering direct communication between regulators and innovators, there is a greater chance to develop informed policies that protect investors while nurturing the transformative potential of blockchain technology. These discussions are instrumental in building a transparent and secure future for the entire digital asset ecosystem.

Frequently Asked Questions (FAQs)

1. What was the main purpose of the SEC’s meeting with Mysten Labs?

The primary purpose was to discuss approaches to cryptocurrency market regulation, allowing the SEC’s crypto task force to gain insights into new blockchain technologies like Sui and for Mysten Labs to share their perspective on the industry.

2. Who is Mysten Labs and what is Sui?

Mysten Labs is the developer behind Sui, a high-performance Layer 1 blockchain designed for scalability and speed, supporting a wide array of decentralized applications.

3. Why is clear crypto regulation important for the market?

Clear crypto regulation provides investor protection, fosters market stability, encourages institutional adoption, and allows blockchain innovators to build with greater certainty, reducing risks and promoting responsible growth.

4. What are some key challenges in regulating cryptocurrencies?

Challenges include defining digital assets, navigating complex international jurisdictions, keeping pace with rapid technological advancements, and preventing market manipulation and illicit activities.

5. How do these discussions benefit the future of cryptocurrency?

These dialogues are crucial for bridging the knowledge gap between regulators and developers, leading to more informed, balanced, and effective policies that can shape a secure and thriving digital asset economy.

If you found this article insightful, consider sharing it with your network to spread awareness about the evolving landscape of crypto regulation. Your engagement helps foster a more informed community!

To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency price action.

This post Crucial SEC Meeting Unveils Future of Crypto Regulation with Sui Developer first appeared on BitcoinWorld and is written by Editorial Team

Vous aimerez peut-être aussi

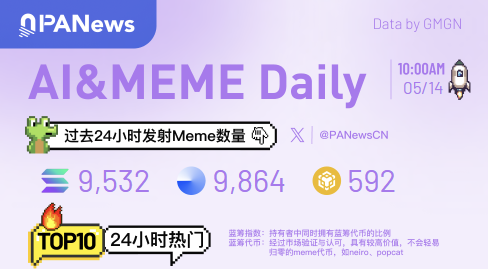

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Sending Bitcoin to Mars is now theoretically possible: Researchers