Crypto Price Predictions: XLM or HYPE Eye Reversal — Digitap’s Blend of Bank-Grade Security and Blockchain Speed to Drive 50× Growth

Timing is everything in the crypto market, and right now, the tides are turning. The once-unstoppable market leaders are losing their momentum as a new wave of investors is hunting for the next 50× breakout. It’s not just about holding the biggest names anymore, but more about finding projects with real utility, real users, and real growth potential.

XLM and HYPE may be showing signs of reversal, but their charts tell a cautious story. Both are battling resistance after months of sideways action. Traders are starting to ask: is this the top of their run, or just a pause before something new takes over?

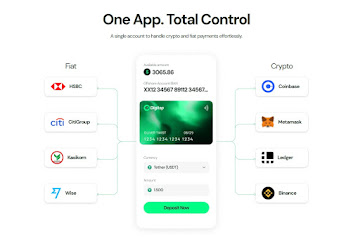

And that’s where the conversation shifts to Digitap ($TAP), a new “bank-meets-blockchain” altcoin that’s taking center stage for all the right reasons. It is offering bank-grade security, Visa card integration, and near-instant global payments. Analysts say Digitap could be the dark horse that turns early investors into 50× winners in 2025.

Why XLM’s Reversal Hype Is Getting Attention

Stellar (XLM) is a crypto built for cross-border transfers. It has the ability to offer fast settlement at low fees. It has already established quite a few esteemed partnerships with big companies to bridge the gap between crypto and traditional finance. But with new altcoins emerging within the same payments category, the price momentum of XLM has stalled in the reversal zone.

The recent sideways movement suggests that the market is witnessing new entrants. Some traders see a reversal in the cards as well. If XLM breaks above the current resistance price of $0.38, a new leg upward may unfold. But some analysts caution that a failed breakout could lead to downside toward support zones of $0.25.

Because of XLM’s already high market capitalization, the “easy money” multiple gains are not possible. When investors want exponential returns, they often look beyond already well-known crypto coins.

HYPE Struggling with Unlocked Token Supply

HYPE already got the early attention for being a new crypto coin from speculative momentum trading. But the token faces reversal headwinds now because of several reasons. One major reason is that over $11 billion worth of HYPE tokens are slated for unlocks soon.

This could create an imbalance between the existing demand and supply. When this equilibrium gets shaky, price typically comes down. That makes holding this crypto coin during the unlock window a little risky.

Another reason for the momentum reversal is that the valuation today reflects premium expectations rather than usage. If market sentiment turns adverse, HYPE’s speculative shine could rotate toward projects that offer real-world utility.

Digitap’s Vision: Security, Usability & Scale

Digitap is architected with one goal: to make crypto as spendable as fiat and as simple, fast, and secure as using any modern bank. It combines decentralization with compliance, smart routing with traditional rails, and privacy with regulation-ready features.

The payments engine is designed to route every transaction over the most efficient path. Whether that’s an on-chain route or conventional banking rails, AI selects the best route on its own. This speeds settlement and cuts costs for all users. Digitap also supports Visa-backed cards so that users can spend crypto or fiat at any location worldwide.

Security is not an afterthought in this crypto project. Digitap uses a zero-trust framework and 100% banking-grade encryption. Moreover, there is an optional no-KYC onboarding for privacy-conscious users. So, users don’t have to provide any identity documents for opening the crypto account wallets on Digitap.

The main aim of Digitap is to serve real users like freelancers and global workers. This means Digitap’s growth depends on adoption and not just speculation. That gives it an edge over other speculative crypto coins.

Why 50x Is Achievable for Digitap

Analysts making 50× price projections for Digitap point to several key factors. First, its early-stage presale price is low relative to potential market cap. Second, its use case addresses the $250 trillion cross-border payments market. Third, its tokenomics reward holders as usage scales in the crypto market.

Compared to XLM or HYPE, Digitap is launching from a lower valuation base, which means it has more room to grow. The path to 50x may involve phases with major exchange listings, Visa & merchant deployments, but each step compounds value. For those searching for life-changing returns, Digitap is arguably one of the best cryptos to buy in Q4.

Digitap is Live NOW. Learn more about their project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Crypto Price Predictions: XLM or HYPE Eye Reversal — Digitap’s Blend of Bank-Grade Security and Blockchain Speed to Drive 50× Growth appeared first on Live Bitcoin News.

Vous aimerez peut-être aussi

Where Is Marcela Borges Now? The Horrific True Story Behind ‘Terror Comes Knocking’

Solana Company could acquire more than 5% of SOL supply and pursue a Hong Kong secondary listing